China will have more shopping centre space than Western Europe in 5 to 10 years, as developers race to build glitzy malls for the country’s fast-growing middle classes, according to a recent report by real estate consultancy CBRE.

China will have more shopping centre space than Western Europe in 5 to 10 years, as developers race to build glitzy malls for the country’s fast-growing middle classes, according to a recent report by real estate consultancy CBRE.

However, while the market continues to provide positive results for both developers and retail brands, the survey also noted that while demand for prime retail space in China continues to outstrip demand, there is a potential glut of new space forming in the developing areas of the country’s first and second-tier cities.

Among the most impressive statistics to come out of the report is the rate with which mall development in China is rapidly reaching global standards in terms of volume. China has built at least 20 million square metres of shopping centres in 14 major cities over the past decade, with a further 14.8 million square metres under construction. Western European centres today cover 55 million square metres, so China is quickly catching up.

Despite the amount of retail space that has been brought into the market over the last decade, the China has a well documented dearth of prime retail vacancies. However, according to CBRE the high occupancy rates at the top end does not mean that all mall developers are doing well.

The survey found that while there is a scarcity of prime retail space, and there has been a major increase in consumer spending due to China’s economic boom, an often haphazard approach to shopping centre expansion in the emerging submarkets of Tier 1 and Tier 2 cities, as well as in the “smaller” markets (typically with populations of over 1 million people), has led to some instances of high vacancy.

Thus in most Chinese cities the study found that demand for prime space typically outweighs supply, and absorption rates consequently remain high, while outlying areas often have developments which sit largely empty.

For example, in Chengdu the survey found an average vacancy rate of 11.6%, but this ranged from below 4% in the core submarket of this rapidly western Chinese city (Chunxi Rd and Yanshikou) to over 40% in Xinnan Tiandi –an emerging submarket.

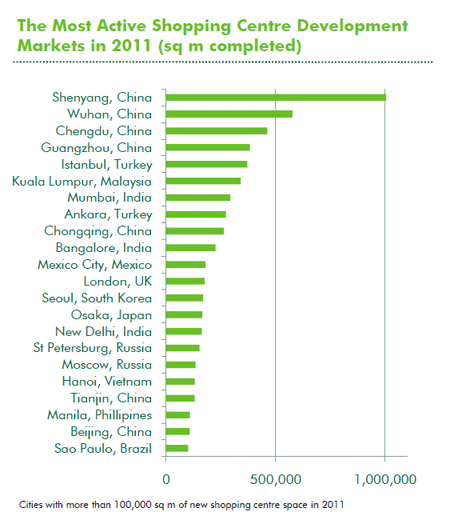

For developers, the study found that China was by far the most active development market last year with four cities in the top five worldwide in terms of the amount of new space completed.

Shenyang (8.1 million people) accrued the most new space with six new centres totalling over one million sqm opening there in 2011. The next most popular home for new mall space in 2011 among Chinese cities was Wuhan (9.8 million people) where 574,000 sq m of new mall space opened, also in six developments.

In terms of new developments under construction, Chinese cities account for exactly half of all the shopping centre space under construction in the 180 cities that the survey analysed.

The biggest pipeline of new retail space is in Tianjin where 2.45 million sq m is currently under construction. To put that into perspective, in Europe, only Paris and Moscow have more existing shopping centre space. In addition to Tianjin, Shenyang has 2.17 million sq m under construction and Chengdu has 1.89 million sq m.

For international retailers, Beijing, Shanghai and Hong Kong all ranked in the top 10 target destinations.

The findings are part of a report, Shopping Centre Development – The Most Active Global Cities, which was published last week by CBRE based on a survey of retail real estate development in 180 of the world’s major cities. Worldwide, the survey found “unprecedented levels of construction and new openings taking place,” with 7.8 million sq m of new space having been opened in 2011 and a further 29.6 million sq m under construction, an amount equivalent to the combined existing space in France, UK and Germany.

The survey focussed on new centres of over 20,000 sq m and excluded retail warehousing and factory outlet centres.

Leave a Reply