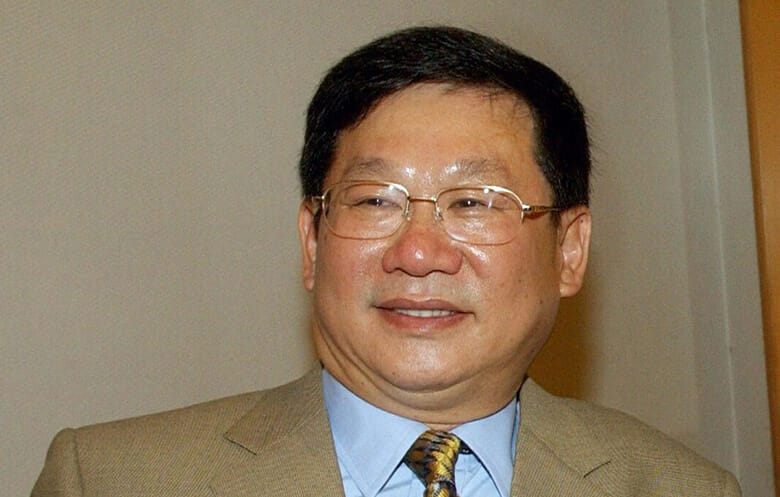

Zhang Li was arrested in London last January and extradited to the US six months later (Getty Images)

Guangzhou R&F Properties has announced the resignation of co-chairman Zhang Li as a board member and CEO, effective 29 December.

Zhang, who co-founded the developer with Hong Kong businessman Li Sze Lim in 1994, stepped down “due to his other commitments which require more of his time and dedication”, according to a filing with the Hong Kong stock exchange.

The news comes less than six months after Zhang cut a deal with US prosecutors to avoid prison time after admitting to bribing a local official in order to secure approvals for a San Francisco mixed-use project. Zhang’s local Z&L Properties entity was fined $1 million, with Zhang himself penalised $50,000.

“The board would like to express its sincere gratitude to Mr Zhang for his valuable contribution to the company during his term of office as an executive director and the CEO of the company,” R&F said in the filing. His role as co-chairman was unmentioned, with Li — who had previously served as the company’s other co-chair — now helming R&F on a solo basis, per company information at the time of publication.

Consequential Probe

Zhang was arrested in London last January after an investigation of former San Francisco Department of Works director Mohammed Nuru, who was said to have enjoyed luxury trips to China and other benefits at Zhang’s expense in return for pushing forward 555 Fulton Street, a five-storey mixed-use building with a planned 139 homes and 29,000 square feet (2,694 square metres) of retail. Zhang was extradited to the US six months later.

San Francisco’s 555 Fulton Street got Zhang in hot water

During his incarceration, the tycoon took the opportunity to sell some California properties, including 555 Fulton Street and a ranch in Silicon Valley’s Santa Clara.

Public records in Santa Clara revealed that Z&L Properties had reached a preliminary deal to sell the Richmond Ranch, a 3,654 acre (1,479 hectare) property southeast of San Jose, for an undisclosed sum. According to local news reports, the company also agreed to sell 555 Fulton Street.

After buying up a series of California properties for projects from 2014 through 2017, Z&L has partly completed just one development, a 640-unit condo project near San Pedro Square in San Jose. That project, known as 188 West St. James Street, reportedly faces foreclosure proceedings due to delinquent homeowners’ dues.

In 2019, the company saw another San Jose project taken away by city authorities after acquiring the site in 2017 and failing to make progress. Z&L is also said to be marketing a project at 70 South Almaden Avenue in San Jose that never broke ground.

Dodging Jail

Zhang could have faced 20 years in prison if convicted of the bribery charge. Instead, the case will be dismissed entirely within three years if all conditions of the agreement with prosecutors are met, Bloomberg reported.

In July 2022, Guangzhou R&F won an extension from its creditors on $5.1 billion in offshore bonds, making it the first major mainland developer to restructure its debts during the ongoing property crisis. In its interim report for 2023 issued last August, R&F reported a net loss of RMB 4.97 billion ($700 million) for the first half, narrowing from a year-earlier RMB 6.89 billion.

“The net loss for the period was mainly attributable to the decrease in recognised sales resulting from challenging operating conditions in the property sector and financial conditions that has affected market sentiment towards China property as well as foreign exchange loss caused by the depreciation of renminbi against US dollars,” R&F said in the report.

Development revenue fell 19 percent year-on-year in the half to RMB 12.3 billion based on delivery of 1.4 million square metres of sale properties, down 24 percent.

Leave a Reply