CNLP plans 10 mil square metres and a doubling of market share

With a fast-growing e-commerce sector driving demand for distribution space in mainland China, LaSalle Investment Management has expanded its efforts to acquire assets in the country’s warehouse sector by forming a $300 million joint venture with JD.com-backed developer China Logistics Property Holdings (CNLP), according to an announcement late last week by the Shanghai-based builder.

The joint venture agreement provides LaSalle with a new partner in its ongoing quest to acquire and deploy a network of logistics parks in the region, as well as providing it with “certain pre-emptive rights” regarding “existing logistics assets and developments” from among the 5.8 million square metres (62 million square feet) of stabilised, newly completed and in-progress projects controlled by the developer formerly known as Shanghai Yupei Group.

In return, CNLP (中国物流资产) gains access to new funding to build its pipeline of new projects, while also winning the right to provide project and property management services owned by the joint venture as it positions itself as a logistics facilities operator and adopts an “asset-light model,” according to the statement.

Planning a $300M Warehouse Fund

CNLP’s Peter Pan Naiyue sees the joint venture as a a way to meet demand for warehouses

“The cooperation with LaSalle will benefit the Group’s long-term development, notably optimizing the capital structure and reducing the operational cost, which will further enhance the financial stability,” CNLP’s chief financial officer Cheuk Shun Wah said in a statement. “The fund cooperation model helps accelerate the expansion of our logistics business, which allows us to seize market opportunities more nimbly and maximize profit for our shareholders and investors.”

According to Reuters, the company hopes to more than double its market share in the sector and is interested in developing at least four more funds.

The terms of the agreement also call for CNLP, which raised nearly $115 million by selling a 10 percent stake in the company to mainland ecommerce titan JD.com in April of this year, to contribute up to US$90 million in its own cash into the joint venture.

JV Could Develop 600,000 Square Metres of Sheds

The company sees the new fund as an opportunity to capitalise on growing demand from online retail and other end-users in China by developing more warehouse facilities with LaSalle. “Driven by rapid growth of e-commerce and domestic consumption in recent years, demand in the major logistics market has been persistently strong,” said Pan Naiyue, CEO of CNLP.

As of June 2018, CNLP was operating facilities at 60 logistics parks in 42 cities throughout the country, according to the company’s website. Within the next three years, it hopes to expand to 60 cities and to 10 million square metres. According to the Reuters report, CNLP currently has a 7 percent market share and hopes to establish itself outside of China, in countries such as Vietnam, Cambodia, Indonesia and Malaysia.

The joint venture with LaSalle should provide enough capital to build 600,000 square metres of logistics space, according to the announcement.

LaSalle Expands Logistics Portfolio

LaSalle Investment Management, an independent subsidiary of Jones Lang LaSalle with $60.0 billion under management, is already a significant player in the logistics market in China and elsewhere in the region.

In April of this year, LaSalle closed on $1.15 billion in equity for its fifth pan-Asia opportunistic fund, LaSalle Asia Opportunity V (LAO V), which includes logistics assets among its target sectors. The company also operates its own logistics park brand, Logiport, in Greater China, Korea and Japan.

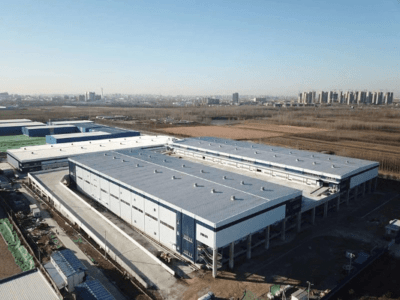

The asset management firm started in the shed business in China in 2007, and in early 2018 opened its tenth mainland distribution facility, Logiport Beijing Tongzhou at 56,000 square metres in the Yongle Economic Development Zone.

With the completion of that site, its portfolio in the country totalled 720,000 square metres. It also has assets in Shanghai, Kunshan, Changshu, Wuhan and Chengdu and as of early 2018 had five more warehouses on the boards, with completion expected by 2019.

In December of last year LaSalle completed its first logistics project in Korea, by finishing construction on the 43,405 square metre Logiport Icheon facility south of Seoul. In November 2017, the Chicago-based investment manager closed on its fourth Japanese logistics fund at $350 million.

Strong Investor Support

LaSalle is already a major player in the market

Shanghai-based CNLP was founded in 2000 as the Yupei Group and listed in Hong Kong in 2016. Its shareholders include Hong Kong-based RRJ Capital and COSCO-related Sino-Ocean. It has also had backing from the Carlyle Group and Anbang.

JD.com, China’s second largest e-commerce company and the largest tenant of CNLP, bought a 9.9 percent stake in the company in April for $115 million. It has been extremely active in the sector. In May, JD.com invested $306 million in ESR, and in February it raised $2.5 billion for JD Logistics.

Google and Walmart are investors in JD.com. But the company has been facing some challenges recently. Last week it reported a larger-than-expected loss in the quarter ended in June. While discounts were in part to blame, the company also noted heavy investment in warehouses and related logistics technologies.

Leave a Reply