Nuveen Real Estate, one of the largest investment managers in the world, provides an in-depth sector analysis into the Asia Pacific real estate market for 2020 and discusses why the company, which manages a suite of funds and mandates across Asia Pacific, Europe and the United States, is watching for a recovery.

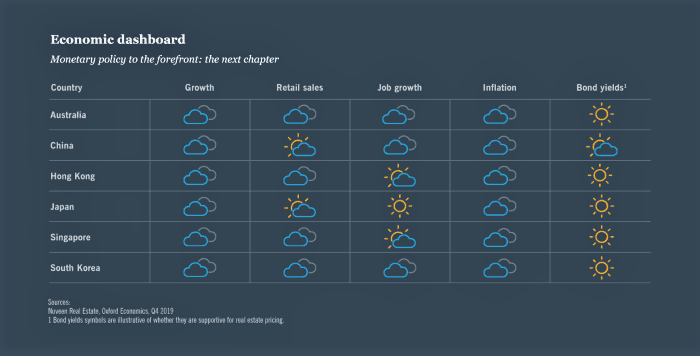

The outlook for Asia Pacific economies heading into 2020 is showing clearer signs of improvement after the significant headwinds that the region’s growth landscape faced in 2019 – particularly from the United States-China trade tensions which softened global business sentiment and trade. Growth momentum is likely to strengthen visibly across the region in H2 2020. The exception is Hong Kong, where the months-long protests will likely continue to drag on domestic sentiment and demand.

Monetary policy loosening will be the key driver of improving the outlook. Most central banks in the region lowered interest rates during the last few months of 2019. While Japan did not cut rates, forecasts indicate the policy rate is likely to drop to -0.3% in early 2020, from the current -0.1%. Similarly in Australia, even as the Reserve Bank kept rates steady at 0.75% in October 2019, expectations are for another cut of between 25-50 bps in 2020.

Monetary policy loosening will be the key driver of improving the outlook. Most central banks in the region lowered interest rates during the last few months of 2019. While Japan did not cut rates, forecasts indicate the policy rate is likely to drop to -0.3% in early 2020, from the current -0.1%. Similarly in Australia, even as the Reserve Bank kept rates steady at 0.75% in October 2019, expectations are for another cut of between 25-50 bps in 2020.

Harry Tan, Head of Research, Asia Pacific Nuveen Real Estate

“This sustained period of lower-for-longer interest rates should help to engineer a more robust macroeconomic recovery across the region in the second half of 2020,” says Harry Tan, Head of Research, Asia Pacific. He adds, “These supportive financial conditions should continue to drive increasing investor interest and capital flow into the real estate market, especially from income-focused investors.”

Compared with 2018, transaction volumes declined in 2019, partly as a result of the more uneven growth environment and tight pricing, but also due to the limited investability of quality stock. This trend is likely to persist, particularly as the bid-ask spread will likely remain wide, even with strong investor interest driven by low rates, diversification requirements and substantial untapped equity still waiting to be deployed into regional markets.

Louise Kavanagh,

Managing Director, Asia Pacific, Nuveen Real Estate

At the extended point of the cycle, where local market fundamentals are likely to detach from pricing across some markets, investing into resilience, durability and structural megatrends should have a role in long-term portfolios seeking attractive risk-adjusted returns.

Louise Kavanagh, Managing director, for our Asia Pacific cities platform says “It’s a tougher climb narrative to achieve risk-adjusted returns and to find investments, but fundamentally, real estate still makes sense in terms of its relative value. The Asia Pacific region is now driving and outpacing world growth with a number of macroeconomic themes driving rapid development. Coupled with a diverse set of market opportunities, and increasing maturity and transparency, the region offers a compelling case to invest in it.”

Read more about the sector opportunities for investors in Nuveen Real Estate’s Asia Pacific 2020 outlook.

This sponsored feature was contributed by Nuveen Real Estate, one of the largest investment managers in the world, with $130 billion of assets under management and over 80 years of real estate investing experience.

Leave a Reply