Lance Li, CEO, BW Industrial Development JSC

Let’s go back to the end of June 2021, when the ultra-contagious Delta variant triggered a spike in infections in Ho Chi Minh City, reaching as high as 4,000 cases for the first time. As an office worker in a non-priority vaccination group, you hastily ordered an imported box of FDA-approved 3M 1870+ N95 masks from the e-commerce site Shopee. Before the spike, orders were delivered within 3-5 days, and certainly in no more than a week. However, in fact, due to strict social distancing restrictions, it wasn’t until mid-September, when you’d already received two doses of AstraZeneca, that your order arrived at your door.

In that 10X-longer delivery window, several things happened: city authorities tightened social distancing measures three consecutive times, the number of infections exceeded 650,000, and the number of COVID-19-related deaths surpassed 16,000. With the pandemic putting incredible pressure on importers, sellers, e-commerce sites and delivery companies, the shipping delay was an inevitable consequence of an overloaded global supply chain. Alongside the epidemic’s heartbreaking statistics is a gloomy economic picture: in the third quarter of 2021, Vietnam’s GDP shrank by 6.17 percent, and nearly 10,000 businesses left the market every month.

While the effects of COVID-19 have touched nearly every aspect of the global economy, not all businesses have been adversely impacted. “The pandemic has certainly led to an unfortunate series of events. However, from a business perspective, it’s been an accelerant for warehouse demand,” said Lance Li, CEO of BW Industrial Development Joint Stock Company, in an interview with Forbes Vietnam.

Stepping Into the Void

While the pandemic left the world grappling with supply chain and logistical disruptions, the demand for warehouses has soared due to overwhelmed transport networks and a surplus of raw materials to ward off inventory shortages. BW, the largest industrial for-rent developer in Vietnam specialising in the development of warehouses and factories for rent, witnessed a high volume of inquiries throughout the pandemic. The company’s long-term development strategy allowed it to capture these short-term opportunities efficiently: it developed light, modern, industrial warehouses to satisfy the rising demand in manufacturing and explosive growth in e-commerce. Currently, BW offers a variety of product lines, mainly ready-built factories, ready-built warehouses and built-to-suit facilities.

A BW logistics facility at VSIP in Haiphong

“Even during the recent rise of the Delta variant, our overall occupancy is close to 90 percent,” Li said. This second year of the COVID-19 pandemic has been an active year for BW. At the beginning of 2021, the company witnessed a threefold increase in rental enquiries compared with the same period last year. The company recently closed a deal with a well-known logistics and package delivery company for a 5 hectare (12.4 acre) warehouse in a strategic location in Ho Chi Minh City.

Wanek Furniture, a key manufacturing company in the supply chain of one of the largest furniture retailers in the US, Ashley Furniture, leased another 4 hectare site from BW in Binh Duong Province. Market demand skyrocketed in the past two years, evidence of which can be seen in the fact that BW’s factory in VSIP 2A industrial park is already fully occupied following its construction completion in early June 2021.

Founded in 2018, BW is a joint venture between Warburg Pincus and Becamex IDC. The high-profile private equity firm and the pioneer developer of large-scale industrial townships in the South shared a strategic vision of establishing a modern industrial and logistics real estate platform in Vietnam.

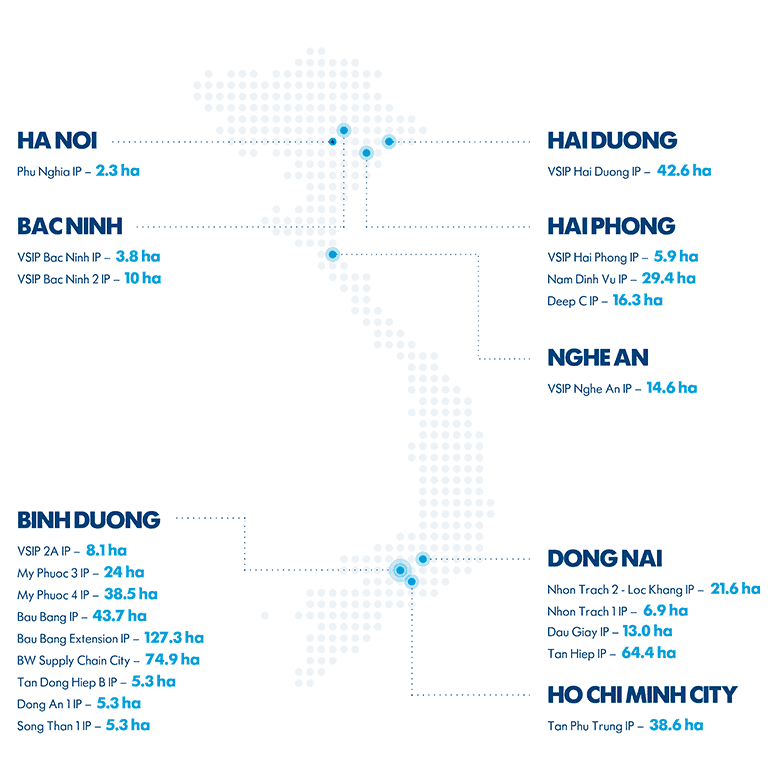

In only three years, BW’s rapid expansion has drawn undeniable attention from local industrial developers. As of the end of September 2021, the company has grown its land bank massively, with a total of 602 hectares to date and various projects located in Binh Duong, Dong Nai, Ho Chi Minh City, Bac Ninh, Hai Phong, Hai Duong and Hanoi — Vietnam’s key industrial cities. Following in the footprints of the “queen bees”, or giant FDI companies investing in Vietnam, hundreds of satellite and ancillary businesses fuel the demand for ready-built factories. BW already has a stronghold in ideal locations to satisfy such growing demand.

International Background

BW is led by senior executives with varying international backgrounds and has executed on the clear strategy and international expertise of Warburg Pincus, the equity firm that witnessed the rapid development of the for-rent industrial real estate market in China and other Asian countries. BW’s key product lines are ready-built factories and warehouses with flexible sizes suitable for all types of tenants. In addition, the company also provides customised industrial and logistics facilities based on each customer’s business goals, budgets and progress. As of September 2021, BW’s ready-built properties’ total gross floor area is 4.1 million square metres (44.1 million square feet), of which nearly 1.3 million square metres is completed and under operation. The company offers a variety of flexibly sized factories from 500 to 10,000 square metres, which means the largest size can be 1.5 times larger than a FIFA football field.

One of BW’s customers is Shopee, a leading e-commerce platform with more than 60 million monthly visits. “The strategic partnership with BW gives us the capability to deliver best-in-class logistics services to our users, further strengthening the growth of e-commerce in Vietnam,” said Tran Tuan Anh, managing director of Shopee Vietnam.

Similarly, Nelson Wu, general director of BEST Inc Vietnam, said his company visited more than 50 facilities and worked with more than 10 agents before finding BW: “Their solid infrastructure platform helps deploy modern tech solutions, which helps us better manage our business.”

BW’s operations are targeted at specific customer groups, among which are the e-commerce platforms in a “money-burning” race to win the market without racking up massive investment in fixed assets while allocating resources mainly for promotions and expansion.

Another group of customers using leased assets is foreign investors implementing the China+1 strategy due to the ongoing trade war between the US and China. To avoid solely investing in China and to diversify business into other countries, especially taking on the supply chain lessons learned during the first wave of the pandemic, foreign investors are choosing Vietnam as an alternative production base. In the first stage, these overseas investors seek ways to stabilise their cash flow by renting ready-built factories, especially when industrial parks in prime locations have reached 2-3X the price increment in the last three years.

Southern Concentration

As of October 2021, 79 percent of BW’s ready-built properties are located in southern localities of Vietnam; 18 percent are in the northern region; the remaining are in the central region. With an extensive network of projects across Vietnam, the fourth wave of COVID-19 has had an insignificant effect on BW’s operations.

BW now has projects across northern, southern and central Vietnam

“Indeed, this pandemic is an opportunity for manufacturers and warehouse operators alike to rethink their inventory strategy,” Li said. Before the pandemic, most manufacturers received goods just-in-time for production to keep inventory costs down and utilise space more efficiently. As the global supply chain broke down during the COVID-19 pandemic, this lean strategy revealed its weakness. The late arrival of cargo ships carrying raw materials is one reason among many that led to a severe shortage of components and halts in production. “The global shipping industry’s lack of containers left warehouses jammed with cargo for quite some time before exporters were able to load it onto ships,” Li said. “These circumstances increased the demand for warehouses like never before.”

Recently there have been concerns that FDI enterprises will move factories out of Vietnam, but Li doesn’t think so. The CEO explained that Vietnam’s key attraction lies in its geographical location and labour force.

As new COVID variants sweep across China, India, Indonesia, Malaysia and the Philippines, “Vietnam still holds strong in comparison,” he said. “For our ready-built factory sector, we have many clients waiting for visas to fly to Vietnam to make key decisions,” he added.

Li elaborated on the advantages that help Vietnam remain an attractive destination for foreign capital: a skilled and relatively inexpensive workforce; rapidly improved infrastructure; and a growing number of trade agreements that Vietnam is a part of, including the ASEAN Free Trade Area, CPTPP, EVFTA and, most recently, RCEP.

From another perspective, Li sees an upswing in warehouse demand associated with the explosive growth of e-commerce, which is still in a relatively nascent stage and accounts for only 5.5 percent of total retail sales. “We expect it to grow significantly in the coming years; we’re already seeing an increase in demand for modern warehousing, cold chain and cold storage,” he said. Modern, multi-storey warehouses are also on track to be rolled out faster in the next few years, particularly around Hanoi and Ho Chi Minh City, where land prices are high and strategic locations are in short supply.

Moving forward, Li believes Vietnam has been a key beneficiary of the reallocation of manufacturing and supply chain activities to Southeast Asia. This transformative shift was further accelerated by the supply chain disruptions that resulted on account of COVID-19. “We strongly believe there is a lot of room for this market to expand,” Li said. “The tremendous growth potential in e-commerce and high FDI influx to Vietnam have given us a lot of confidence.”

A version of this article previously appeared in Forbes Vietnam

Leave a Reply