How has the city’s commercial real estate landscape changed over the years? In this article, we will look at its past and future and share our insights into how organisations can maximise real estate’s value as the economy diversifies.

How has the city’s commercial real estate landscape changed over the years? In this article, we will look at its past and future and share our insights into how organisations can maximise real estate’s value as the economy diversifies.

At JLL’s City Forum 2022, our panel discussed the latest GBA infrastructure development plans and how the GBA cities are connecting more closely. Visit http://co.jll/ZrEH50JzPNW now to watch the full event on demand.

An Evolving Landscape

Powerful economic and public sectors are reshaping Hong Kong’s commercial real estate landscape. As technology and innovation businesses become more prominent within Hong Kong’s economy, repurposing of existing commercial districts along with significant new office and transportation infrastructures will be required.

The private sector also has a significant role to play in response to the government’s economic plans. Investors can not only participate in urban regeneration and development of the city’s technology clusters, but also in the traditional land sales for office, retail and residential use.

Hong Kong’s Harbour Metropolis and the upcoming Northern Metropolis have clear development blueprints, but their precise timing is subject to complex considerations over the next 15 years. To prepare for this, real estate leaders must ready their strategies to navigate the changes for success.

“The evolution of the Hong Kong economy offers investors and occupiers ways to develop their businesses and gain competitive advantage. The time to activate your real estate plan is now.”

Alex Barnes, Managing Director, JLL Hong Kong and Macau

A Tale of Two Cities

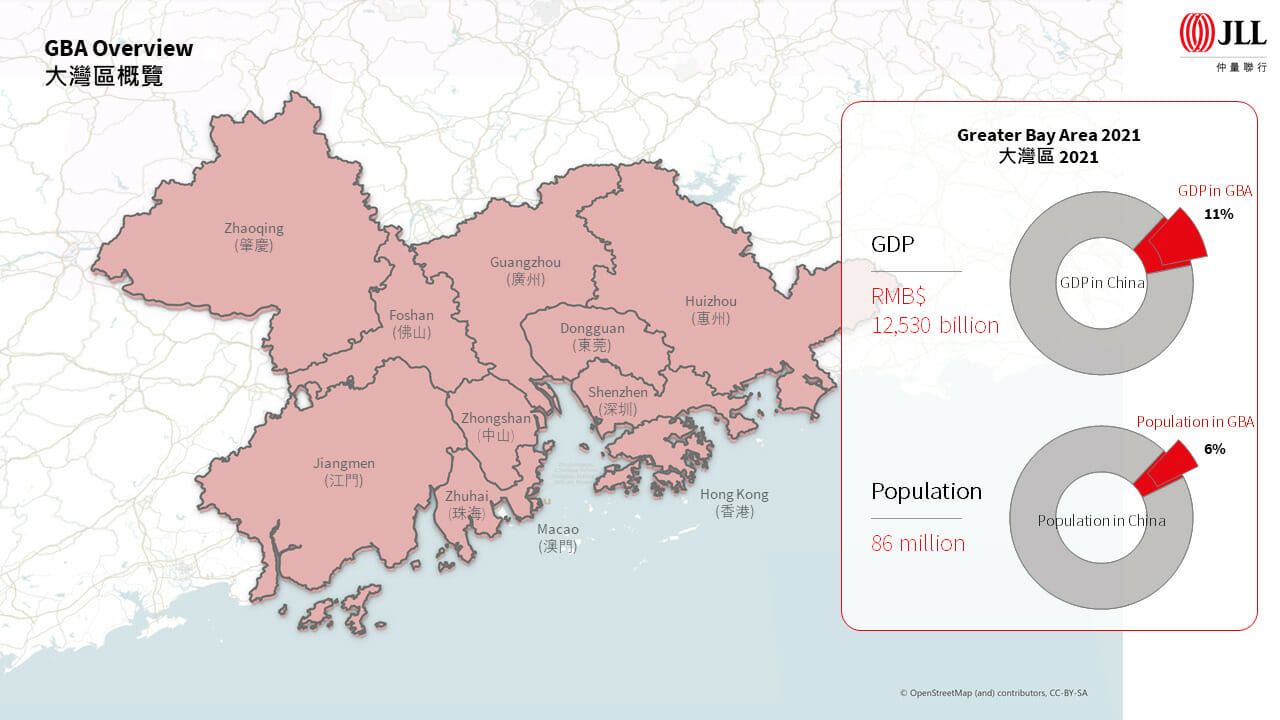

The Hong Kong economy is changing, and both the financial services and technology-based businesses are playing increasingly important roles. The way that the government plans to address this evolution will reshape the whole real estate landscape, and a significant focus is the city’s integration into the Greater Bay Area (GBA). In 2021, 11 percent of China’s GDP was from the GBA, which is around RMB 12 trillion; and with 6 percent of China’s population located in the area, there is a vast amount of untapped potential.

“We believe in the future, Hong Kong will gain more talent and companies, as well as additional government support. The city will eventually be able to absorb the office supply even as investment in the GBA increases.”

Oscar Chan, Head of Capital Markets, JLL Hong Kong

Overview of the Greater Bay Area

Over a 15-year timeline, current districts will be expanded, realigned and combined, while at the same time new clusters will be created. Hong Kong will evolve into a North-South commercial corridor with two anchoring cores:

- 1. Northern Metropolis — Technology Focused

- 2.5 million people are envisioned to live in the 300 square kilometre (116 square mile) area adjacent to the Hong Kong-Shenzhen border, which will facilitate Hong Kong’s integration with the GBA. The research capabilities and global connections of Hong Kong’s universities will be combined with Shenzhen’s well-developed tech-based supply chain — this will create nearly a million job opportunities, of which around 60 percent will be IT-related.

- The current space is not sufficient to meet the demand when the technology sector takes off. We estimate that 400 million square feet (37 million square metres) is needed for residential use and 100 million square feet is needed for non-residential structures such as office, retail, labs, business parks, warehouses and government/institution/community (GIC) sites.

- 2. Harbour Metropolis — Services Focused

- Financial services will remain the mainstay of Hong Kong’s economy despite the tech boom. The city’s highly open financial system, along with its prudent and long-established regulatory regime, is unique and important to China’s long-term growth.

- The multiple commercial districts on Hong Kong Island and the ones in West Kowloon, Tsim Sha Tsui and Kowloon Bay will be consolidated into a single Harbour Metropolis. This will provide a wider range of options and price points for both large and small occupiers. The combination of urban regeneration and accelerated reclamation will also ease the tight supply that has contributed to high rents and sub-optimal building quality and amenities. Options for occupiers will further increase when Lantau Tomorrow comes to fruition.

The growth of these two Metropolises will relieve Hong Kong’s land supply shortage. Streamlining the land conversion process and accelerating the timing of reclamation should also help the creation of a long-term land reserve for the coming decades.

Transportation Enables Transformation

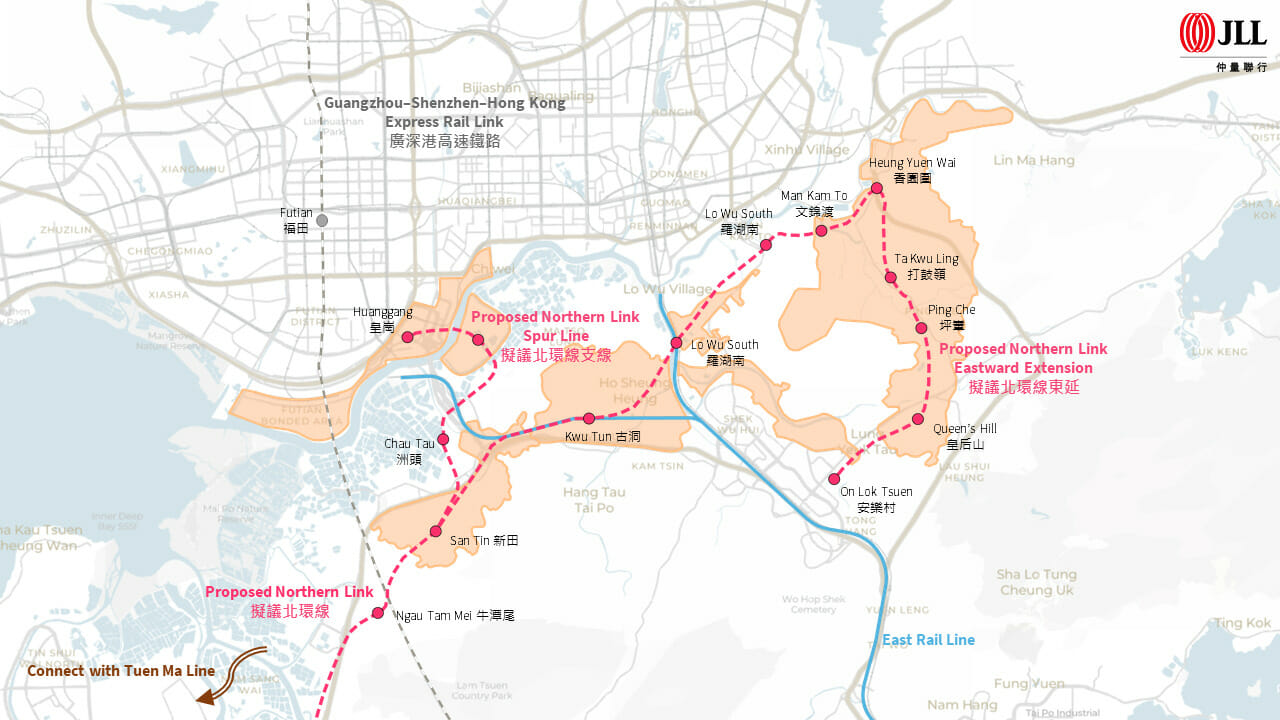

Since the COVID-19 pandemic began, the goods vehicles throughput of the Shenzhen Bay Bridge has rapidly increased by almost 50 percent by the end of 2021; Hong Kong’s upcoming transportation enhancements can link up the North-South corridor and further facilitate the integration with the GBA. Major railway and highway infrastructures are being constructed and planned, with HK$100 billion ($12.7 billion) in funding allocated to the Northern Metropolis alone.

In addition to the new Northern Metropolis infrastructure, an MTR North Hong Kong Line will potentially connect Tung Chung and Tseung Kwon O; together with the MTR Northern Island Line, which will stimulate North Shore development.

The proposed Northern Link, Northern Link Spur Line and the Northern Link Eastward Extension

The Private Sector Opportunity

To provide more specialised real estate to enhance emerging clusters, the government should actively involve the private sector. Investors and developers can accelerate the transformation of Hong Kong’s commercial real estate with private entrepreneurship and capital engaged. The private sector will have the opportunity to build specialised real estate such as labs and business parks to cater for the technology businesses.

The Need for a Strategic Plan

The 15-year development period has already begun at an accelerating pace. Investors need to consider the implications of the existing portfolios and who are going to be the tenants of the future; where occupiers should watch out for new developments that will offer them the best locations for the right talents. In the long run, organisations that can navigate these uncertainties will be able to generate significant real estate upside from the evolution of the Hong Kong economy.

This sponsored feature is provided by JLL.

Leave a Reply