Zac Tang is a Senior Analyst with Colliers Research in Hong Kong

With a record $5.32 billion of mainland investment into Hong Kong property last year, up from just $3.31 billion in 2015, mainland China investors are rapidly transforming the market for development sites and mature assets in the city.

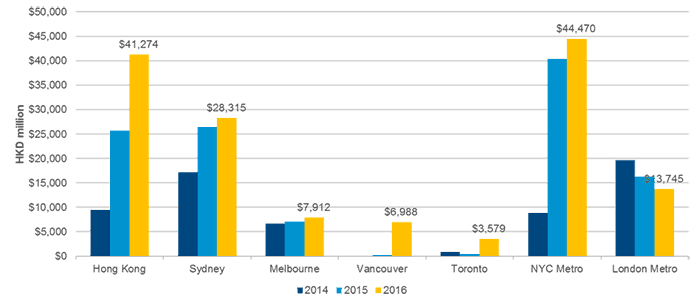

Research by Colliers International shows that Hong Kong’s real estate market was second only to New York’s as a target for mainland capital in 2016, and our analysis of current trends indicates that the SAR should surpass the Big Apple this year as the most favoured investment destination among mainland developers, corporates and high net worth individuals.

Heavy inflows of mainland Chinese capital into Hong Kong may moderate in the near term, given the stabilisation of the RMB in foreign exchange markets. However, over the long run Chinese investors are in the territory to stay. Both local and mainland developers will need to adapt to the changing face of Hong Kong real estate.

China’s Love of Trophies Drives up Prices in Central and Beyond

While Chinese investors have snatched up trophy assets like Chase Manhattan Plaza and the Waldorf Astoria in New York, the highest profile assets in Hong Kong’s Central district are generally not for sale. With local developers determined to hang onto their Central landmarks, mainland investors have ventured into the Wanchai waterfront for record setting en-bloc purchases – such as Evergrande’s HK$12.5 billion purchase of the Mass Mutual Tower in 2015 and Everbright’s HK$10 billion 2016 acquisition of the Dah Sing Financial Centre. Mainland buyers have also been active in the en bloc market in Kowloon East and other areas outside of Central.

Hong Kong has quickly become a top destination for mainland capital

In addition to these investment deals, mainland corporates have become the fastest growing group of office tenants; the number of PRC companies in Hong Kong has increased by double digits between 2012 and 2016. The demand from mainland corporates has been bidding up Central office rent and is expediting Hong Kong’s decentralisation process by forcing more multinationals and SMEs into decentralised locations.

Chinese buyers are no less disruptive in residential. In March, HNA, the acquisitive mainland investor and developer, bought its fourth plot of land in Kai Tak in as many months for HK$7.44 billion, effectively doubling the market price per square foot compared to three years earlier.

With demand continuing and prices still on the rise, mainland investors and occupiers should explore opportunities in the decentralised areas. With more affordable prices in Kowloon and the New Territories, there is greater potential for upside as these locations mature. Price growth in core-areas, despite their prestige value, may slow after two years of rapid increases based on previous cycles.

Mainland Developers Stand on Their Own

When Chinese developers first came to Hong Kong, they usually teamed up with local partners. In the 1980s and 1990s, Chinese developers such as CITIC Limited (previously known as CITIC Pacific) and China Overseas Land jointly acquired residential sites with local developers, but the size of leading mainland developers has grown exponentially over the last 20 years.

Companies like China Vanke, China Overseas, Poly Property, and HNA have all bid for and won land sales independently. In February 2017, two lesser known Chinese developers, Logan Property and KWG Property, surprised the market by winning a bid for a residential site in Ap Lei Chau Island, paying a record HK$16.86 billion (US$2.17 billion) for the site near Hong Kong’s newly opened South Island metro line.

How Local Developers Can Adapt

The Hong Kong ambitions of mainland investors are helping to make Kai Tak an investment hotspot

Aggressive pricing strategies adopted by mainland developers in land tenders have put their Hong Kong counterparts on the defensive. While participation from these mainland giants in the Hong Kong property market could create tension in the short term, both sides are facing the necessity of developing innovative strategies to replenish their depleting land banks.

The local development market is getting crowded with more PRC developers entering Hong Kong, and the share of land sales value won by the top five local developers fell from 23 percent to 8 percent between 2015 and 2016. To maintain a stable stream of future supply of residential units, local developers will need to use a range of different resources rather than reliance on the government land sales programme to replenish their land banks.

One option is a long-term investment from local developers in agricultural land banks. Hong Kong’s top four local developers together have amassed 106 million square feet of agricultural land, with 45 million and 30 million from Henderson Land and Sun Hung Kai Property respectively. Converting farm land to residential involves complex planning and negotiations – but it is much harder for PRC developers to get involved in the purchase of agricultural land in Hong Kong.

There are also opportunities for local developers with brownfield sites. The government has been encouraging the transformation of the old industrial cluster in Kowloon West, Kowloon East and Island South where industrial activities have been decreasing.

Mainland involvement in Hong Kong property is not going away, and local developers need to adapt by weaning off reliance on government land alone. Forming consortia with medium-sized PRC developers can be a win-win solution for both parties. Hong Kong market expertise and knowledge in building regulations from a local player will be very useful to PRC developers; in return, Hong Kong developers can be more effective in penetrating the mainland China market.

This sponsored feature was contributed by Colliers International, Asia Pacific

Leave a Reply