Colliers International analyst Yasas Wickramasinghe

The potential growth of the fintech industry in Hong Kong will create office space demand from fintech companies, traditional finance institutions and fintech startups. The bulk of demand will be concentrated in the core and fringe CBD with portion of demand trickling down into decentralised locations. Alternative office space providers, such as serviced offices and co-working spaces are becoming a major source of office space supply for these tenants.

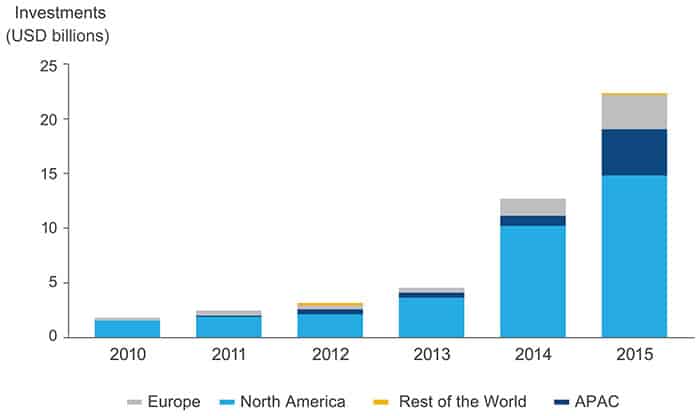

Global investments in fintech, or financial technology, have increased by 11 times in last five years to US$22.2 billion in 2015, as businesses leverage innovative processes to disrupt the financial sector. And the fintech trend has now arrived on local shores, as Asia Pacific investments in the sector during the first five months of this year nearly doubled the 2015 total of $4.3 billion, reaching approximately $7 billion by the end of May.

Fintech is the adoption of technology to enhance existing financial operations or the use of technology to disrupt incumbent operations by introducing new and innovative processes. Fintech innovations focus on a variety of traditional financial operations such as lending, payments, transaction record management, insurance and digital currency. With investment and implementation growing, the time is ripe for the Hong Kong office market to experience the impacts of the emerging fintech industry in coming years.

With the current rate of growth driven by consumer, institutional and investor demand, Colliers predicts that 2016 total investment in Asia Pacific will reach around US$15.2 billion and will record 20 percent and 10 percent growth in the following two years respectively. In Hong Kong, the number of fintech incubator programmes increased from one in 2012 to seven in 2016. The number of fintech startups has grown to 86 in 2015, a 16 percent increase from the level of the previous year. With this growing interest in the sector, Hong Kong is well-positioned to experience growth in this sector in coming years.

Fintech Office Demand Will Come From a Multitude of Sources

Growth in the fintech industry will inevitably increase the demand for traditional and non-traditional office spaces in Hong Kong. Demand for office space will mainly come from three major sources.

First, traditional finance institutions will seek additional office space to integrate fintech operations such as innovation centres, incubators, accelerator programmes and tech staff. The type of office spaces sought by these tenants will vary depending on the operation. Innovation centres are normally positioned at prime locations closer to parent institutions. Incubators tend to be located in low-cost settings such as decentralised nodes due to their independent and non-client facing nature. Surplus space at current locations can also be used to establish incubators and to accommodate in-house fintech operations.

Second, fintech service providers will be the major demand driver from the sector. Given their need to be close to their clients, their office space demand will be heavily focused on the core and fringe CBD of Hong Kong, including Central, Admiralty, Wan Chai, Causeway Bay and Sheung Wan. However, decentralised locations, such as Island East and Kwun Tong could be attractive for fintech companies with more regional operations or large companies considering split-operations.

Lastly, growth in fintech tech startups will increase the demand for low-cost and alternative office spaces. These companies will consider co-working spaces and other lower grade buildings in core and fringe CBD for their offices during the initial stages of the business.

A Unique Set of Office Space Expectations

Compared to traditional office occupiers in Hong Kong, fintech tenants have several unique characteristics. Attesting to the cultural trend of the tech industry, these firms prefer to create a work environment that fosters a community and promote collaboration and interactions; meaning that these companies have an appetite for large and open floor plates. The dynamic growth plans of most companies require them to expand and contract in size within a short period of time. Thus, the flexibility in terms of lease term and space are paramount for these firms. High quality technology infrastructure is another crucial element that is essential for fintech companies.

Alternative Office Spaces are Rising

The need for flexibility, collaboration and top-notch technology infrastructure together with the need to find a prime location in the CBD have encouraged many fintech companies, financial institutions and startups to consider serviced offices and co-working spaces as their office solutions. For example, out of 40 companies from 2015 American Banker fintech 100 ranking that has offices in Hong Kong, 13 companies have their offices in serviced offices.

Serviced offices are an attractive option for fintech companies for several reasons. First they offer much- needed flexibility in terms of lease term and office size. Second, given the limited vacancy rate in prime locations in Hong Kong, serviced offices are able to provide a prime location at an attractive price. Third, the congregation of similar types of tenants in one location fosters the community that fintech companies seek to promote. Lastly, the service office providers are capable of providing high-quality technology infrastructure and cater to other specific needs of these tenants.

For startups and traditional financial institutions co-working spaces have proven popular. The lower cost, flexibility and alternative office atmosphere in these locations have made them appealing for the millennial work force that is prominent in the startup sector. According to the traditional finance institutions, co-working spaces are a suitable space to foster future fintech talent through incubator and accelerator programmes by partnering with co-working space operators. For example, last year, Standard Chartered Bank partnered with the Chinese online search giant Baidu and the co-working space operator TusPark Global Network to open a fintech incubator programme in Kwun Tong.

This post is sponsored by Colliers International. To read more about fintech industry’s impact on the Hong Kong office market, download our report at: www.colliers.com/en-gb/hongkong/insights/colliers-radar/mingtiandi-fintech

[…] The potential growth of the fintech industry in Hong Kong will create office space demand from fintech companies, traditional finance institutions and fintech startups. The bulk of demand will be concentrated in the core and fringe CBD with portion of demand trickling down into decentralised locations. Alternative office space providers, such as serviced offices and co-working spaces are becoming a major source of office space supply for these tenants. Read more on: http://www.mingtiandi.com […]