Data centers have become critical components of our growing dependence on technology. Surging demand coupled with high barriers to entry for new supply and a global search for attractive investment returns have brought the sector to center stage.

Big data keeps getting bigger. And faster. And more valuable. The amount of digital data expected to be created over the next five years will be more than double the amount of data created since digital storage was first invented in 1956.1 By 2030, the number of internet-connected devices is expected to grow by 242% compared to 2019.2 Data centers are not only real estate, they are the infrastructure lifeblood of the modern economy.

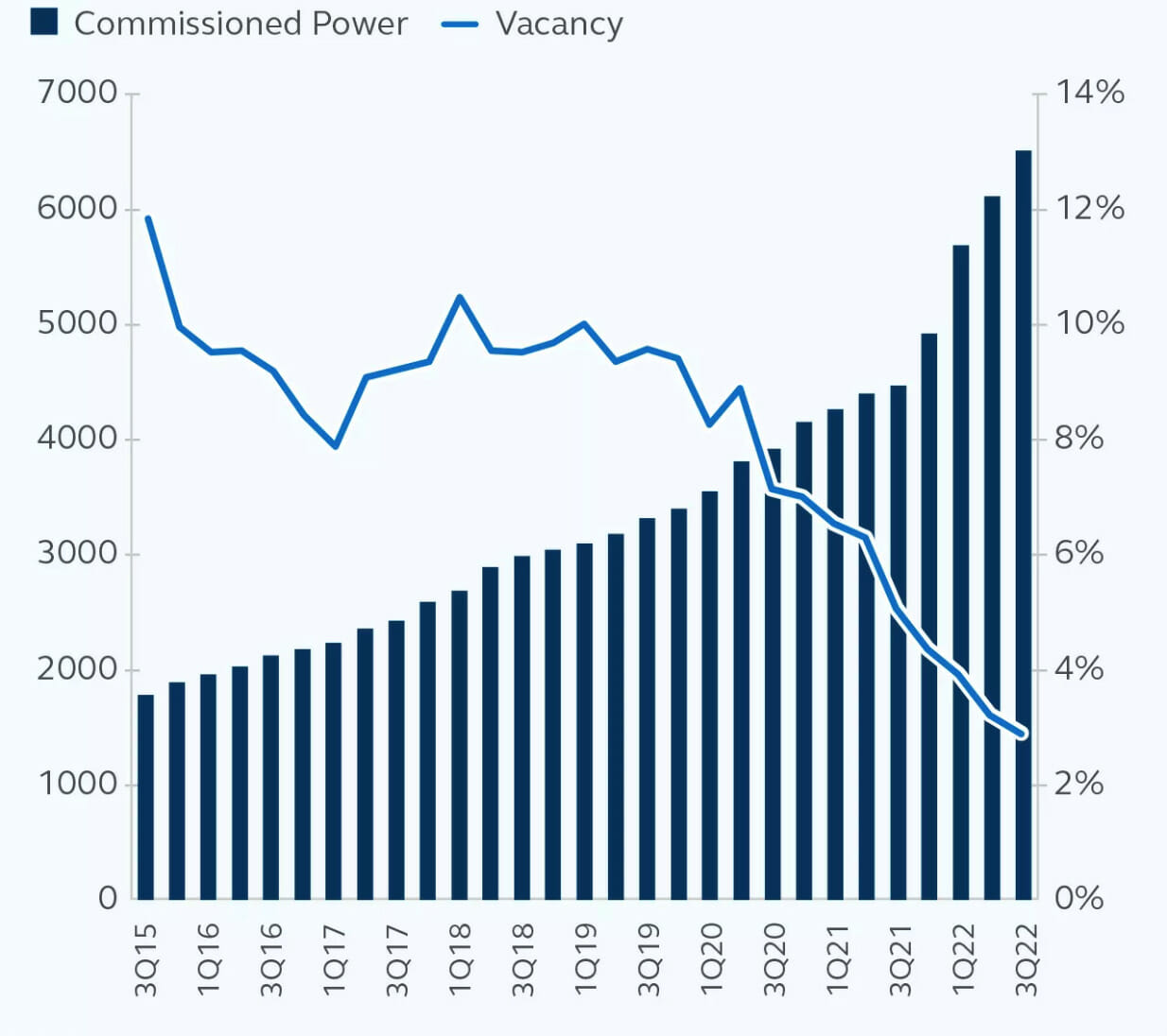

Processing, housing, streaming, and securing all this data has led to rapidly increasing demand for data centers. In fact, even though leased data center capacity has more than tripled since 2015,3 vacancy is at an all-time low. Given the growing awareness of the significance of data centers to the economy, investors are increasingly looking for ways to participate.

The elements that appeal most to investors today include:

- High demand for quality data center space—but limited supply of data centers able to keep pace with exponential data growth from developments in outsourcing, cloud adoption, and emerging technologies.

- Long-term leases and credit-worthy tenants have led to a stable cash flow and attractive returns in both up and down markets.

- Access to a specialized product type to diversify their portfolio.

Private data center investing requires a high degree of specialization to source, build, and lease the properties. With a favorable risk-adjusted return profile, high barriers to entry, and past resiliency in both up and down markets, we believe data centers represent an attractive long-term investment opportunity.

Demand for Data Centers

Data centers are the engines that propel the modern economy, as more and more systems become driven by some form of data. They’ve become the cornerstone of the information economy—the central nervous system of the interconnected internet network, further propelled by the COVID-19 pandemic which made everyday tasks from working to shopping completely dependent on data and fast connectivity. While data storage was once the primary purpose of data centers, computing power and network connectivity matter even more today. Digital technologies have transformed numerous aspects of society and the economy. Work, education, banking, healthcare, and shopping are a few examples of activities that individuals and businesses now perform online. Globally, ambitious digital mandates are underway to strengthen and expand digital data capabilities, including enhancing business usage of cloud technology, digitalizing public services, and extending 5G capabilities.

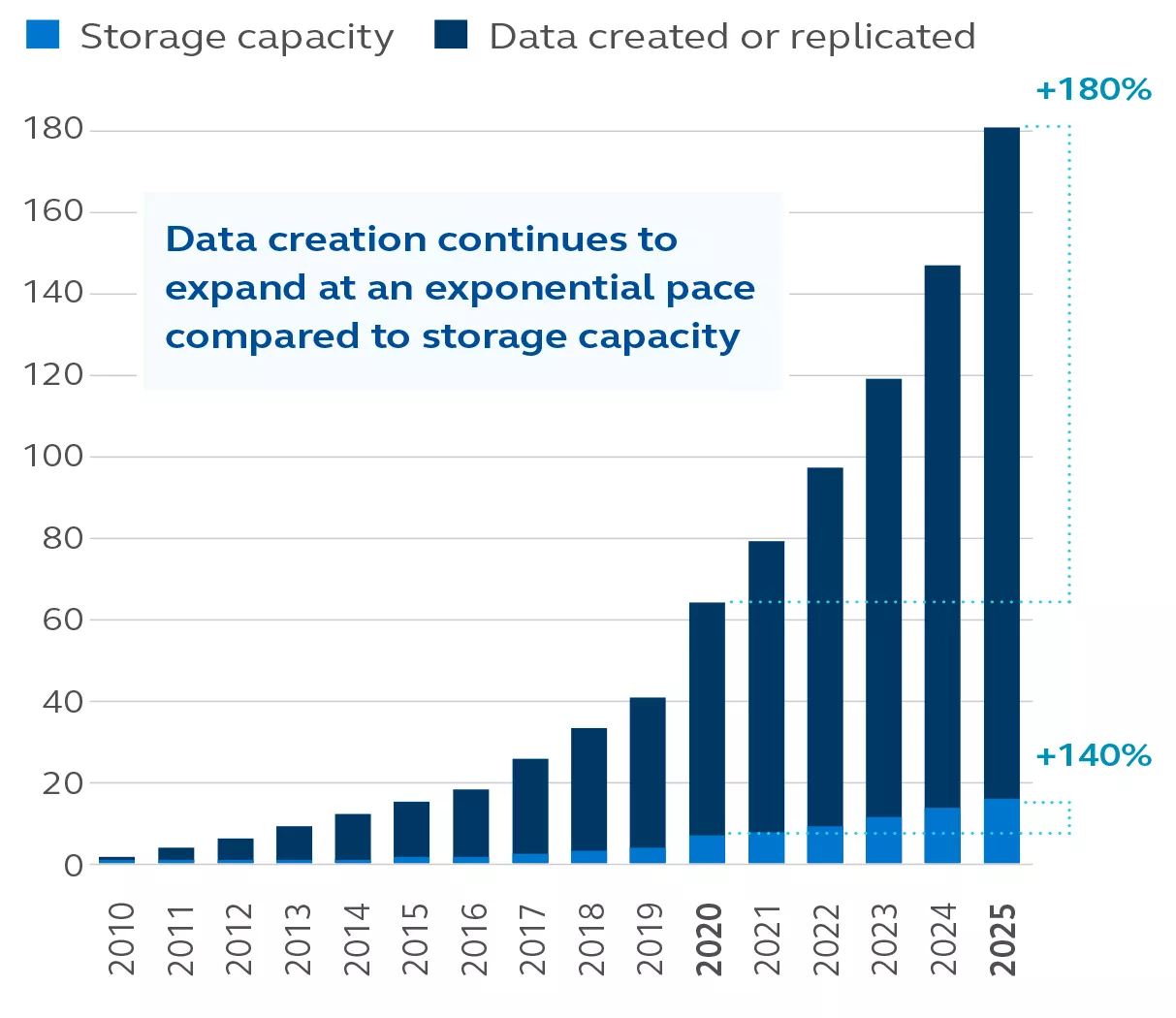

Exhibit 1 shows that the amount of digital data created globally in 2025 will be nearly ten times the amount of data created in 2015. The adoption of new technologies including personal devices and smart everything, in conjunction with the growing penetration of internet in developing markets are the main drivers behind this exponential growth. IDC, a global market intelligence provider, estimates that the volume of data in the world will pass 180 zettabytes by 2025. For reference, a single zettabyte is equivalent to one sextillion bytes, or a one followed by 21 zeros, enough data to fill 250 billion DVDs. Put simply, that’s a lot of data that will drive significant investments in storage infrastructure.

Exhibit 1: Volume of data generated vs. storage capacity (IDC 2022.)

Data centers are attractive in that they occupy physical infrastructure space but are also vital to the virtual infrastructure on which modern society depends. It is an asset class that sits at the intersection of infrastructure and real estate. Tenant demand for existing space continues to increase, with hyperscalers—the largest cloud computing providers—driving near-record demand. Hyperscalers continue to aggressively expand their operations to accommodate end users’ needs, including social media, entertainment, gaming, and cloud services.

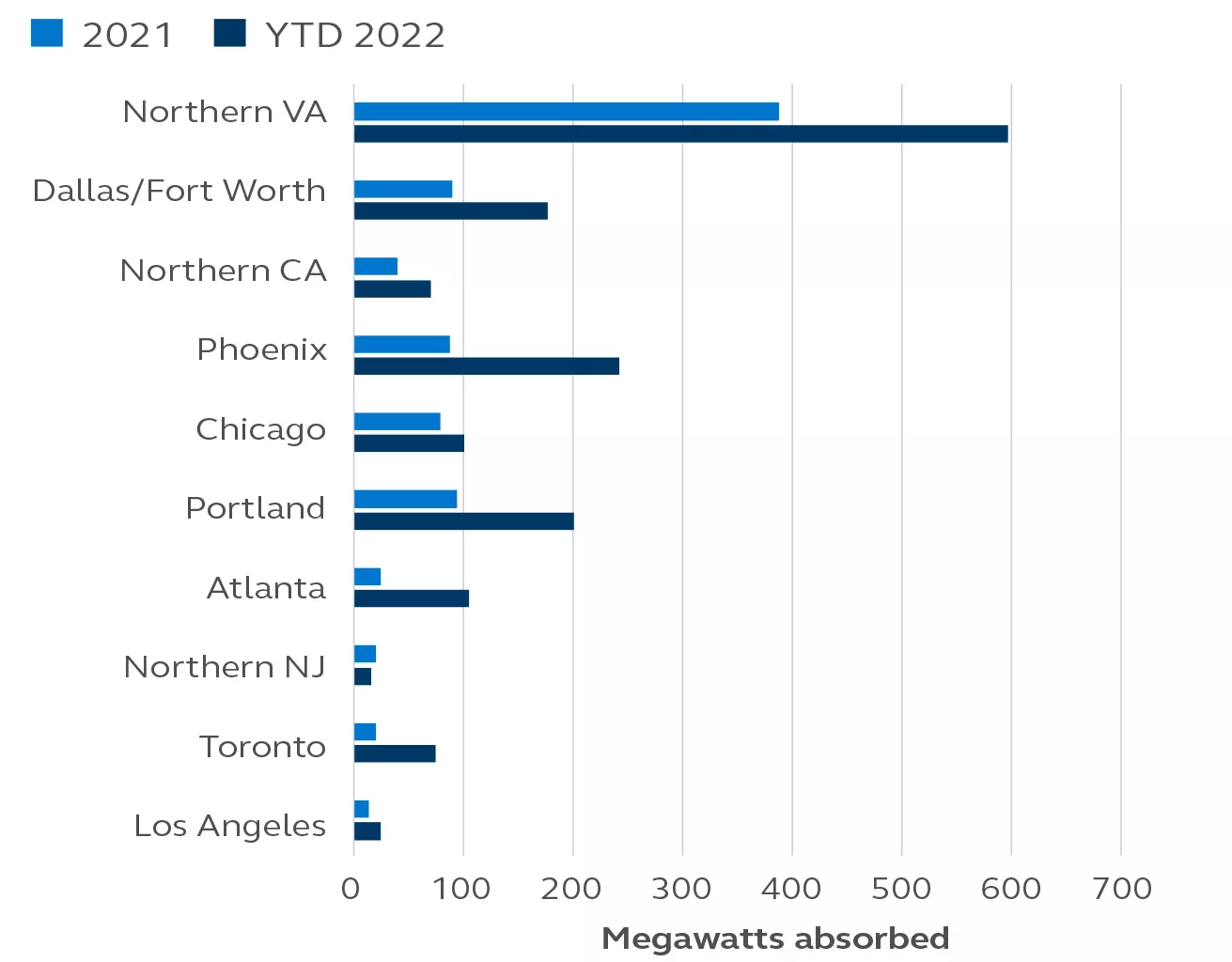

In North America, absorption of space has accelerated in most key markets, particularly in the largest data center clusters as shown in Exhibit 2.

Exhibit 2: Demand for North American data centers continues to accelerate. Net absorption by key market through 3Q 2022, megawatts (MW) (datacenterHawk, Principal Real Estate, 3Q 2022.)

Demand is Far Outpacing Supply

Growing demand has not been satisfied by the supply side, due in part to power grid limits imposed by local governments. While rental growth in North America slowed for a period of time, more recently the industry has seen a return to strong rental growth.

Record low vacancy rates in key markets and accelerating demand have shifted the balance of pricing power toward landlords. We anticipate that this shift will result in higher rates and contract escalations going forward. This is important as data center tenants are not immune to many of the same concerns such as rising energy prices, supply chain issues, and labor shortages that are prevalent in other property sectors. Given the lack of supply, hyperscale users are having to compete for key locations and there are limited options for enterprise requirements.

Exhibit 3: Market size and vacancy rate (datacenterHawk, September 2022.)

Structural Demand Drives Investment Opportunities

Data centers present a unique opportunity for real estate investors. With growth and defensive attributes, the data center industry has proven resilient in both economic downturns and periods of economic expansion. Low correlations to other assets, a favorable risk/return profile, and new liquidity from institutional capital make data centers a portfolio component worth considering. Longer leases, many times in excess of 10 years, also make data centers attractive giving investors exposure to cash flows from high-quality credit tenants at higher yields than most other property types.

With Google users alone generating 8.5 billion searches per day and the growth of streaming content as an entertainment and information source, Principal Real Estate has identified the hyperscale segment of the market as its top priority.

“While we have experience working across data center markets, we have focused in on hyperscalers and cloud providers as the future of the sector,” said Casey Miller, managing director for portfolio management with Principal Asset Management. “These regional and global giants are looking for infrastructure solutions for the long term and represent the fastest-growing segment of the data center industry.”

For long-term investors—particularly those aiming to fund obligations by matching income and liabilities— stabilized data centers may offer some inflation mitigation—an attractive benefit given today’s inflationary environment. Further, while sourcing opportunities in growth sectors during economic uncertainty is challenging, data centers are among the few areas where the structural growth story is intact.

The options to gain investment exposure to the data center sector are scarce due to limited offerings—core investments rarely trade and the pool of highly-technical developers who have capacity to build hyperscale datacenters is thin.

Casey Miller, Managing Director, Principal Asset Management

Investors who are able to partner with a strong developer may potentially achieve both an enhanced return and continued access to this sector, which is primed to further strengthen due to a number of factors, including the continued supply and demand imbalance, tenant preference to do repeat business with existing developers, increased headwinds to procure suitable sites with necessary power and fiber, and the long lead time on equipment necessary to commission a data center. All of these aspects point to the valuable opportunity in the develop and lease-to-core strategy, which we believe will prove advantageous for both tenants and investors going forward.

Key Attributes

While the technology supported by data centers has advanced rapidly, from a real estate perspective, most of the important requirements have remained unchanged. We believe key attributes of these assets include:

Location: As with all real estate investing, location is critical. The ideal data center location offers:

- Dependable access to low-cost power

- Proximity to a large population

- Fiber connectivity

- Low risk of natural disasters

- Sales tax incentives

Given the importance of these criteria, in North America a handful of markets have emerged as more dominant than others, including: Northern Virginia, Dallas, Northern California, Phoenix, Chicago, Portland, Atlanta, and Austin/San Antonio.

Facility: Because these assets host critical applications, they’re constructed with zero tolerance for downtime. They must offer multiple layers of protection, including:

- Structurally enhanced walls, floors, and roofs

- Multiple sources of power from multiple substations, as well as backup power through generators

- Temperature- and humidity- controlled environment with air handler components

- Controlled access with 24×7 security, mantraps, and biometric screening

Experience Critical to Execution

Given the highly specialized and niche nature of the data center industry, we believe experience and access are critical to successful execution. As an active commercial real estate investor for more than 60 years4 — including more than 14 years in the data center sector—we have witnessed the asset class evolve and adapt to the changing needs of occupiers. Our experience has resulted in a favorable track record and meaningful industry relationships:

- A top-10 global real estate manager with a fully integrated real estate platform.5

- Over 440 total development and value-add projects since 2001, valued at nearly $25.1 billion. Invested more than $2 billion in 20 data center transactions.6

- Our substantial equity and debt business gives us a distinct perspective of real estate and capital markets.

- In-house expertise in responsible property investing and ESG – data centers have many unique development, operational, maintenance, security, and energy requirements.

- Demonstrated ability to source and close significant volume of high-quality investments.7

- Able to source experienced partners that bring significant technical and location-specific expertise, as well as ability to attract strong tenants.

About Principal Asset ManagementSM

With public and private market capabilities across all asset classes, Principal Asset ManagementSM and its specialist investment teams apply local insights with global perspectives to deliver compelling investment opportunities aligned with client objectives. Principal Asset Management is the global investment management business for Principal Financial Group® (Nasdaq: PFG), managing $501.5 billion in assets.

1 Principal Asset Management AUM as of December 31, 2022.

Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC.

1 BusinessWire, Data Creation and Replication Will Grow at a Faster Rate Than Installed Storage Capacity, March 24, 2021; IBM.

2 Statista, July 2022.

3 datacenterHawk, September 2022.

4 Principal Real Estate Investors became registered with the SEC in November 1999. Activities noted prior to this date were conducted beginning with the real estate investment management area of Principal Life Insurance Company and, later, Principal Capital Real Estate Investors, LLC, the predecessor of Principal Global Investors Real Estate.

5 Managers ranked by total worldwide real estate assets (net of leverage, including contributions committed or received, but not yet invested; REOCs are included with equity; REIT securities are excluded), as of 30 June 2022. “The Largest Real Estate Investment Managers,” Pensions & Investments, 3 October 2022.

6 Based on gross asset value as of 31 December 2022.

7 Past performance is not indicative of future results and should not be relied upon to make an investment decision.

Leave a Reply