Allgreen wants a Green Mark certification for Seletar Mall (Image: Cuscaden)

Robert Kuok’s Allgreen Properties has completed its S$550 million ($410 million) purchase of the Seletar Mall in northeastern Singapore from a joint venture of Cuscaden Peak and United Engineers Ltd (UEL), the companies announced Thursday.

Allgreen, the Singapore property development arm of Kuok Group, paid the equivalent of S$2,900 per square foot of net lettable area to secure its fifth retail asset in the city-state as it diversifies its bets on Singapore’s post-pandemic retail recovery into suburban malls.

“The Seletar Mall aligns with our vision of enhancing and diversifying our presence in the retail landscape as we move into the heartlands of Singapore,” Tho Leong Chye, the firm’s managing director, said in a statement. “Along with the upcoming Pasir Ris Mall slated for opening in the second quarter of 2024, Allgreen hopes to provide unique and exciting offerings for tenants and shoppers in the suburban centres of Singapore.”

The company is adding the property in the Fernvale area to a portfolio which already includes the Great World complex and the Tanglin Mall in Singapore’s Orchard area, as it readies the launch of its Pasir Ris Mall project on the upper east coast.

Family Friendly

The deal’s completion came a week after SGX-listed Paragon REIT officially passed on its right of first refusal for Seletar Mall as Cuscaden, which sponsors the trust, prepared to sell the asset. That move paved the way for Allgreen to close on a deal which was first reported in January.

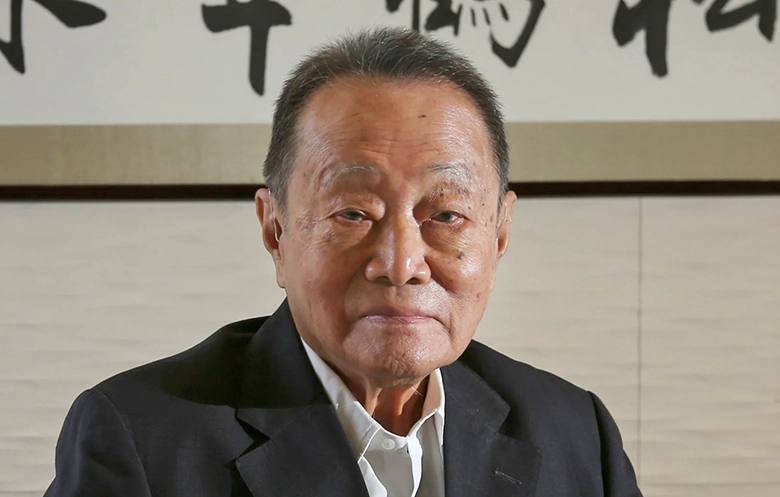

Robert Kuok likes Singapore’s suburbs

Following the acquisition, Allgreen said it is looking at making enhancements to Seletar Mall including aiming for an unspecified certification under Singapore’s Green Mark regimen for sustainable buildings.

With Temasek Holdings-backed Cuscaden Peak having held 70 percent of the joint venture and and Yanlord Land’s UEL unit having owned the remaining 30 percent, the partners sold the asset, which spans six floors, at a 14 percent premium to the asset’s book value of S$480.5 million as of the end of 2021.

The property measuring 189,467 square feet (17,600 square metres) in net lettable area is located at the intersection of Fernvale Road and Sengkang West Avenue with a direct link to Fernvale MRT station.

Catering to families and other shoppers in the Sengkang and Punggol areas, the 2014-vintage asset is fully leased by tenants including NTUC FairPrice supermarket, hotpot chain Haidilao and Aussie housewares and electronics retailer Harvey Norman. JLL and Cushman & Wakefield acted as joint exclusive advisors to the seller.

All Eyes on Suburban Retail

“The timing of this divestment is opportune, drawing strong interest from prominent local and international real estate players attracted to the growth and resilience of Singapore’s suburban retail assets,” said Roy Tan, group managing director of UEL. “There continues to be high demand for the limited pool of good quality properties within this segment, where the outlook remains positive.”

Allgreen is acquiring the property after average passing rents for suburban malls rose to S$14.7 per square foot in the fourth quarter of 2023, inching up 0.8 percent from the preceding three months, according to Savills.

Retail sales in Singapore during 2023 surpassed 2019 levels with statistics from the Singapore Retailers Association showing that a retail index for the city-state increased by 1.3 percent in January 2024, compared to the same month a year earlier.

“Singapore’s suburban retail sector continues to be highly sought after by global and domestic capital seeking exposure in the tightly held retail investment market,” said Ting Lim head of Singapore capital markets for JLL.

In December NTUC Enterprise sold a total of 18 community shopping malls in two separate deals totalling S$255 million.

In March 2023 Hong Kong’s Link REIT completed its S$2.16-billion acquisition of the Jurong Point and Swing By @ Thomson Plaza suburban retail properties from Mercatus, the real estate investment division of NTUC.

Cuscaden Cuts Back

Cuscaden’s executive vice president for portfolio management Chua Chi Boon said offloading the mall aligns with the company’s strategy of realising the value of their development projects and redeploying cash from disposals to boost shareholder returns.

Since it took over the real estate business of Singapore Press Holdings in 2022, Cuscaden, which was formed as a consortium of hotel tycoon Ong Beng Seng and his SGX-listed Hotel Properties, with Temasek-backed CapitaLand and Mapletree, has made a number of disposals without acquiring new assets.

Last year, Cuscaden sold three mansions on Singapore’s Nassim Road to an Indonesian family for S$206.7 million, with that deal coming after it sold a good class bungalow along Yarwood Avenue in November 2022 for a reported S$30 million.

The firm continues to hold a stake in the recently completed Woodleigh Residences condo project in the Bidadari area, along with its associated mall, as its last directly owned assets in Singapore.

Outside the city-state, the group owns and operates a portfolio of student accommodation assets in 19 cities across the UK and Germany.

The firm also sponsors Paragon REIT, which owns the Paragon mall in the Orchard area, the Clementi Mall, and the Rail Mall in Bukit Timah.

Leave a Reply