Revenues for Singaporean retail developer CapitaMalls Asia dropped 8.7 percent during the fourth quarter of 2013, due mainly to a slow down in China, the company said in a statement this week.

According the most recent financial results for the Singapore-listed firm, which is part of Temasek Holdings’ CapitaLand Group, revenues for October through the end of December were S$103.7 million (US$81.9 million), mainly due to lower returns from China, where the company opened fewer malls in 2013 than it had the previous year.

However, net profit for the group rose 17.1 per cent to S$216.4 million from S$184.8 million in the corresponding quarter during 2012, thanks to better performance in the company’s home market, where net profit was up 63 percent compared to the same period in 2012.

In a statement to the press in Singapore, CapitaMalls Asia’s Chief Executive Lim Beng Chee, said, “Our key markets of Singapore, China and Malaysia continued their good performances last year, recording increases in net property income and tenants’ sales and strong shopper traffic.”

During November of 2013, CapitaMalls Asia announced that it was spending RMB 2.2 billion (US$361 million) to acquire a mall in Guangzhou, China from Greenland Real Estate, a subsidiary of state-owned Greenland Group.

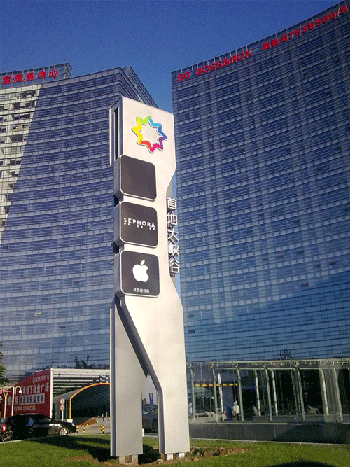

The acquisition from Greenland Group followed a move in July of 2013 when CapitaMalls Asia won a tender to acquire the Grand Canyon Mall in Beijing, from Capital Airport Real Estate Group Co., Ltd for a reported RMB1.74 billion.

Leave a Reply