HKRI Taikoo Hui Centre 2 (left) was among the office properties delivered in Q2

Developers enticed by Shanghai’s burgeoning tech and service sectors are betting that the city needs more offices, with nearly a quarter million square metres of new space being added to the city centre last quarter, according to figures compiled by Mingtiandi from agency data.

Drawn from research by six international property service providers, this first edition of Mingtiandi’s Shanghai Office Index finds that this surge of new supply is already bringing down average rents across the city with an estimated 376,000 square metres of additional space expected to be rolled out in core commercial areas this year.

Drawn from the latest Shanghai office reports by CBRE, Colliers International, Cushman & Wakefield, JLL, Knight Frank and Savills the Office Index compiles and compares data for average rental rates, new supply, vacancy rates and projected new supply to provide an aggregated picture of what the largest agencies are seeing.

Where possible we have noted differences in definitions and methodologies, and links are provided to the original reports for readers searching for greater detail.

Robust Demand, but Influx of Supply Drags on Rents

Despite some variation in the headline figures, the agencies broadly agree on the main trends in the market. Companies in the banking and financial, professional services, information technology and retailing sectors led strong absorption of grade A offices in downtown Shanghai (the Central Business District or CBD) last quarter – according to Colliers, the highest quarterly absorption in the past decade at 261,000 square metres.

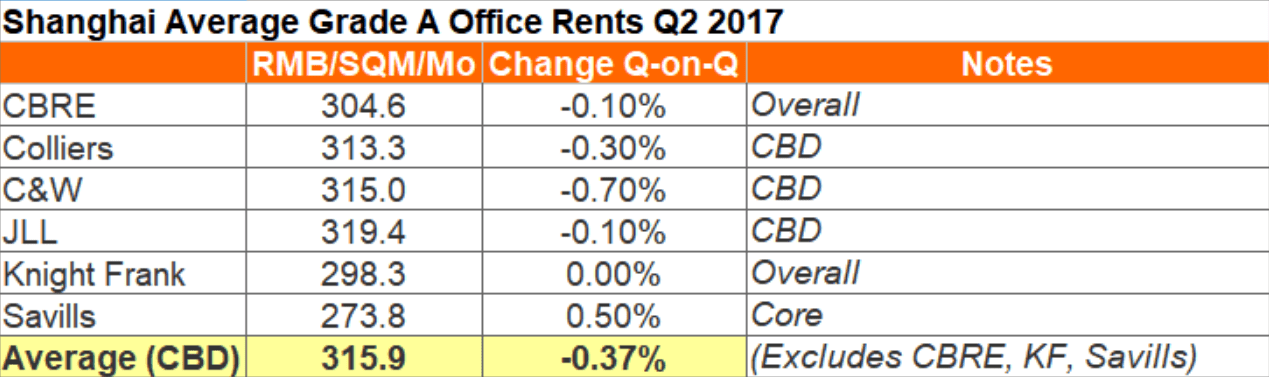

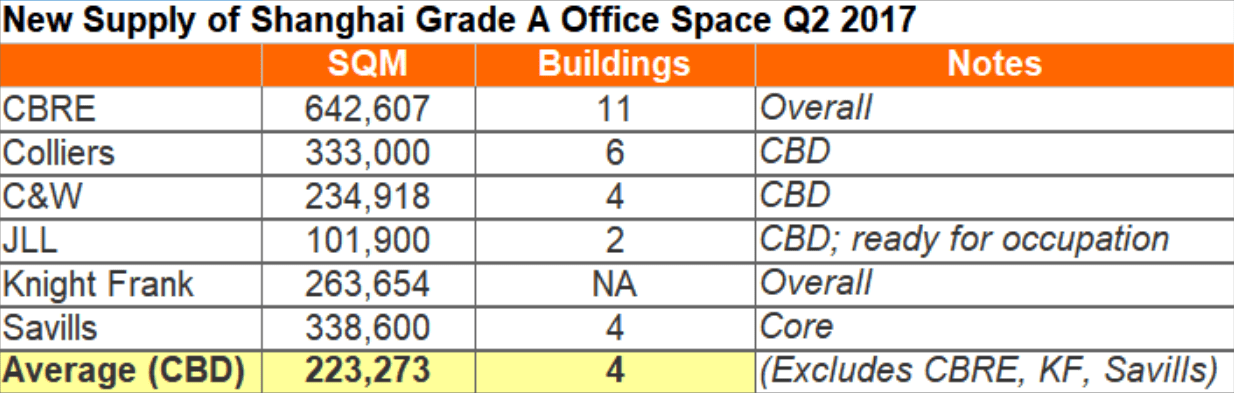

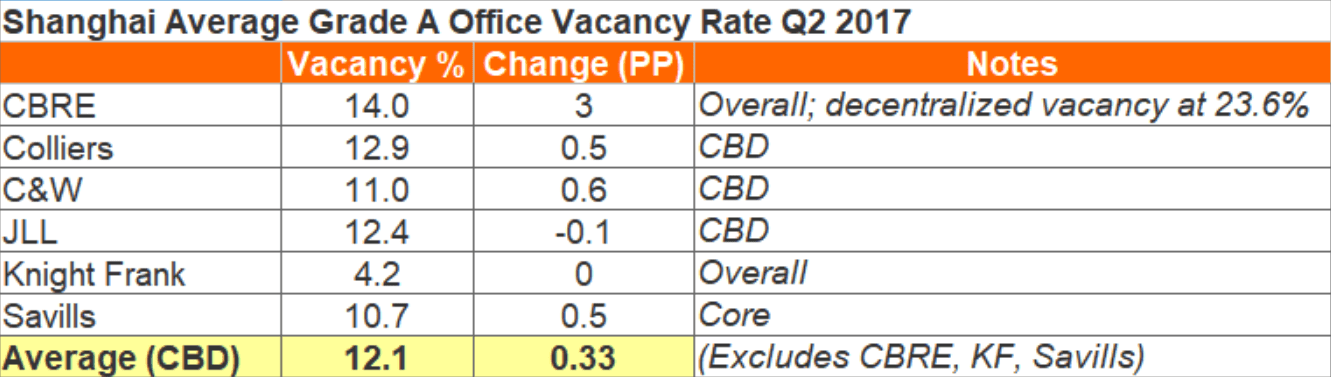

Most agencies reported an ongoing wave of new office deliveries, averaging 223,273 square metres in the downtown, which boosted vacancy rates by an average of 0.33 percentage points quarter-on-quarter to 12.1 percent. The influx of new supply placed downward pressure on grade A asking rents, despite the robust occupier demand, with average downtown rent easing by 0.37 percent to RMB 315.9 ($46.6) per square metre per month.

On the Same Page – Mostly

That rent figure is an average of three agencies’ estimates, which ranged from RMB 313.3 ($46.2) to RMB 315 ($47.1) per square metre per month. CBRE and Knight Frank provided estimates referencing the overall Shanghai office market – including the decentralized areas which resulted in lower overall figures than surveys parsing out downtown areas. Savills reports on “core” markets, which the agency defines more broadly than the standard CBD area by including submarkets such as Hongqiao and North Station. For clarity and consistency, only the CBD-specific rent figures of Colliers, Cushman & Wakefield and JLL have been included in the average.

Counting buildings would seem to be a straightforward task, but the agencies gave divergent accounts of how much “new supply” cropped up during the quarter, due to different reporting methodologies. Going against the grain, JLL, which only counts buildings ready for occupation as new supply, reported that the downtown supply wave “[took] a breather” during the quarter, with only two buildings completed.

By any measure, it’s clear that a grade A supply surge is hitting the emerging districts of Shanghai outside the mature business hubs. JLL reported that a total of 10 decentralized projects were completed last quarter, adding 504,000 square metres of space to the market. Colliers tracked three new projects coming online across Zhabei’s Tianmu Hengfeng area, Xuhui’s Binjiang, and Pudong’s Qiantan.

The impact of new supply is being felt much more strongly in these decentralized areas than in the downtown. According to CBRE, the average decentralized vacancy rate stood at 23.6 percent, while JLL reported that vacancy climbed by 3.2 percentage points quarter-on-quarter to 25.7 percent.

Prediction Is Difficult, Especially About the Future

Looking ahead, CBRE sees a large pipeline of 570,000 square metres of grade A office space being delivered in Shanghai during the second half of the year, with 70 percent of that in decentralized areas. More dramatically, Colliers forecasts an additional 440,000 square metres of space coming online in the central business hubs and over one million square metres in the outlying districts.

Cushman & Wakefield anticipates that 290,000 square metres will launch in the city center during the second half, noting that the new supply is expected to boost office vacancies. “The market should see average rent continue to adjust on pressure from fast maturing emerging submarkets and high levels of new supply,” according to the agency.

Colliers is the only agency to provide numerical rental and vacancy forecasts in its publicly available report. According to the agency, average downtown vacancy will hover around 15 percent by the end of 2017, and this high vacancy level should persist through 2018 given the influx of new supply. Colliers also predicts a moderate rental adjustment of negative one to two percent for the downtown over the next two years, with rent picking up starting in 2019.

The agencies tended to agree that a new supply boom over the the rest of the year will exert a drag on rental rates and motivate landlords to offer greater concessions and more flexible lease terms to tenants. The wave of office deliveries will also elevate vacancy rates despite continued strong absorption from Shanghai’s tertiary sector.

Shanghai’s emerging submarkets, where the supply influx will be most intense, will continue to mature as the city’s metro network expands, offering better access to these formerly remote locales. A range of high-quality office options coming online will drive higher vacancies, but over the long term, rising demand for emerging industries and corporate relocations from the downtown should support absorption in these lower-cost markets.

Reports Used in this Study

To read the reports yourself, please follow the below links:

CBRE

CBRE MarketView China, Q2 2017

Colliers

Colliers Quarterly Q2 2017 Shanghai | Office

Cushman & Wakefield

MarketBeat Office Snapshot Q2 2017 Shanghai

JLL

JLL Shanghai Second Quarter Property Review (news release)

Knight Frank

Greater China Property Market Report Q2 2017

Savills

Report not yet publicly available

The combination of seasonal reports from different consultings is great! Thanks for sharing.

Glad you find it useful. Watch for our upcoming report on the Hong Kong office market.