The office portion of Asia Square Tower 2 changed hands for over $1.5 billion last year, helping drive growth in Singapore

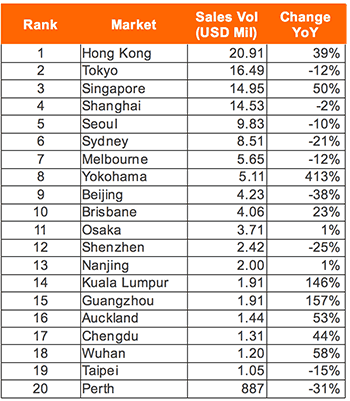

Hong Kong shouldered aside Tokyo to take the crown as the most active metropolitan real estate investment market in Asia Pacific last year, with deals for income-producing assets jumping 39 percent year-on-year to $20.9 billion, according to a new report by Real Capital Analytics (RCA).

Transaction volume in the city reached a new peak for the second year in a row. Hong Kong also recorded an all-time high of $21.4 billion of development site acquisitions in 2017, surging 78 percent year-on-year, as mainland capital flooded into the city and land scarcity drove up prices.

The heated activity in Hong Kong came as $157.5 billion in income-producing properties changed hands across the Asia Pacific region in 2017, a total which grew six percent year-on-year to hit a historic high. According to real estate information provider RCA, development sites added another $644 billion to the total transaction volume.

Hong Kong Commercial Prices Grow by One-Fifth in 2017

While mainland-backed deals grabbed the headlines in 2017, in the latest edition of Asia Pacific Capital Trends RCA found that Hong Kong-based buyers accounted for 80 percent of overall deal volume in the city’s commercial property market during the year.

Local property giant Henderson Land Development’s purchase of the Murray Road car park site in Central for $3 billion in April led the way for development sites, while mainland builder LVGEM helped drive a near-doubling of activity in the Kowloon business district by scooping up the 8 Bay East office tower project for $1.2 billion last October. The company’s tally did not include mainland-backed CHMT Peaceful Development Asia’s $5.15 billion acquisition of The Center on Queen’s Road — a preliminary agreement for which was signed in early November last year.

The frenetic activity in the Hong Kong market helped drive 20 percent growth in commercial property prices in 2017 compared to the previous year, with prices tripling since the end of 2006, according to preliminary data cited by RCA.

Collective Sales Power 50% Singapore Surge

Although Hong Kong led the way in transaction volume, the city’s growth rate was surpassed by its rival to the south, with the value of of deals for income producing assets transacted in Singapore growing by 50 percent, to reach a high for this decade of $15 billion.

The buoyant market in the city-state was led by a number of mega-deals including the nearly $1.6 billion sale of the Jurong Point shopping mall to Mercatus Co-operative in April and the purchase of the office portion of Asia Square Tower 2 by CapitaLand Commercial Trust for $1.5 billion in September.

Also fuelling activity in the Southeast Asian financial hub was a wave of large residential collective sales, in which housing units under multiple ownership are sold to a single buyer, typically for redevelopment purposes. Tightening supply of land for development and a recovering housing market prompted a flurry of such transactions in Singapore last year, and the enthusiasm shows no signs of abating.

Most Active Metropolitan Markets 2017 (Income-Producing Properties)

Seoul and Tokyo Slip as Deals Go Provincial

South Korea was another standout performer in 2017, with deals for income-producing property achieving a record high of $14.3 billion, up seven percent year-on-year. Domestic investors drove the increase, while the majority of capital shifted away from the core business districts of Seoul to suburban markets and regional cities. Volumes in the capital, Seoul, slid by 10 percent.

Korean asset manager IGIS emerged as the single biggest global buyer in Asia last year, by notching deals including the $635 million acquisition of the prime office property Signature Tower Seoul from Ascendas-Singbridge in August.

Activity in Tokyo slipped by 12 percent last year, as the Japanese capital saw $16.5 billion of income-producing property deals, ranking second among Asia’s metropolises. As in Korea, investors hunted for value outside the capital city, chasing deals in regional markets such as Yokohama and Osaka. Income-producing property deals ticked up by three percent in Japan as a whole.

Investors in China Shift Focus Away from Shanghai

Guangzhou saw a 157 percent surge in transactions last year, including the sale of Metropolitan Plaza

Shanghai came in fourth place as a metropolitan market, with $14.5 billion of transactions, declining slightly as capital shifted to regional cities including Guangzhou – which surged 157 percent – Chengdu, Chongqing, Nanjing and Wuhan.

Major deals in southern China’s Guangzhou included the sale of the Metropolitan Plaza mall to Link REIT for $585 million in May and the purchase of the Guangzhou Damazhan Comm Center, a downtown grade A office building, by Gaw Capital for $172 million.

While the mainland’s biggest cities ranked a few places from the top among centres in the region, mainland China as a whole accounted 92.5 percent of the market for development sites with $596 billion worth of such deals.

Sheds and Shelters Heat Up

In addition to the spurt in site sales, apartment acquisitions skyrocketed by 57 percent across Asia Pacific to $20.3 billion last year, while industrial property deals (mostly warehouses) grew at a robust clip of 20 percent to $19.1 billion.

Rapidly climbing prices for office and retail assets, and the reluctance of many owners to sell, drove investors to other property types. Office activity dipped by two percent last year while retail remained flat.

Leave a Reply