Asia’s real estate investors are choosing Singapore over Hong Kong for a second straight year

The long-running Singapore-Hong Kong rivalry may be over for many property investors in the region, with the Lion City trouncing its competitor to the north, according to a report released this week.

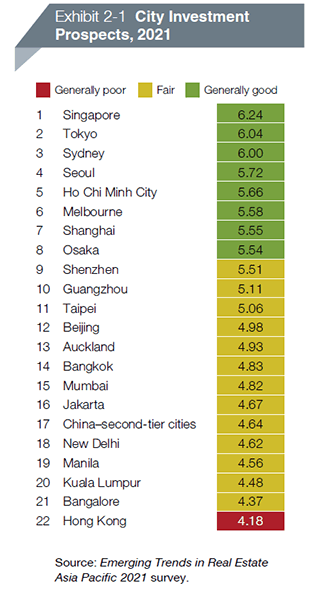

Southeast Asia’s wealthiest nation topped the list of Asia Pacific cities ranked by their property investment prospects for the second year in a row, said the nonprofit Urban Land Institute (ULI), which issued the report with PwC.

Also for the second year running, Hong Kong came in dead last after two dismal years of social unrest and a COVID-induced recession, the report said.

Sense of Stability

Singapore is winning favour for its stability and transparency, as risk aversion has taken on an even higher priority with investors in the year of COVID-19, the survey found. Two other markets benefiting from calm political and economic environments are Sydney and Tokyo, which ranked second and third for their property investment prospects in the 2021 Emerging Trends in Real Estate: Asia Pacific report.

“If you’re looking for safety or security, you’re probably going to Japan and also to some property types in Australia,” said one brokerage analyst interviewed for the report.

ULI Asia Pacific president David Faulkner

And while Singapore lacks the liquidity associated with Sydney and Tokyo, it boasts plenty of core assets, together with Grade A office valuations that are some 30 percent lower than in Hong Kong, the report said.

Seoul and Ho Chi Minh City rounded out the investment top five in the ULI’s annual investor sentiment survey, based on responses from nearly 400 real estate investors, lenders and developers.

“Despite the common rhetoric that the pandemic has ignited many changes to our society, what we have seen so far in the real estate sector is an acceleration of trends already underway before the arrival of COVID-19,” said David Faulkner, president of ULI Asia Pacific.

Among the trends that picked up speed this year was the emergence of logistics as a key asset class, according to the report. With COVID-19 having supercharged the e-commerce companies leasing much of the region’s warehouse space, logistics has proved to be the most resilient to the economic shocks of the pandemic.

Corrections on the Horizon

The report suggested that despite the proactive response to the COVID-19 pandemic adopted by many jurisdictions in Asia Pacific, leading to relatively successful containment of the virus, several markets in the region, including China, could be headed for a correction.

The report suggested that despite the proactive response to the COVID-19 pandemic adopted by many jurisdictions in Asia Pacific, leading to relatively successful containment of the virus, several markets in the region, including China, could be headed for a correction.

While government policies have helped, “There is a sense that asset values have been propped up by a combination of transient factors — government support programmes, bank forbearance policies, healthy corporate balance sheets — that are unlikely to last,” the report said. “As the tank runs dry, there is growing conviction among investors that a market correction is inevitable.”

At the head of the pack for correction is China, where government-mandated liquidity tightening, including the Three Red Lines guidance on lending to indebted enterprises that was first floated in August of this year, could create financing challenges for small developers.

Also vulnerable to stress are India and Australia. In India, the collapse of non-bank financing and pressures from the pandemic have left most developers in tight financial straits, according to one respondent cited in the report. In Australia, the region’s most COVID-impacted economy is seeing higher vacancy rates that are expected to bring down office rents, and with them capital values.

Investment Dark Horses

Seoul and Ho Chi Minh City landed spots in the survey’s top five investment locations for their solid structural fundamentals, amplified by the pandemic.

Seoul gained traction as the cornerstone of a South Korean domestic economy built to meet local demand rather than serve a risky international environment. The country’s commitment to e-commerce helped: South Korea lagged behind only China and Taiwan for e-commerce retailing in 2020 so far, with 16 percent of all retail sales taking place online.

Ho Chi Minh City ranked as the emerging market with the best growth prospects for next year, due to Vietnam’s successful response to the pandemic and its ability to step into the manufacturing gap left by China’s drive to advanced technology and lingering Sino-US trade tensions.

As an extension of the embrace of logistics as an asset class, cold storage is rapidly becoming a hot market, thanks to continued demand from grocers catering to increased online food shopping and the looming need for vaccine storage. A shortage of facilities in APAC has cold storage assets already trading at a 300 to 350 basis point premium on conventional logistics assets, the ULI said.

Still Going Green, Still Going Office

Faulkner noted environmental, social and governance (ESG) themes as an example of a trend with a rising profile pre-COVID, in addition to developers moving towards “designing general-purpose structures that can be adapted to serve multi-purposes over their lifetimes”. With landlords recognising ESG as a factor in corporate bottom lines, there is growing demand for green debt in APAC, according to the ULI.

“The main driver persuading landlords to adopt ESG features is that institutional funds — particularly those based in Europe — increasingly have mandates only to buy assets (or to place capital with funds that buy assets) that meet certain ESG standards,” the report said.

Also on the investor radar is the build-to-rent residential sector, as cash flows from apartment rents prove to be more resilient to the current downturn than commercial leasing revenue. Cash-strapped corporates raising capital through sales of real estate assets with lease-back options has also become an investment opportunity for institutions this year, according to the report.

Notable, however, is a continued commitment to office assets, if at slightly reduced levels. Many respondents believed that companies in Asia Pacific would eventually bring their teams back into the office, as few respondents showed interest in long-term work-from-home practices. They cited work culture, small home sizes in the region and a lack of colleague interaction as reasons that work-from-home would be a short-term trend.

Leave a Reply