Singapore’s Duo twin towers traded for S$1.6 billion amid a surge of investment in the city-state (Image by Iwan Baan)

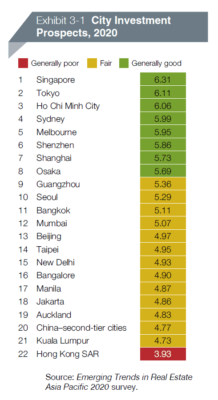

Singapore took the crown as the city with the most favourable real estate investment prospects in Asia Pacific, while Hong Kong plunged to the bottom of the ranking, according to an annual survey by the Urban Land Institute (ULI) and PwC.

The large, established markets of Tokyo, Sydney and Melbourne joined the Lion City among the top five most attractive destinations for capital in 2020, while Ho Chi Minh City made a surprise appearance in third place, bucking a flow of investors away from emerging markets.

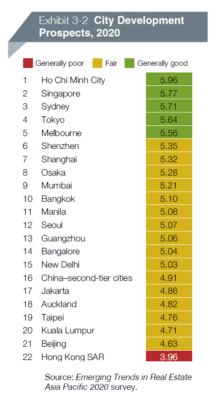

Vietnam’s largest city also topped the list for city development prospects, according to the Emerging Trends in Real Estate: Asia Pacific 2020 report, which gauged the outlook of 463 industry experts.

Lion City Roars Ahead

The sunny outlook on Singapore reflects the city-state’s rebound from a slump across all property sectors, as cross-border investors led a 73 percent year-on-year surge in transactions in the first half of 2019, totaling $4.9 billion.

The city ranked 21st place for investment prospects in the 2017 outlook report, but interest in the southeast Asian financial center has ignited since then, with Singapore jumping to third place in the 2018 outlook and then to second place in the survey published last year. Singapore’s continued rise in 2019 was bolstered by investors steering clear of the troubled mainland China and Hong Kong markets.

The city ranked 21st place for investment prospects in the 2017 outlook report, but interest in the southeast Asian financial center has ignited since then, with Singapore jumping to third place in the 2018 outlook and then to second place in the survey published last year. Singapore’s continued rise in 2019 was bolstered by investors steering clear of the troubled mainland China and Hong Kong markets.

Southeast Asia’s wealthiest nation saw six acquisitions worth at least $300 million in the first half of the year, including Oxley Holdings’ sale of Chevron House for S$1.025 billion ($758 million) and the disposal of Chinatown Point Mall by Perennial Real Estate Holdings and co-investors for S$520 million ($383.28 million), both announced in April. In July, Allianz teamed up with Gaw Capital Partners to acquire the Duo Tower and Duo Galleria for S$1.6 billion (US$1.2 billion).

Hong Kong Suffers Amid Unrest

Buffeted by months of street protests that have wrought havoc on the city’s retail and hotel sectors, Hong Kong was the only city out of 22 to receive a “generally poor” rating for its investment and development prospects in 2020. Despite the turmoil, investment values in the office sector have remained relatively unscathed and the city is expected to maintain its edge as a financial hub, while some investors appear stymied by a lack of deals on the market.

“A couple of the big sovereign funds called to ask if this is an opportunity, but I had to tell them, essentially, that no one is selling,” one Hong Kong-based investor told ULI and PwC.

“A couple of the big sovereign funds called to ask if this is an opportunity, but I had to tell them, essentially, that no one is selling,” one Hong Kong-based investor told ULI and PwC.

Sentiment is also grim in China’s second-tier cities, which ranked 20th for investment prospects, as overseas investors have largely retreated in favour of Shanghai and Beijing. Oversupply woes, particularly in the office sector, continue to plague the secondary cities and China’s weakening economy has sparked liquidity fears.

“A lot of foreign capital has been burned in the Tier 2, Tier 3 cities,” one fund manager is quoted as saying in the report.

Getting Defensive, Except in Vietnam

For the most part, investors are placing their bets on large, liquid and defensive markets as the end of the current real estate cycle approaches and concerns about geopolitical stability and the impact of the trade wars take centre stage. The large and liquid markets of Shenzhen, Shanghai, Osaka, Guangzhou and Seoul rounded out the top 10 list for 2020 investment prospects.

Ho Chi Minh City emerged as an outlier, not only taking third place for investment but also topping the list for development and for buy/hold/sell recommendations for all asset classes – office, retail, residential, industrial/distribution and hotel. Most of the real estate capital flowing into Vietnam’s financial hub has targeted development, especially in the residential sector, triggering problems with overbuilding.

Leave a Reply