Grade A office rentals in Shanghai held fast during the second quarter, despite three major new buildings coming on the market. However, the outlook for 2015 and beyond could hold trouble for some projects as the city now has more than two million more square metres of office space under construction, according to a recent report from property services firm Cushman & Wakefield.

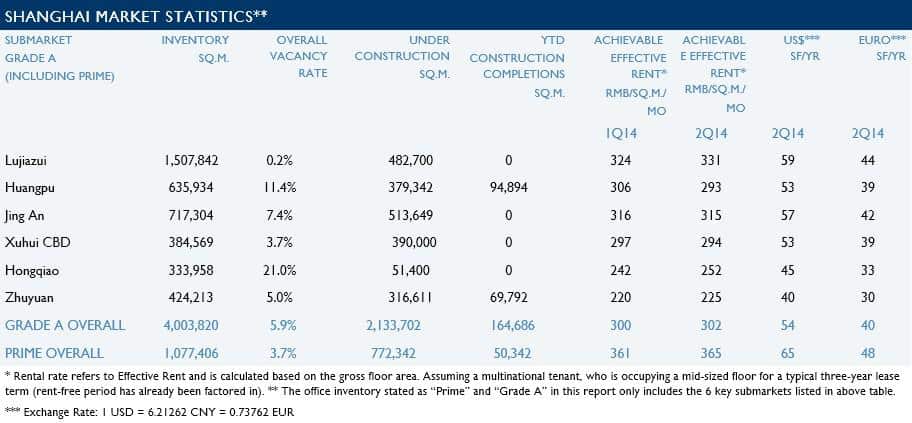

As revealed in the agency’s report, 165,000 square metres of grade A office space was added to the Shanghai market during the period from April through June, as three new office buildings were completed. The opening of 5 Corporate Avenue and 100 Bund Square in Huangpu district, and Lujiazui Century Financial Plaza Tower 2 in the Zhuyuan area of Pudong raised the needle on the citywide vacancy rate only slightly to 5.9 percent, up two-tenths of a percentage point from the previous quarter, and down six-tenths of a percentage point from the same period in 2013.

5 Corporate Avenue (which last year was acquired by China Life Insurance from developer Shui On Land) and Lujiazui Century Financial Plaza Tower 2 had pre-leasing rates of as high as 70% upon completion. However, along with softening in the overall economy, these new completions had placed downward pressure on rental rates in the prime districts of Puxi, as some existing tenants decided to relocate or expand into these newer developments.

Rental Rates Rise in Pudong

Rents continued to rise in Pudong’s prime districts of Lujiazui and Zhuyuan, with rates going up 2.0 percent and 2.5 percent respectively, compared to the previous quarter. Lujiazui is now Shanghai’s most expensive office market, with an average rent of RMB 10.88/sqm/day for grade A (including Prime) stock, as the area continues to consolidate its appeal for financial services companies. Jing An district in Puxi, which is home to the West Nanjjing Road business district had the second highest rents at RMB 10.37/sqm/day, according to the agency’s figures.

New Buildings Bring Higher Vacancies

The new building openings brought higher vacancy rates for their home districts, with 5 Corporate Avenue and 100 Bund Square pushing Huangpu’s vacancy rate to 11.4 percent, up from 5.4 percent in the first quarter. In Zhuyuan, the debut of Lujiazui Century Financial Plaza Tower 2 was seen as moving the vacancy rate up from 0.3 percent to 5.0 percent quarter-on-quarter.

Vacancies in Lujiazui continued to tighten with available space dropping to a reported 0.2 percent, and the percentage of available space in Jing An fell from 10.4 percent in the first quarter to just 7.4 percent at the end of June as tenants took up significant amounts of space in the Kerry Centre and Wheelock Square.

During the remainder of this year the agency expects vacancy rates to be limited as only a few smaller developments such as Henderson 688 and The Place Phase II in Hongqiao will open over the second half of 2014.

Lower Rents in Puxi Will Keep Tenants Downtown

Looking forward to 2014 and beyond the agency sees office occupiers returning their attention to downtown areas as more grade A space becomes available within the traditional city centre.

Michael Stacy, Head of Commercial, Shanghai at Cushman & Wakefield said: “There are 2.1 million square meters of new developments now under construction in the Shanghai CBD. While this may seem like a lot of supply, there are limited projects among this basket that will provide high quality building infrastructure, metro access and supporting amenities to prospective tenants.”

Stacy does foresee the rollout of these downtown buildings slowing down the trend of large companies seeking space in areas away from the city centre, as another study by the agency found that few potential candidates for decentralization left in the core CBD.

As rents in downtown Puxi continue to soften, Cushman & Wakefield expects fewer tenants to move to the outlying areas, except those that need massive floor areas.

The agency did seem some bright spots for office developers in Puxi, particularly for large, high end projects. “We are seeing tenants looking ahead to the delivery of premium projects in the CBD two to three years out, such as Dazhongli’s development in the Jing An District, and lining up their lease expiries with the delivery of these projects in order to facilitate consolidations and relocations,” Stacy added.

Leave a Reply