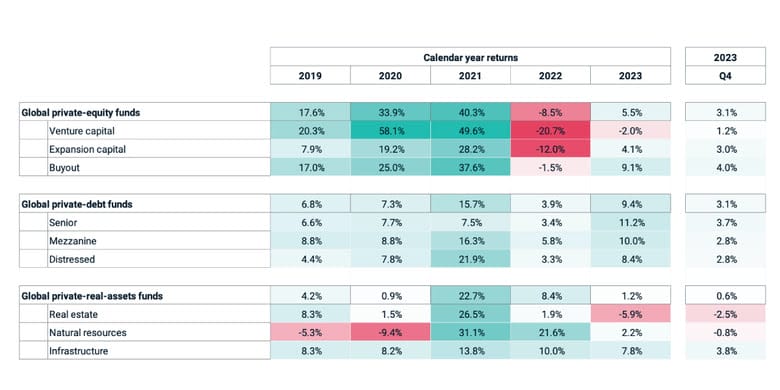

Real estate funds tumbled to a 5.9% loss in 2023 (Image: MSCI)

Senior debt funds saw the highest annual return among major private asset classes in 2023 as real estate funds delivered the worst global performance, according to an analysis by MSCI.

The data provider said senior debt funds generated an internal rate of return of 11.2 percent last year, followed by mezzanine debt funds at 10 percent. Real estate funds, meanwhile, recorded a loss of 5.9 percent while venture capital funds endured a loss of 2 percent, marking the only categories with negative returns on the year.

“On a quarterly basis in Q4 2023, venture capital reversed a seven-quarter streak of declines, posting a 1.2 percent return,” Keith Crouch, head of private capital index research and product development at MSCI, said in a research note. “Venture capital funds had dramatically outperformed all other asset classes during 2020 and 2021 but have since underperformed, with a cumulative return for the 16 quarters since 2019 now about tied with buyout funds.”

The study drew on statistics from the Burgiss Manager Universe, a database that covers more than 13,000 private asset funds representing $15 trillion in cumulative investments across private equity, private real estate, private debt, infrastructure and natural resources.

Sturdy Infrastructure

Among private real asset funds, infrastructure funds topped the table with a 7.8 percent annual return as natural resources funds finished a distant runner-up with a 2.2 percent return.

Keith Crouch, head of private capital index research and product development at MSCI

Infrastructure continued to show momentum in the last three months of 2023, returning 3.8 percent on a quarterly basis, while real estate and natural resources trailed with respective losses of 2.5 percent and 0.8 percent for the period.

Among private equity funds, buyout vehicles shone brightest with a 9.1 percent annual return while expansion capital strategies produced a 4.1 percent return, the latter rebounding from a 12 percent loss in 2022.

Private equity funds as a whole posted their highest quarterly distribution rate of 2023 during the fourth quarter with an annualised 10.8 percent. But their full-year distribution rate of 9.5 percent was well below the 2015-19 average of 23.6 percent and even below 2022’s rate of 11.8 percent, Crouch said.

“The slow pace of distributions remains a concern for limited partners in private equity funds,” he said. “Newly raised funds continued to call capital while distributions from mature funds have been muted since 2022.”

Property Less Popular

The loss-making performance of global real estate funds occurred in a year of anaemic capital-raising for the asset class, according to two recent reports.

Global investment managers raised $129 billion in new capital for non-listed real estate in 2023, representing a 51 percent drop from the previous year and the lowest level since 2016, based on the findings of the 2024 Capital Raising Survey by the Asian Association for Investors in Non-Listed Real Estate Vehicles.

The ANREV poll showed that managers deployed 16 percent of new capital raised last year, down from 26 percent in 2022 and 47 percent in 2021, as they set a record low for rate of execution.

In a State of the Market report, Realfin said global private real estate fundraising in 2023 suffered its sharpest drop in 14 years, tumbling 33.1 percent to $151.3 billion. The number of private vehicles reaching a final closing recorded the deepest decline of all time, plunging 43.5 percent to 473, according to the London-based data provider.

Leave a Reply