Non-profit real estate research organisation Urban Land Institute (ULI) has just polled its members on what cities are best for property investment, and despite high prices and scarce land, Shanghai has come out on top for the second year in a row in the eyes of real estate professionals.

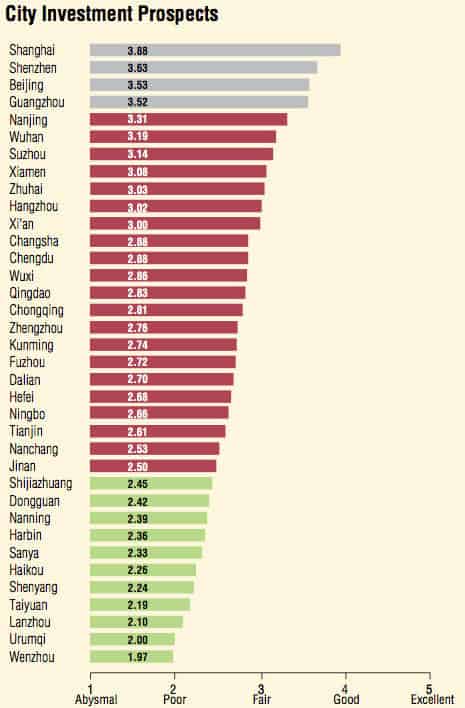

Mainland China Real Estate Markets 2014: ULI Analysis of City Investment Prospects is the fourth such annual survey conducted by the Urban Land Institute, and the findings this year emphasised a retreat to China’s most developed and stable markets in the first tier cities. Shanghai, Shenzen, Beijing and Guangzhou – all considered first-tier – were ranked one through four respectively, with fifth place being taken up by Nanjing, the capital of eastern China’s Jiangsu province.

Ironically, a comparison of the results of this year’s survey – as well as a scan of recent headlines – with the preferences stated by the ULI’s members in 2012 seems to show that some of the cities that these professionals were most interested in investing in during 2012, are now what the places that they most wish to avoid.

The annual survey of the professional group’s members reports on real estate development and investment prospects in 36 of the largest cities in Mainland China, as well as issues affecting those prospects. The ULI survey was conducted in April and May of this year and polled members active in China.

Speaking of the results of this year’s poll, Ken Rhee, ULI’s Chief Representative in Mainland China and co-author of the report said, “The survey shows that people are comfortable operating in the major cities including Shanghai and Beijing which have strong underlying market fundamentals, but are increasingly cautious about the prospects for many Tier 2 and 3 cities, especially those with oversupply issues such as Chengdu, Tianjin and Shenyang.”

Chengdu, the capital of western China’s Sichuan province was ranked as the top choice of ULI’s members in 2012, when Tianjin ranked 18th and Shenyang 21st.

For 2014 the ULI’s membership chose these cities as their top five:

1. Shanghai

Shanghai retained its top ranking for both investment and development prospects and continues to benefit from having the deepest pool of investment-grade assets across all the major asset types. Last year the ULI ranked Shanghai as second only to Tokyo for real estate prospects across Asia.

2. Shenzhen

Shenzhen’s strong performance this year is largely due to the central government’s establishment of the The Qianhai Shenzhen–Hong Kong Modern Service Industry Cooperation Zone, which provides companies registered there with preferential conditions. Shenzhen moved up to number two on the list this year, after finishing sixth in 2013.

3. Beijing

Beijing has continued to surprise many investors who worried about the large oversupply of office buildings released after the 2008 Olympics. However, strong demand for Grade A office buildings from local companies, means the new supply has been fully absorbed and Beijing now has the highest average office rents in Mainland China. Still, Beijing slid one slot this year after coming third in 2013, but this remains far above the city’s ninth place finish in 2012.

4. Guangzhou

Guangzhou’s high ranking for investment comes from the maturing of the Pearl River New Town and the improving infrastructure of the city following the 2012 Asian Games. Like the other Tier 1 cities, Guangzhou is running out of developable land in the city core and developers need to look towards urban renewal projects to find opportunities.

5. Nanjing

Nanjing has often been overlooked by institutional investors, in favor of Suzhou. However, the opening of the high-speed railway connecting the city to Shanghai and Beijing has made it very accessible and highlighted new opportunities to investors.

Second Tier Cities Being Treated with Caution

While investors preferred China’s largest cities this year, some second tier cities still scored with the real estate professionals, with Wuhan, Suzhou, and Xian all ranking among the top 10 in investment or development prospects. There were notable declines in this year’s rankings, however, for former favorites Hangzhou, Chengdu, and Chongqing.

Hangzhou’s investment ranking dropped to tenth from fifth, though its development ranking moved up to 11th from 13th. Chengdu’s ranking dropped to 13th from eighth for investment prospects and to 15th from seventh for development prospects due to an oversupply of commercial properties in its downtown and in the Tianfu New Area. Chongqing continued its decline in rankings, dropping to 16th from 12th for investment prospects and to 17th from 14th for development.

In terms of sectors, industrial and distribution continues to be the most popular among respondents with 56 percent indicating they plan to increase exposure to this sector, in response to the rapidly growing e-commerce in Mainland China and the severely limited stock of high-grade logistics warehouses.

China has suffered a nation-wide slowdown in the real estate market this year, with smaller cities generally being among the worst hit. In addition, many investors have become increasingly concerned about the oversupply of new stock in a large number of Tier 2 and 3 cities.

In all 107 industry professionals responded to the survey this year, and these results were were supplemented by individual interviews and group discussions. A copy of the group’s 2013 report can be accessed here.

Leave a Reply