JLL’s Megan Walters says mainlanders are moving in as western firms search for cheaper space

Just two years ago Hong Kong’s students were taking to the streets to protest their lack of electoral choices, but the next round of riots could come from CFOs struggling to pay the city’s world-leading office rents.

Grade A office rental rates in Hong Kong’s Central district, the city’s traditional downtown rose by more than 13 percent this year according to JLL’s Global Premium Office Rent Tracker, making the cost of an office more than 50 percent higher than what tenants would pay in London or New York.

Bankers, lawyers and other unfortunates who need to impress their clients with a premium grade office at the city’s poshest addresses are now paying an average US$302 per square foot per year in Central, compared to $197 per square foot in London’s West End and $194 per square foot in New York’s Midtown.

Mainland Demand Driving Hong Kong Rental Rates

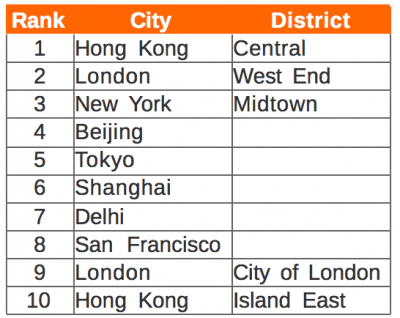

The world’s most expensive office locations, according to JLL

JLL attributed the rising office rental rates to increased demand from mainland China companies, who have increasingly turned to Hong Kong as a springboard for their international expansion.

“Mainland Chinese wealth and asset companies are moving in as they seek to boost their presence in Hong Kong. This demand is expected to continue with the launch of the Shenzhen-Hong Kong Stock Connect program in December,” said Megan Walters, JLL’s head of research for Asia Pacific.

In a turnabout from years past, when Chinese companies were seen as being more frugal than western multinationals, it is the American and European firms that are now looking for cheaper space. “Hong Kong’s Central district is being reshaped as western banks and financial institutions downsize or move out due to global challenges such as slower economic growth and increased compliance and regulations,” Walters noted.

Mainland Cities Slide, Singapore Falls Off a Cliff

While Hong Kong prices continued to climb, both Beijing and Shanghai fell a place to fourth and sixth position respectively. Tokyo leapfrogged past Shanghai to take fifth spot, propelled by high leasing activity and big-ticket pre-commitments, while New York has seen premium rents increase by more than 10 percent in 2016. Singapore takes 18th spot in the rankings after rents began falling last year and with the market set to receive a number of major new office projects over the next three years.

This is the second straight year that JLL has published its Global Premium Office Rent Tracker report, which compares occupation costs across 35 major markets in 31 cities.

Leave a Reply