China’s real estate markets produced a major upswing in new investment, growth in land sales and housing sales in the first quarter, following the government’s December commitment to destock an overhang of unsold homes.

Growth in new real estate investment rose by 6.2 percent year on year during the first three months of 2016, and growth in new home sales jumped 43.6 percent by value, compared to the first quarter of last year, according to figures released over the weekend by China’s National Bureau of Statistics.

While the recovery in the real estate industry has been widely attributed to lower interest rates, builders and homebuyers appear to only have begun taking advantage of this cheap credit following government declarations regarding a need to rekindle the housing industry during the final month of 2015.

Shenzhen Home Prices Jump 61 Percent in One Year

China’s southern commercial hub of Shenzhen continues to be the epicenter of the housing recovery, with home prices now up by 61 percent year on year, according to the bureau’s data. Shanghai prices grew by 25 percent over the same period.

Along with Beijing, both Shanghai and Shenzhen witnessed unprecedented surges in home sales volumes and prices during March, as homebuyers rushed to conclude deals before an anticipated clampdown on real estate sales in China’s megacities.

Compared to February, home prices were up by 3.5 percent in both Shanghai and Shenzhen.

Since the new downpayment rules went into effect, the volume of homes sold in Shenzhen fell by more than 50 percent in the last two weeks, and Shanghai’s home sales slid by nearly 60 percent, according to figures published by the China Real Estate Index System.

The surge in activity in the two urban centres helped to pull home sales for the first quarter up by 71 percent compared to a year earlier, with much of that increase coinciding with the March surge in Shanghai and Shenzhen.

A Government Led Rebound

While many analysts have attributed China’s real estate rebound to cheaper credit alone, the timing of this first quarter recovery appears to be more closely synchronised with a government vow to destock lower tier cities and revive real estate investment, although lower interest rates also facilitated the growth spurt.

China’s benchmark interest rates over 12 months from 1 April 2015 to 31 March 2016

Source: tradingeconomics.com

China’s central bank lowered interest rates six times in 2015, with the last rate cut coming in mid-October. Despite this cheaper credit, growth in new investment and land sales continued to slide through the end of last year.

The turnaround in investment and sales seems more closely in tune with December pronouncements from China’s top leaders, such as a December statement out of the Central Economic Work Conference.

“Obsolete restrictive measures [in the property market] will be revoked,” the attendees of the Conference announced at the end of the top level session. Home purchase restrictions which had earlier been put in place to tamp down home price inflation and fears of a bubble had been locking many buyers out of the market, and had made prices more expensive, particularly for speculators owning multiple units for investment purposes.

China’s highest governmental body, the Politburo, also got behind the housing revival in December, declaring that, “We must destock property inventories, by turning migrant workers into urban citizens in a faster pace and pressing ahead housing reform to meet demand from these new urban residents,” after a session chaired by President Xi Jinping.

Sales of land, and investment in new projects began rising soon thereafter, and a home sales market already on the upswing rose further. For March, 40 out of 70 major Chinese cities reporting rising home prices, up from just 32 in February.

Recovery Concentrated in China’s Wealthiest Areas

While China’s housing rebound is spreading to more cities, that doesn’t mean that things are improving everywhere.

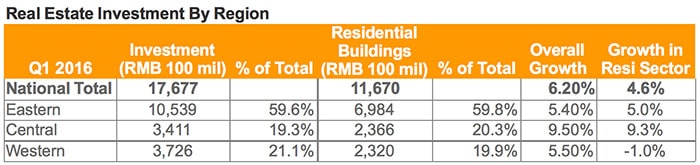

Nearly 60 percent of the nearly RMB 1.8 trillion that the bureau reported as invested in China real estate projects during the first quarter, was directed into projects in eastern China, which the survey defined as including the first tier cities of Beijing, Shanghai, Guangzhou and Shenzhen, as well as the comparatively wealthy provinces and municipalities of Tianjin, Hebei, Liaoning, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan.

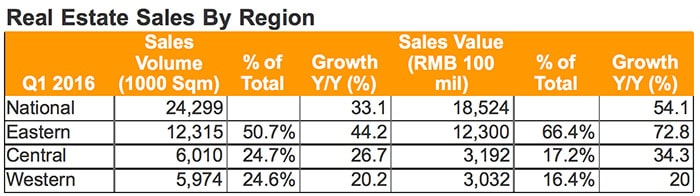

In terms of housing sales, by value more than 66 percent of the RMB 12.3 trillion in Chinese homes sold during the first three months of the year were in eastern China. Central China, which the survey defines as including Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan, accounted for 17.2 percent of the RMB 18.5 trillion in sales.

Western China, which is defined as Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang, contributed only 16.4 percent of overall sales.

Leave a Reply