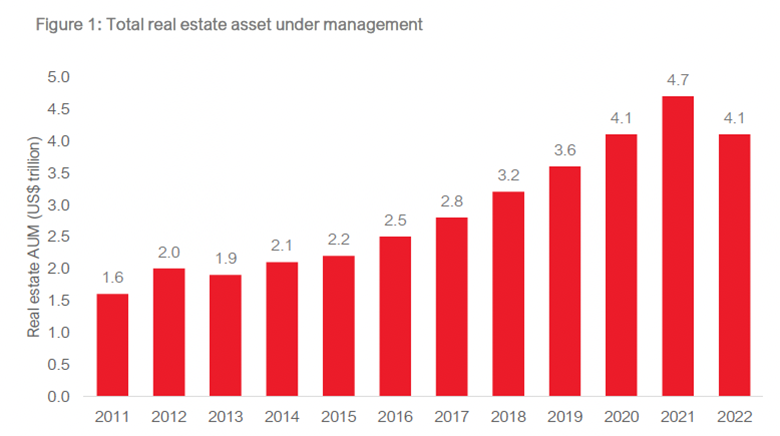

Total real estate AUM slid back to $4.1 trillion last year (ANREV)

ESR’s M&A growth propelled the Hong Kong-listed firm ahead of arch-rival GLP Capital Partners to claim the top spot in assets under management for Asia Pacific non-listed real estate strategies in 2022, according to data compiled by a group of non-profits serving the property investor community.

ESR, which completed its $5.2 billion acquisition of ARA Asset Management in January of last year, commanded $70.8 billion in non-listed APAC AUM to sit well ahead of Singapore’s GLP ($56.9 billion), with Sydney-based firms Charter Hall and Goodman in third ($40.3 billion) and fourth place ($33.7 billion), as reported in the Fund Manager Survey 2023, a publication of the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), its European counterpart INREV and Chicago-based fiduciary association NCREIF.

The ongoing consolidation in the non-listed real estate industry is evidenced by the concentration of AUM in larger fund managers throughout 2022, said Amelie Delaunay, senior director of research and professional standards at ANREV.

“It is interesting to observe that non-listed real estate AUM in APAC is dominated by single-sector industrial and logistics investment managers, ESR, GLP and Goodman, which is a shift from five years ago where more diversified managers figured in the top three,” Delaunay said.

Blackstone Beats All

The fifth-place finisher in APAC, US investment giant Blackstone, led all fund managers worldwide with more than $500 billion in total real estate AUM after an increase of over $33 billion in 2022, the survey said.

ESR’s Jeffrey Perlman now looks after the largest manager of APAC real estate assets

The global top five was rounded out by Blackstone’s fellow North American firms Brookfield, Prologis, PGIM and Nuveen. MetLife sat at sixth, just ahead of ESR (making its debut in the top 10), followed by CBRE, AXA Investment Managers and Starwood Capital in the eight, ninth and 10th spots.

The total AUM of the top 10 exceeded $1.9 trillion, with each manager reporting total real estate allocations in excess of $100 billion. Along with Blackstone, Toronto-based Brookfield also reported AUM of more than $200 billion.

“The combined assets under management of the top four managers account for almost 27 percent of the total real estate capital in this year’s survey,” ANREV said.

North American Focus

North American strategies remained dominant in 2022, accounting for 39 percent of total AUM at $1.6 trillion, followed by European strategies with total allocations of $1.2 trillion (29 percent), APAC strategies with $754 billion (18 percent) and global strategies with $565 billion (14 percent).

This edition of the Fund Manager Survey included 116 managers and represented real estate AUM of $4.1 trillion at the end of 2022.

Of the $4.1 trillion total, non-listed vehicles accounted for 82 percent. Non-listed real estate funds continued to be the largest non-listed products by AUM globally, accounting for $2 trillion (60 percent) of total non-listed real estate AUM, followed by separate accounts investing directly, debt funds, and JVs and club deals.

Note: This article has been updated to reflect revised data submissions received by ANREV.

Leave a Reply