The ULI forecast for 2015 says that China’s warehouses are “ablaze.”

Despite a well-documented decline in China’s real estate market during 2014, the country’s most mundane buildings have just been voted the most exciting investment opportunity by property professionals across the region.

The logistics real estate sector – the world of warehouses and forklifts – was selected as the most promising property type for 2015 across Asia Pacific in a survey conducted by the Urban Land Institute and PwC. And within the sector, China ranked tops among geographic locations.

Real Estate Investors Can’t Get Enough of China’s Warehouses

In the annual survey, the logistics sector was said to receive “near-universal endorsement” among professionals interviewed, and was featured as the clear winner compared to residential, commercial or hotel opportunities by the survey respondents.

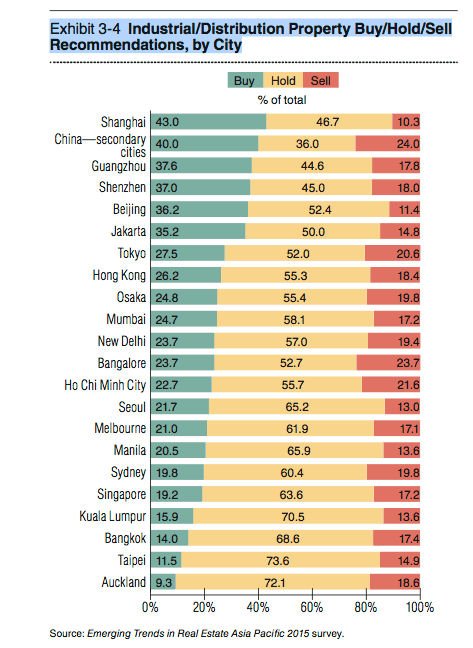

The institute interviewed 385 subjects, including investors, property developers, lenders, brokers and consultants and asked them their opinions regarding prospects in 22 different geographic locations in the region and across five property types including office, industrial, retail, apartment, and hotel.

According to the report, “Emerging Trends in Real Estate® Asia Pacific 2015,” warehouses owe their growing appeal to a number of factors, including a shortage of supply, the growth of ecommerce and investment yields that outshine other property types.

China the Leading Location for Logistics Investment

Despite China being significantly downgraded for its potential in other property types for 2015, the country’s prospects for logistics deals still received glowing reviews.

Among the 22 locations included in the survey, the top five ratings all went to mainland destinations, with Shanghai ranking first, followed by the generic “China – Secondary Cities,” Guangzhou, Shenzhen and Beijing, in that order.

And the survey’s authors sounded optimistic for fortune to continue to favor the region’s warehouse sector, including China. Citing figures from Deutsche Bank, the report said that logistics now accounts for about 10 percent of total real estate transactions in the region.

The authors added that, “The acute shortage of modern distribution facilities will last for years, especially given the rocketing popularity of internet shopping across Asia.”

China Logistics a Top Target for Foreign and Domestic Money

Respondents selected Shanghai as the top location for logistics space in Asia.

Already over the last few years China’s warehouse sector has become an increasingly popular target for both overseas and local real estate investors.

Following a string of successes by Singapore-government controlled developer Global Logistic Properties (GLP), a number of prominent investors have jumped in, including Goodman upping its partnership with CPPIB to $2 billion, Blackstone forming a logistics JV with Vanke, Equity International and Dutch pension fund PGGM joining with the Redwood Group, and Temasek Holdings backing Yupei.

GLP itself has also received further investment, as the Singaporean developer earlier this year received $2.51 billion in new funding from a Chinese consortium that included the Bank of China Group Investment and private-equity firm Hopu Funds.

Still Some Reservations About China Logistics Potential

Despite strong overall grades given to the potential for building more big sheds in China, some of the survey respondents contended that too much money was already flowing into a relatively small market segment.

While acknowledging that warehouses are “the only sector that looks obviously undersupplied in the country.” One survey respondent complained that, “The problem is that there are just a handful of guys [who] are really good onshore doing it and there’s a lot of capital chasing it, so yields are starting to get bid down to crazy levels.”

The concern among these contrarian market observers is that with much more attention being paid to the logistics sector, and a large number of domestic players currently entering the market, investment yields rapidly compress in the coming years.

While we can’t know for certain what the future will hold, the ULI and its survey will be back again next year for us to find out if China warehouses are still seen as the next big thing.

Leave a Reply