Brookfield’s buy of the Pradera Asia portfolio is APAC’s biggest retail deal of 2021

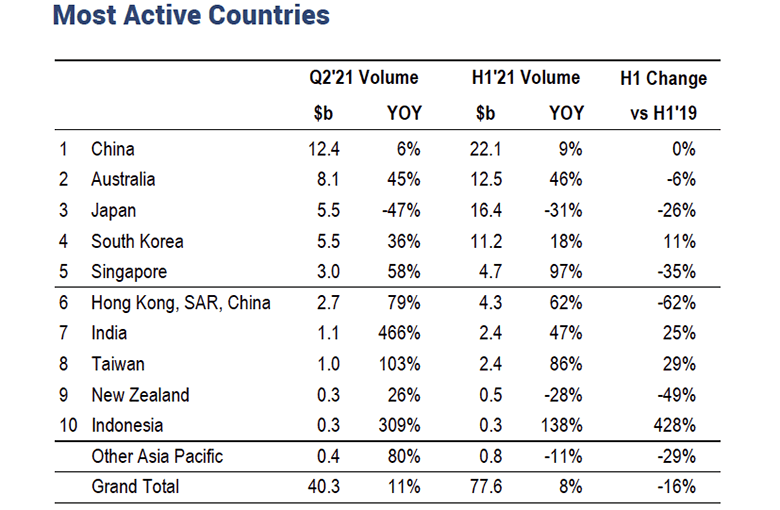

China continued its reign as Asia Pacific’s biggest real estate market in the second quarter with $12.4 billion in property investments, a total that was up 6 percent compared with the same period in 2020, according to Real Capital Analytics.

Last year’s introduction of the Three Red Lines policy targeting heavily indebted companies only accelerated China’s emergence as the top property investment market in the region by prompting sales of once-untouchable assets, the property information provider said in its recent Asia Pacific Capital Trends report.

The mainland total outstripped by more than 50 percent the amount invested in Australian property during the period, with Oz racking up $8.1 billion in deals, a 45 percent jump from the same quarter in 2020. Japan, meanwhile, saw investment plunge 47 percent year-on-year to $5.5 billion, but RCA cautioned against reading too much into the drop.

“One of the main themes we are seeing is the rise of China as the biggest investment market in the region, at the expense of Japan,” said David Green-Morgan, RCA’s managing director for APAC. “It is not so much about Japan falling back — it remains one of the biggest and most resilient real estate markets globally — but China’s seemingly unstoppable growth trajectory. China’s emergence at the summit of the most-invested markets in the region has quickly become the norm.”

Region in Recovery

The rebounds in China and Australia were part of a broader upswing across Asia Pacific during the second quarter, with investment activity in the region reaching $40.3 billion, up 11 percent compared with the same period last year, when many countries had locked down in the face of the pandemic.

Eric Pang, Head of Capital Markets, China, JLL

Among the primary drivers for the recovery in investment was an 82 percent surge in industrial deals, which hit $13.4 billion during April to June to come within striking distance of the $13.6 billion recorded in the office sector.

South Korea and Singapore rounded out the region’s top five markets with respective volumes of $5.5 billion (up 36 percent year-on-year) and $3 billion (up 58 percent), while Hong Kong was next with $2.7 billion (up 79 percent).

Still, it was China’s irresistible rise that commanded the most attention, with JLL reporting that Asia’s biggest economy saw its third-highest quarterly volume ever for real estate investment.

In its Asia Pacific Capital Tracker, the property consultancy said that while mainland landlords continued to suffer from a glut of office space that has pushed up vacancy rates, the country’s rising industrial segment picked up the slack.

“Though traditional sectors such as office and retail still accounted for more than half of the total transactions, there was also a new trend in the market,” said Eric Pang, JLL’s head of capital markets for China. “Some investors exited traditional sectors and made investments into alternative assets, such as data centres and industrial parks.”

Home of the Megadeal

China chalked up Asia Pacific’s largest deal for a single industrial asset during the second quarter with Singapore-based GLP’s $942 million purchase of the GLP Songjiang Internet Data Centre in Shanghai from Zhejiang Century Huatong Group. Beijing-based GDS contributed the second-largest industrial deal for a single property with its acquisition of the GDS BJ15 Data Center in the capital city from CITIC Group for $587 million.

Source: Real Capital Analytics

Canadian asset manager Brookfield’s $1.4 billion purchase of the Pradera mainland mall portfolio from joint ventures backed by the Abu Dhabi Investment Authority and Australia’s Macquarie was APAC’s largest retail deal of the second quarter, and indeed of the entire first half.

China’s biggest office deals closing in the quarter were Hexie Health Insurance’s acquisition of a Beijing office property from Korean conglomerate SK Group for $1.4 billion and GLP’s purchase of blocks C and D at the ZT International Center in the capital from developer Zhaotai Group for $523 million.

Looking ahead, funds managed by US private equity giant Blackstone have agreed to pay $3 billion for developer Soho China, which owns seven prime commercial assets in Beijing and Shanghai, while mainland insurer Ping An is seeking to acquire majority stakes in six mixed-use Raffles City projects from Singapore’s CapitaLand in Shanghai, Beijing, Chengdu, Hangzhou and Ningbo for $4.8 billion.

Leave a Reply