China’s housing recovery is still a work in progress (Getty Images)

Home prices in China declined more quickly in May, as a prolonged housing slump continued to weigh on the world’s second-largest economy despite successive rounds of policy support measures.

An index of new home prices in 70 major Chinese cities dropped 0.2 percent in May from a month earlier while second-hand home prices fell 0.5 percent over the same interval, marking the steepest declines in the past seven months, according to an analysis by European bank ING.

Home prices rose or held steady in just 17 of the 70 cities surveyed in May, down from 25 in April, data released on Monday by the National Bureau of Statistics showed. Only three cities saw second-hand home prices stable or increasing in May, down from six in April and the lowest count since last September.

“After several months of relatively encouraging data, where the pace of price declines slowed and more cities saw price stabilisation, we’re seeing faster price declines with fewer cities experiencing upswings,” said Lynn Song, chief economist for Greater China at ING.

“This suggests there’s a risk that the property market slides backwards again. It’s possible that activity may have stalled amid higher levels of trade-war uncertainty,” Song said.

Stimulus Falls Short

After releasing several rounds of policy support measures to shore up the property market, China’s central bank last month cut the benchmark five-year loan prime rate (LPR) by 10 basis points while it also trimmed the interest rate on loans from an individual’s housing provident fund by 25 basis points.

Lynn Song, chief economist for Greater China at ING

These moves marked the latest in a barrage of policy measures to rekindle the housing market, however, the ING analyst saw them as inadequate to the current challenge.

“While the 10-basis-point People’s Bank of China rate cut in May will help on the margins, more support will likely be needed as positive momentum looks to have stalled,” said Song.

“Stabilising housing prices remains a very important goal. Property represents 60-70 percent of China’s household balance sheets. As long as this does not turn around, it’s difficult to expect a substantive and sustainable recovery in sentiment,” he added.

Sales Slide Continues

In recent months, Beijing has repeatedly pledged to stabilise the property market while local governments have rolled back home-buying curbs and taken steps to stimulate demand.

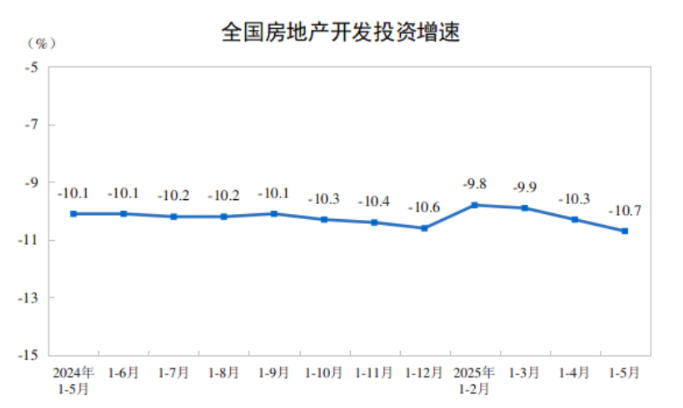

Overall investment in Chinese real estate from Jan through May fell 10.7% from a year earlier (Image: NBS)

Last week, the Guangzhou city government reiterated its decision to lift all cooling measures on home purchases, including scrapping rules which limit household purchases of homes, removing government’s pricing guidance, reducing down payments requirements and lowering interest rates.

Despite these measures, sales of new private homes continue to struggle.

Separate data from the statistics bureau on Monday showed that the value of developer sales of new homes in the first five months of the year fell 2.8 percent compared to the same period in 2024, accelerating from the 1.9 percent decline in the January through April period.

Sales by floor area were down 2.6 percent in the January-May period, widening from a 2.1 percent decline in the first four months of the year.

With consumers keeping their cash in their pockets, developers continue to hold back on new investments, with NBS figures showing total property industry investment falling 10.7 percent year-on-year in the first five months of 2025, worsening from a 10.3 percent decline in the January through April period.

The housing slump was also reflected in the kickoff of new projects with construction starts by floor area slumping 22.8 percent in the Jan through May period to 231.8 million square metres (2.5 billion square feet), although this decline narrowed compared to the 23.8 percent year-on-year drop reported in the first four months of this year.

Leave a Reply