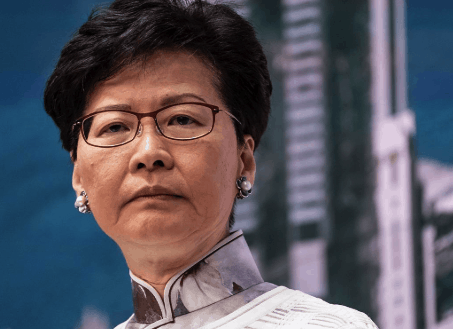

Carrie Lam hopes that allowing bigger mortages can help calm Hong Kong

Hong Kong’s embattled chief executive Carrie Lam announced a raft of measures to help low-income households and the middle classes buy their own homes in her annual Policy Address this week in a belated attempt to tackle high housing prices in the world’s least affordable city, and reduce resentment that has helped to trigger months of often violent protests on the streets of the financial hub.

During the annual address on Wednesday, which sets out the government’s priorities for the year, Lam unveiled plans to increase Hong Kong’s supply of transitional housing and starter homes as well as proposing a program to provide a one-off living subsidy to low-income households.

The chief executive, who is equivalent to the mayor of the Special Administrative Region, also said the government will buy back more land in the New Territories from developers to build more housing under a Land Sharing Pilot Scheme which is scheduled to start accepting applications next year.

Following the announcement of the housing and land policies, Hong Kong developer stocks on the Hang Seng Index closed higher, with “a positive feeling that the scarce land resources could now unlock their market value faster than before,” according to Kenny Tang, chief executive of Royton Securities, as quoted in a story by the South China Morning Post.

Lowered Down Payments Meet Mixed Reviews

In her speech, which was delivered via a video link after Lam fled jeering opposition politicians in Hong Kong’s Legislative Council, the chief executive call housing the city’s “toughest livelihood issue and said that her goal was to enable every resident of the city to have their own home.

Hong Kong’s chief executive fled the Legislative Council on Wednesday

To lower the first run on the world’s steepest property ladder Lam unveiled a new policy to allow first time homebuyers to borrow up to 90 percent of a property’s value on purchases of homes valued up to HK$8 million double the HK$4 million ceiling currently in place on such mortgages. For all purchasers of properties who can pay 20 percent or more up front, the valuation ceiling has now been raised from HK$6 million to HK$10 million.

Welcoming the government’s “supportive policies to help buyers get on the property ladder”, property consultancy Colliers International said in a statement that, “We expect the higher ceiling for property values eligible for high mortgage ratios will likely increase the liquidity in the secondary market and encourage owners to upgrade and trade their flats.’

However, the Toronto-based firm cautioned that developers would be unlikely to see a measurable boost from the government moves under the current market conditions. “Although activities in the secondary market are likely to increase, prices are unlikely to be driven up significantly as some positive spin from the policy could partly offset the currently gloomy market sentiment with the continuing demonstrations remaining unresolved,” Colliers said.

To qualify for mortgages under the government policies, homebuyers are limited to spending only up to half of their monthly income on mortgage payments and must be screened by banks for their ability to pay. First time homebuyer can avoid the bank testing stipulation but are subject to requirements for additional mortgage insurance.

Consumers were also less than impressed with the new measures with many seeing the ability to offer a greater quantity of larger loans as primarily a benefit to those selling homes while buyers will be left with still larger debts in a city where the median home price was equal to a record-high 20.9 times the median annual income last year, according to a survey published in January.

HK$5 Bil Committed to Transitional Homes

Noting that housing is the “toughest” livelihood issue and “a source of public grievances,” for her constituents, Lam pledged to build 10,000 transitional homes in the next three years for those on the waiting list for public housing, and said that the government was allotting HK$5 billion ($637 million) to fund the initiative. Official figures show that there are currently more than 250,000 people on the waiting list for Hong Kong’s Public Rental Housing (PRH) scheme, with qualified applicants having to wait more than five years to secure a home under the program.

The government will also invite the Community Care Fund to launch two-rounds of “one-off living subsidies” for low-income households, that are not living in public rental housing and not receiving Comprehensive Social Security Assistance.

A second pilot project for the Urban Renewal Authority’s Starter Homes program, which sells homes below market rates for eligible buyers will be launched at a private residential site, Lam indicated, which is expected to provide about 1,000 units for households who cannot afford to purchase a home on the private market.”

Land Resumption to Accelerate

On boosting land supply, Lam decided, as expected, to step the government’s use of the Lands Resumption Ordinance to take back undeveloped plots which developers have hoarded in their land banks.

Lam said that three types of land would be bought back from developers under the program, including 450 hectares of privately owned brownfield sites in the New Territories; private land which has been zoned for high-density housing under the outline zoning plan but currently is not yet subject to a development plan; and three urban squatter villages in Chai Kwo Ling Village, Ngau Chi Wan Village and Chuk Yuen United Village.

“The government’s plan to invoke the Lands Resumption Ordinance proves their determination to increase the supply of public and subsidized housing,” Joseph Tsang, chairman of JLL Hong Kong said in a statement. “If the subsidized housing supply increases, home seekers in the private housing market will decrease,” Tsang added.

Like his counterparts at Colliers, the JLL executive expressed caution about the impact of the government’s policies on a city where the real estate market has ground nearly to a halt in the face of tighter liquidity on the mainland and social upheaval on Hong Kong’s streets.

“Housing prices will be largely affected by the local economy, social movement and global economy in the short run, however,” Tsang said while predicting that property prices would continue to decline in Hong Kong. “These particular factors currently remain in the negative,” he said in reference to the city’s current enviroment. “As such, the combination of this with the increase of subsidised housing supply will offset the positive impact the relaxation of mortgage restrictions should have.”

Leave a Reply