The top four investment destinations in APAC aren’t the usual players

What do Blackstone, Dalian Wanda, Brookfield and Fosun International all have in common? They are among the big name players who have invested billions of dollars into India’s real estate market. And it looks as if they are not the only ones who have taken notice of a country once seen by investors as an afterthought.

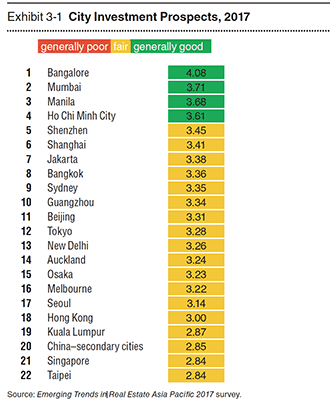

In a survey of investor sentiment regarding Asia Pacific real estate markets jointly published by the Urban Land Institute and PwC, the Indian cities of Bangalore and Mumbai were rated as having the best investment prospects. The shift to the subcontinent comes as investors hunt for higher yields in Asia, according to the nonprofit group’s members.

The overarching theme of the Emerging Trends in Real Estate® Asia Pacific 2017 report was straightforward: Gateway cities and traditional safe havens like Tokyo are out and emerging cities such as Manila are in. The Filipino capital along with Ho Chi Minh City rounded out the top four.

Meanwhile, former darling Tokyo slid all the way to 12th after finishing in first place the past three years. Sydney and Melbourne, last year’s second and third placed cities, also fell out of favor with investors as buyers continue to have difficulties sourcing investable assets at acceptable prices.

“This year’s Investment Prospects survey shows a strong shift away from last year’s favorites, which featured core markets in Japan and Australia. Instead, it favors emerging-market destinations. It is also notable that several gateway cities are in the bottom half of the list – indicating their declining popularity,” KK So, Asia Pacific Real Estate Tax Leader, PwC, said.

India Is The Real Deal

Brookfield bought this complex last month as part of a record-setting acquisition

The rise of Bangalore and Mumbai has been swift with both cities being among the lowest ranked in the ULI and PwC’s forecast in 2014 and 2015. The reason for the dramatic turnaround all comes down to the attractiveness of each city’s office sector.

Bangalore serves as India’s main hub for the business process outsourcing and IT industries and there is huge demand for new space from domestic and international companies looking to open both call-in and research-and-development facilities. The report noted that the Indian BPO industry can deliver annual rental growth of 15 to 20 percent.

While those surveyed viewed Mumbai’s residential sector as nothing short of a mess, it was noted that high quality office buildings continue to see strong demand and rental growth. Just last month, Canadian investment firm Brookfield made the largest purchase to date of commercial assets in Mumbai paying $1 billion to acquire 4.5 million square feet (418,000 square metres) of prime commercial space.

Some Already Ahead Of The Curve In India

Wang Jianlin’s Dalian Wanda is one of a number of players already investing in India

Investors hoping to be first to market in India may be disappointed, however, as several high profile players have already beat them to punch. Private equity real estate investment in India increased 55 percent to $3.96 billion in 2015, according to DTZ/Cushman & Wakefield. Blackstone has become the largest owner of office real estate in the country and Stephen Schwarzman’s firm isn’t the only one investing heavily in the fast-growing Asian economy.

In September, Fosun International was reported to have plans to invest nearly $1 billion in the Indian property market through a real estate platform it is setting up. Dalian Wanda also entered India this year after reaching a preliminary agreement with the Indian government for a $10 billion industrial zone in the Harayana state.

China’s Tier 1 Cities Show Improvement

While not quite the success story of India, tier 1 cities in China have rebounded in the ULI’s ratings for investment prospects following a rebound in mainland real estate markets this year. Finishing fifth, Shenzhen was the country’s highest ranked city for investment, while Shanghai was one spot below it and Guangzhou landed in the tenth spot.

Shenzhen’s soaring home prices have taken centre stage, but office rents in the city have also been on an upward trajectory for years and are now double their level of 2009. Also interesting to investors is the greater Pearl River Delta, which could soon be home to a number of high-tech manufacturing and research facilities.

In Shanghai, a number of foreign funds have either bought or developed away from the city center and the forecast reported this is a trend that will probably continue with land prices in central Shanghai rising even further.

Investors in Bangalore may do well to wait and see President’s Trump attitude to outsourcing. The Bangalore market is a proxy for demand for IT outsourcing services.

Mumbai on the other hand has a much more diversified economy. If India’s 7%+ growth sustains, the Mumbai market is sure to do well.