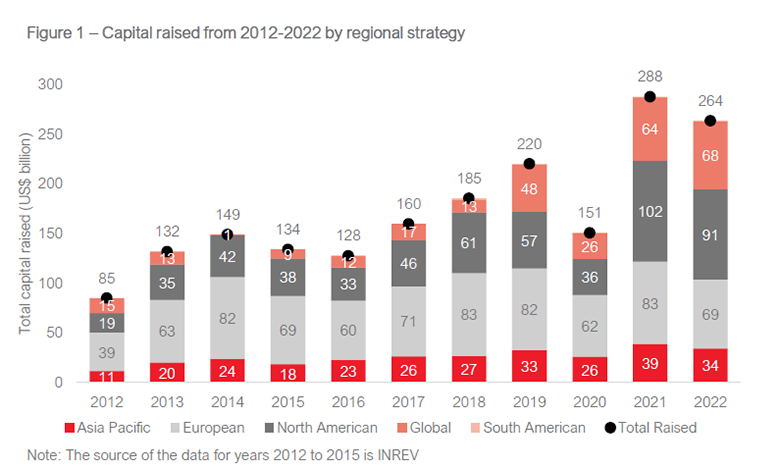

Global capital raising eased to a still-high $264 billion in 2022 (Source: ANREV)

At least $264 billion in new capital was raised globally for non-listed real estate investment in 2022, down 8 percent from the previous year, as high inflation and interest rate rises stirred market uncertainty, according to data compiled by a group of non-profits serving the property investor community.

The amount of capital raised from Asia Pacific investors, however, rose 6 percent last year to $54.8 billion and now represents the largest source of capital globally at 35 percent, the Capital Raising Survey 2023 revealed. By contrast, capital raised from European investors in 2022 plunged 43 percent to $47 billion, accounting for 30 percent.

The study by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), its European counterpart INREV and Chicago-based fiduciary association NCREIF was based on a poll of 116 fund managers from 21 countries across APAC, Europe and North America.

“This year’s Capital Raising Survey affirms real estate as an important asset class for investors, and importantly Asia Pacific investors as the key source of global capital,” said Amelie Delaunay, senior director of research and professional standards at ANREV.

Dry Powder Piles Up

By vehicle type, non-listed real estate funds attracted the most capital allocated to APAC strategies in 2022 at 49 percent. The study also flagged a notable shift towards joint ventures and club deals (25 percent, up from 9 percent the year before), which it said could indicate a preference for more control and strategy involvement.

Amelie Delaunay, senior director of research and professional standards at ANREV

Among non-listed real estate funds targeting real estate investment in APAC, core funds attracted 45 percent of the total capital raised in 2022. Riskier investment styles accounted for 55 percent of the capital raised, with 20 percent for opportunity funds and 35 percent for value-added funds.

Capital overhang began to creep up globally last year as the share of capital raised and already invested made up 26 percent — down sharply from 53 percent in 2021 — implying a heightened level of dry powder on the sidelines available for deployment.

“The share of capital raised but not yet invested is sequentially increasing, indicating persistent challenges in deploying capital globally,” Delaunay said. “And it is interesting to see investors moving towards value-added strategies in the region.”

Industrial Heavily Favoured

In terms of investment style and fund structure, capital raised for APAC open-end funds last year went overwhelmingly to core vehicles (82 percent), while capital raised for closed-end funds was destined primarily for value-add strategies (43 percent).

Within APAC single-sector strategies, 69 percent was raised for vehicles with an industrial/logistics focus, of which $13 billion was raised mainly under non-listed funds and joint ventures and club deals.

Capital raised for single-country APAC strategies more than doubled that of multi-country vehicles in 2022, the survey said.

Leave a Reply