Source: ANREV

The COVID-19 pandemic has made life more difficult for everyone — even real estate fund managers — according to a survey released late last week by a group of non-profit organisations serving the property investor community.

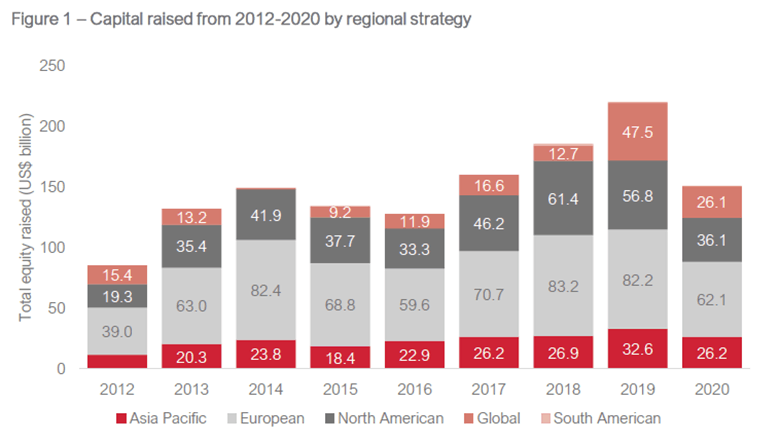

Capital raising for investment in private funds targeting Asia Pacific real estate fell by nearly 20 percent during 2020 from the record $32.6 billion raised a year earlier, to reach just $26.2 billion, according to the Capital Raising Survey 2021.

The study by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), its European counterpart INREV and Chicago-based fiduciary association NCREIF was based on a poll of fund managers.

A representative of ANREV pointed out that, while the amount of fresh funding targeting Asian real estate fell by nearly one-fifth, it was still on par with levels from a few years ago. The Asian capital drives last year equalled the $26.2 billion raised in 2017 and produced results down just slightly from the $26.9 billion achieved in 2018, which could be taken as an encouraging sign.

“To raise similar levels of capital as in previous years during one of the most tumultuous years in living memory speaks volumes about the level of interest and healthy appetite for non-listed real estate as a component of an investor’s portfolio,” said Amelie Delaunay, director of research and professional standards at ANREV. “With more than two-thirds of investors anticipating an increase in near-term capital raising activity, we can expect to see fundraising figures hold up well for the foreseeable future.”

Asia Rising

While the results in Asia Pacific showed a slide from 2019 levels, the decrease was much less marked than global levels, with managers having raised $150.7 billion for investment into non-listed real estate worldwide last year, down more than 31 percent from the $220.3 billion achieved in 2019.

Amelie Delaunay, director of research and professional standards at ANREV

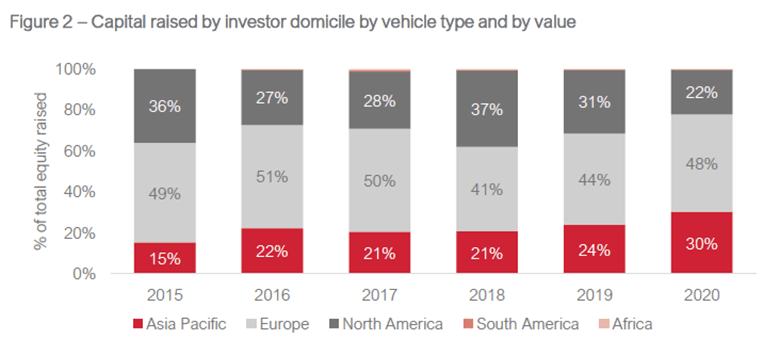

Beyond its importance as an investment target, Asia Pacific is also playing a growing role in capital raising, according to the survey.

Players from the region became the second-largest source of global capital last year, with contributions from the region accounting for 30 percent of the worldwide total in 2020.

European sources still ranked first with 48 percent of the total, while North American investors slid to third in 2020 as their share fell to 22 percent.

On average, the capital raised by individual vehicles in 2020 was higher than in 2019, except for those with a North American regional strategy, the report said.

Source: ANREV

While the amount of money raised was less than in 2019, the size of the largest vehicles increased with global strategies averaging $1 billion, compared with $600 million in 2019, indicating a concentration of capital raising in fewer vehicles from fewer managers.

As a proportion of new capital raised, 17 percent was assigned to Asia Pacific vehicles while 41 percent went to Europe and 24 percent to North America. The remaining 17 percent targeted global strategies.

Core in Style

During the first year of the pandemic, investors in Asia Pacific turned sharply towards core strategies, according to the survey, with funds targeting stabilised properties in prime locations accounting for 87 percent of the capital raised in the region, with the remaining 13 percent aimed at value-add approaches.

By comparison, in 2019 only 54.3 percent of the capital raised in Asia Pacific was chasing core approaches, with 18.3 percent targeted at value-add and 27.4 percent positioned in the opportunistic space — a strategy that disappeared in 2020.

Last year, core strategies grew in importance across geographies, taking up 52 percent of investment from Europe and 68 percent of the total from North America, compared with 35.6 and 9.5 percent respectively in 2019.

Pension Power

Pension funds remained the dominant source of capital for vehicles targeting Asia Pacific last year, accounting for 30 percent of the total capital raised. Sovereign wealth funds were the second-largest source of capital with 21 percent, while insurance firms represented 15 percent.

Globally, the investment managers surveyed said they were more positive about raising capital in 2021 and 2022. More than two-thirds of investment managers, 76 percent, are expecting an increase in near-term capital raising activity, compared with 69 percent in early 2020. Nearly a third said they had not raised any new capital in 2020.

Launched in 2014, the Capital Raising Survey has been carried out on a global basis since 2015 using data collected jointly by ANREV, INREV and NCREIF.

The latest survey included data from 127 investment managers, with 61 domiciled in Europe, 32 in Asia Pacific and 34 in North America.

Leave a Reply