Over of 70% survey by Citibank Hong Kong said now it’s bad time to buy a home

Citi Group’s latest survey on home ownership in Hong Kong shows that over 70 percent of residents feel that it is a bad or terrible time to purchase a home in the world’s least affordable metropolis.

In a survey conducted by the University of Hong Kong Social Sciences Research Centre on behalf of the American financial services giant during the second quarter of this year, the poll asked 500 people in Hong Kong their ideas on buying a home in the city, including how they thought prices might perform and whether they are personally interested in purchasing a property at the moment.

The negative outlook expressed in the report comes as confidence in the upward trend in Hong Kong’s home prices has done a near 180-degree turn over the last year.

Losing Confidence in Home Price Growth

The quarterly survey, which began in 2010, examines Hong Kong’s housing market to assess the current state of homeownership, and to gauge public opinion on the subject of homeownership along with public expectations in terms of future housing price trends.

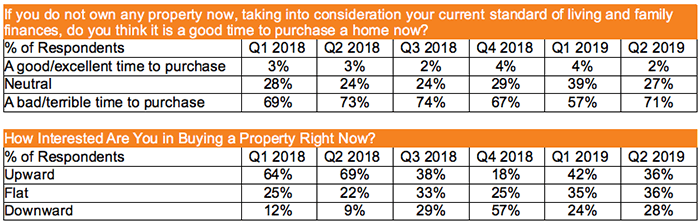

Its latest results showed 71 percent of the 500 respondents felt that it is a bad or terrible time to purchase a home in the second quarter of the year, an increase of 14 percentage points from the previous quarter. More than 70 percent of the young respondents aged between 21 and 29 and interviewed through phone shared the same sentiment.

Two percent of the respondents felt that it is a good or excellent time to purchase a home, down from four percent in the first quarter.

Source: Citibank Q2 2019 Residential Property Ownership Survey

That 71 percent who have turned their backs on the housing market actually shows an improvement over the April to June period of 2018 when 73 percent of respondents indicated that it was a bad or terrible time to purchase a home.

However, in contrast to the same period last year, respondents appear to see less reason to believe that housing prices in Asia’s least affordable city will continue to trend upwards.

While 69 percent of respondents in the second quarter of 2018 believed that prices would rise in the next 12 months, only 36 percent declared the same belief in the most recent quarter. However, that level of confidence in housing price growth is still higher than the 18 percent faith in an upward trend declared in the fourth quarter of 2018.

A recent report on Hong Kong’s residential real estate market by Savills showed that mass market home prices rose by 3.0 percent in the second quarter, quicker than the 0.8 percent rate recorded in the first three months of the year, but off from the 2018 full year pace of 4.6 percent.

Political Frictions Add to Uncertainty

The expectations of local citizens on the trend of home prices have reversed from the first quarter of the year when the market showed a recovery in the volume of property transactions. That confidence was buoyed by the US federal reserve backing away from the idea of future interest rate hikes, which spares Hong Kong mortgage holders from the immediate threat of upswings in bank rates.

However, heading into the second half of 2019, the deterioration of US-China relations and prolonged protests in the city against a proposed extradition bill have already given investors reason to pause on investment decisions.

Centaline Property Agency predicted that sales of second-hand homes will fall 35.5 per cent to a five-month low of 2,600 transactions in July. The real estate brokerage now expects the value of homes sold on the city’s secondary market to drop 33.7 percent to HK$24 billion this month.

In a corresponding move, HSBC and Bank of China (Hong Kong) cut their valuations of used homes in the New Territories and Kowloon on July 9, a month after an estimated 1 million people marched on the streets to oppose the city’s controversial extradition bill, according to the South China Morning Post.

Leave a Reply