Source: Bloomberg News survey on China’s real estate sector in 2014

Although the headlines have been filled with stories of China’s real estate slowdown, a majority of economists surveyed believe that the sector will continue to contribute to the nation’s economic growth this year.

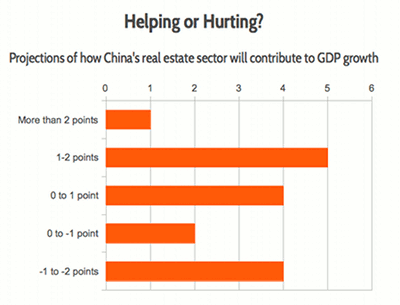

In a recent poll of economic experts by Bloomberg News, 10 out of 17 respondents indicated that China’s property sector would make a net contribution to GDP growth in 2014, with five of the group saying it will account for 1 to 2 percentage points of overall growth, four voting for a less than one point contribution, and one optimistic soul saying the sector would help out with more than 2 points worth of growth.

On the glass-half-empty side, four out of 17 said that real estate would pull down overall GDP growth by 1 to 2 points, and another two respondents expected the sector would slow down growth by less than one point.

Looking forward to 2015, 10 respondents expect real estate to help China’s economy grow, while five expect the sector to pull the economy southward.

Bubble Trouble

Regarding the popular question of whether the country is suffering from real estate bubble, 12 out of the 18 economists who responded indicated that China has some national oversupply of housing, but only seven went so far as to call it a nationwide bubble.

In the survey, which was conducted before news was widely leaked of government plans to relax housing market restrictions, a majority of the respondents said that they expect any changes in such policies to be limited to a regional level.

Some Economists Cheer the Decline of Property

In comments in his column on Caixin last week, former Morgan Stanley chief economist for Asia Andy Xie praised the diminishing role of the real estate sector in the country’s economy, saying, “The quality of China’s GDP growth is rising with falling property prices.”

Xie indicated that, “While growth is slowing, it reflects shrinking of the bad GDP.”

Last week ratings agency Moody’s also indicated pessimism on China’s real estate industry, by downgrading the entire sector to negative.

Leave a Reply