More people came to Mingtiandi last week to access our updated China real estate information than ever before, and I just wanted to take this opportunity to thank all of our readers for your support.

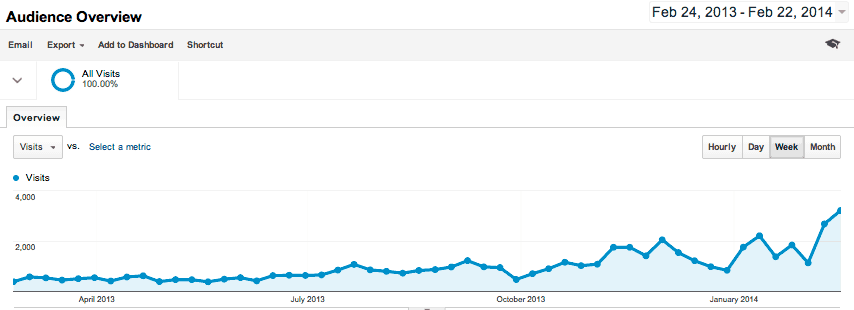

Most Visits in Over Five Years

In all, there were more than 3000 visits to Mingtiandi.com from February 16th to 22nd, the most since the blog was founded more than five years ago.

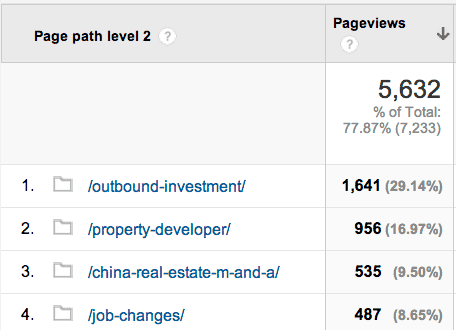

The majority of visitors were looking at stories about China’s outbound investment and listed property developers, with these two categories accounting for more than 45 percent of pageviews during the week.

Since the site introduced more frequent updates in late 2013, and a new design earlier this year, views of Mingtiandi’s real estate news have more than doubled for the period since January 1st, compared to the same period in 2013.

What We Were Reading

Perhaps the biggest reasons for the jump in traffic to Mingtiandi is the increase in information available regarding China’s real estate markets and investors. As global investment by Chinese companies and individuals has boomed, visits to the site’s Outbound Investment section have increased dramatically.

The most popular story for the week was “45,000 Chinese Seek New Homes After Canada Cancels Investor Visas” which was read by more than 300 people. In all, 17 news stories were published on the site during the week.

More than 30 New Subscribers

In addition to the increased traffic to the website, subscriptions to Mingtiandi’s China real estate newsletters was also strong during the week. Decision makers from Brookfield, CapitaLand, Jardines, Jones Lang LaSalle US, Knight Frank, Taubman Asia, Tishman Speyer, and Venator Real Estate Capital Partners all signed up for the site’s email news services.

Still More Property Information on the Way

In the coming weeks, Mingtiandi will be publishing and overview of commercial real estate agency market research so far this year, introducing a new dynamic reporting system for analysing market data and much more.

I appreciate your support so far this year, and hope that the site will continue to meet the needs of the real estate investment community.

Best regards,

Michael Cole

Leave a Reply