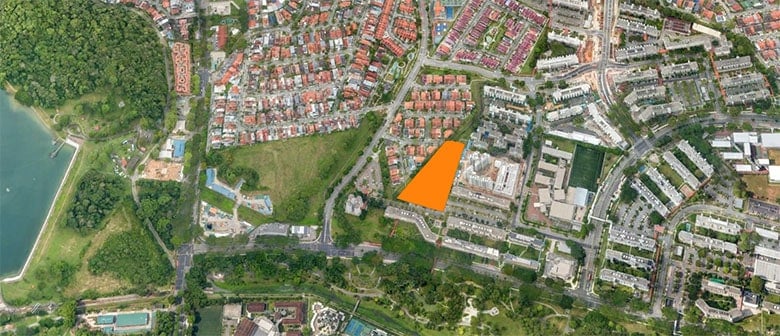

The site is close to a set of three parks in central Singapore

A real estate developer controlled by the family behind United Overseas Bank has placed the top bid for a residential site overlooking a set of parks in central Singapore, edging out 14 other contestants including a joint offer by City Developments Ltd and a unit of Hongkong Land, according to an official announcement.

UOL Group Ltd joined with its subsidiary, Singapore Land Group Ltd and Kheng Leong Company, a private real estate business of UOL Group chairman Wee Cho Yaw, to offer S$381.4 million ($287 million) for the rights to a 31,699 square metre (341,205 square foot) project along Ang Mo Kio Avenue 1 near the Mayflower MRT station, which is slated to open later this year.

“We plan to develop a 24/25 storey project of more than 370 units that will enjoy unblocked views of the Bishan-Ang Mo Kio Park, Lower Peirce Reservoir Park and Shangri-la Park landed housing estate,” UOL chief investment and asset officer Jesline Goh said in a statement.

The competitive bidding for the 99-year-leasehold site, which was sold through a tender by the city-state’s Urban Redevelopment Authority (URA), comes after Singapore condos were resold in record quantities last month, with prices rising 1.5 percent compared with March, according to data released recently by real estate information provider SRX.

Ang Mo Kio Expertise

While UOL will still need to have its design proposal for developing the 12,679 square metre site vetted by the URA to win the tender under Singapore’s two-step land tender system, its offer amounted to nearly 6 percent more than the second-highest bid placed by CDL together with Hongkong Land’s Singapore unit, MCL Land.

UOL chief investment officer Jesline Goh wants more of Ang Mo Kio

Should UOL triumph, it would be paying the equivalent of S$1,118 per square foot of gross floor area for the property, which is located in a residential area just east of the Lower Peirce Reservoir in one of central Singapore’s leafiest sections.

UOL noted that after acquiring the site south of Singapore’s General Hospital for what is now its Avenue South Residence in 2018, it has already sold more than 65 percent of that project, plus 80 percent of its Clavon development in Clementi, and it would now like to replenish its land bank.

The developer also said that its experience in the Ang Mo Kio area, which includes launching the Thomson Three project just south of Bishan-Ang Mo Kio Park five years ago, convinced it of the potential demand for this latest site.

UOL holds a 60 percent stake in the joint venture, while Singapore Land, which was known as United Industrial Corporation before a rebranding last year, has 20 percent, and the final 20 percent slice belongs to Kheng Leong.

Housing Heats Up

The third-highest bid for the Ang Mo Kio site, which is adjacent to the Kebun Baru public housing estate, came from a joint venture by local players Far East Organisation and Sino Group together with Japan’s Sekisui House.

Hip Hup Realty entered the fourth-place bid, and a group of companies backed by mysterious mainland billionaire Gordon Tang offered S$331,888,888 to take the sixth spot in the race, after winning the tender for the Maxwell House site in Singapore’s Tanjong Pagar area with a S$276.8 million bid earlier this month.

With the prospect of a few more years of record-low interest rates, and Singapore’s status as a safe haven having been burnished by its management of the COVID-19 crisis, housing prices in the Lion City have been on a steady upward trajectory in recent months.

Total private home sales volume in Singapore during the first quarter reached 8,100 units, according to official statistics, with that figure representing an increase of 16.9 percent from the previous quarter.

In a report issued last month, local property agency Propnex expressed confidence that Singapore’s housing market would continue on the upswing.

“For the full year 2021, we are projecting private home prices to rise by 6 percent to 7 percent, largely backed by the new launches,” said Ismail Gafoor, the company’s chief executive. “Barring any new cooling measures, we expect more than 10,000 new private homes to be sold in 2021.”

Leave a Reply