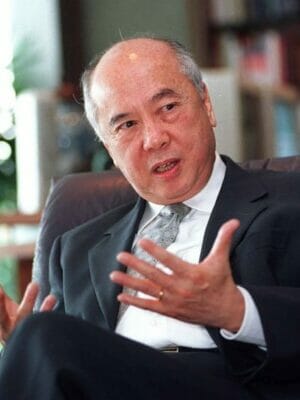

UOL Group chairman Wee Cho Yaw

Singapore-listed property firm UOL Group and its affiliates have won a large residential parcel on Silat Avenue, just south of Singapore’s General Hospital, for S$1.035 billion ($771 million), amid a two-day flurry of major site acquisitions in the city-state.

The price equates to S$1,138 ($848) per square foot of buildable area for the the 99-year leasehold site, which is zoned for a 910,099 square foot (84,551 square metre) residential development with a first-storey commercial space. The Urban Redevelopment Authority awarded the parcel to the sole bidder, a joint venture of UOL Group’s wholly owned subsidiaries UOL Venture Investments (UVI) and UIC Homes, together with property firm Kheng Leong Company.

Kheng Leong is the private real estate business of UOL Group chairman Wee Cho Yaw, who also serves as chairman emeritus of United Overseas Bank. UVI owns 50 percent of the winning joint venture firm, with UIC and Kheng Leong holding 30 percent and 20 percent, respectively.

Government Sells Spate of Sites in One Week

The Urban Redevelopment Authority (URA) announced the award Thursday, as one of three sites under the Government Land Sales (GLS) Programme awarded on the same day. The government also granted a residential site near Orchard Road to a venture of Hong Kong’s New World Development and Far East Consortium (FEC) and Singapore’s SC Global Developments for S$410 million.

At the same time, FSKH Development — a consortium of Singapore-based firms Hock Lian Seng Holdings, Keong Hong Holdings and TA Corporation — won a site at Mattar Road near Aljunied park in the city’s Geylang area for S$223.1 million.

The previous day, a consortium led by Far East Organization won a prime commercial and residential site in the upscale Bukit Timah neighbourhood for S$1.2 billion ($904 million).

“Underwhelming” Outcome for Large Site Near Downtown

The Silat Avenue site has changed hands for $771 million

The Silat Avenue site, spanning 245,973 square feet (22,852 square metres), is located in the Bukit Merah area of central Singapore, just west of the downtown core. The plot lies between the existing Silat neighbourhood and a section of the Rail Corridor, a 24-kilometre former railway line that the government is turning into a community space.

Plans call for the future development to be “sensitively integrated with the section of the Rail Corridor located adjacent to it,” which crosses Kampong Bahru Road. The project “is envisioned to inject new vibrancy into the neighbourhood, and provide a differentiated living environment where high-rise living is assimilated with greenery and heritage,” according to a March announcement by the URA.

The development will also be integrated with five blocks of conserved flats built by the Singapore Improvement Trust (SIT), the predecessor to the Housing Development Board, and will offer new green spaces as well as direct access to the Rail Corridor.

“Silat Avenue is an appealing site within two kilometers from the Central Business District,” commented Tricia Song, head of research for Singapore at Colliers International, in a statement after the tender attracted a single bid last month. “We think the underwhelming tender outcome could be due to the large size of the site (which could accommodate 1,125 homes) and relatively untested location, away from MRT stations.”

The public tender for the site was launched on March 16 and closed on April 26.

UOL Adds to Land Bank

UOL Group is one of Singapore’s largest publicly listed companies, with a development portfolio encompassing housing, serviced apartments, offices, shopping malls and hotels. Chaired by tycoon Wee Cho Yaw, who is estimated to have a net worth of around $9.5 billion, the company said in its own statement that the acquisition of the Silat Avenue site “would enable the UOL Group to replenish its land bank for residential development in Singapore.”

The company signalled in early March that it was still in the market for residential sites after scooping up a series of parcels over the previous year and a half, including the Nanak Mansions development on Meyer Road through a collective sale last September.

Leave a Reply