The bits of Chongqing Tiandi which have already been completed are not part of the RMB 4.1B deal

Shui On Land which developed one of China’s landmark real estate projects in Shanghai nearly two decades ago, has agreed to sell off a set of projects in Chongqing to China Vanke for RMB 4.1 billion ($598 million), according to an announcement on Friday by the Hong Kong-listed firm.

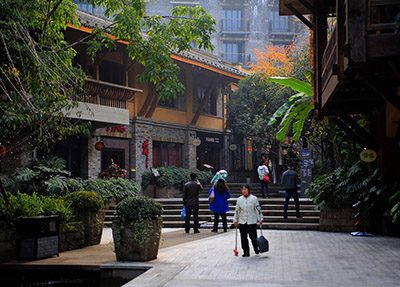

Shui On, which opened the Xintiandi commercial complex in 2000 in a set of converted traditional brick houses in Shanghai’s city centre, has agreed to sell nearly 80 percent of a 1.26 million square metre (13.6 million square foot) portfolio of projects in its Chongqing Tiandi mixed-use development as the latest move to reduce gearing and regain its financial footing.

In the past four years Shui On chairman Vincent Lo has now sold off more than RMB 39 billion in projects in an attempt to unload debt after borrowing heavily to launch new developments in the wake of its Xintiandi success.

Shui On Sells Off 176 Football Pitches Worth of Chongqing

Shui On chairman Vincent Lo has cut so much of his empire that we wonder what’s left

Two Shui On Land subsidiaries, Shui On Development and Grand Hope Limited, have entered into a transaction cooperation agreement with companies controlled by China Vanke to sell the Shenzhen-based developer a 79.2 percent interest in a portfolio of projects within the Chongqing development, according to a statement from Shui On.

The portfolio consists of all the undeveloped land parcels for residential, retail and office use within Chongqing Tiandi – totalling 870,821 square metres (9.4 million square feet) of gross floor area. The deal also includes a 388,420 square metre tower currently under construction. Together, the gross floor area of the project is enough for 176 football pitches, and following completion of the transaction, Chongqing Tiandi will cease to be a unit of Shui On.

Shui On expects to book a profit of RMB 1.7 billion on the deal after bringing in RMB 3.9 billion in income. The burst of revenue is predicted to reduce the developer’s gearing by 11 percent, according to Shui On. In a statement, Shui On said that this latest Chongqing sale is part of an “asset light strategy” that the developer has been following since 2015.

In December 2013 Shui On had already sold an office project in Chonqing Tiandi to Sunshine Life Insurance for RMB 2.4 billion.

Parting With RMB 39 Bil in Projects Over Four Years

For Shui On Land, which had borrowed heavily to produce a series of Xintiandi-esque projects across second tier cities in China, the Chongqing retreat is the latest attempt to reduce a crippling debt burden.

In March Shui On was reported to have signed a memorandum of understanding with a buyer to sell off a 50 percent stake in its Ruihong Xincheng mixed-use project in Shanghai for RMB 8 billion, after making the city’s biggest real estate sale of 2015 with its RMB 6.6 billion sale of the Corporate Avenue phase one office project to Hong Kong’s Link REIT.

Counting the Ruihong Xincheng and Chongqing Tiandi sales, Shui On Land has now sold off more than RMB 39 billion in projects since 2013. Also in 2013, Shui On sold off a 50 percent stake in its Shanghai Xintiandi subsidiary to Canada’s Brookfield for consideration of up to $750 million, after failing to achieve an IPO for the commercial portfolio.

Leave a Reply