The site in Causeway Bay is just across the road from Lee Gardens Three and Six

The kings of Causeway Bay at Hysan Development have defended their turf, besting five other bidders to secure a commercial site near the group’s collection of projects in Hong Kong’s premier retail district.

A joint venture of Hysan, controlled by the Lee family, and fellow local developer Chinachem Group entered the winning bid of HK$19.8 billion ($2.6 billion) for the plot on Caroline Hill Road at Leighton Road. Hysan holds a 60 percent stake in the JV and Chinachem owns 40 percent.

“Developing such a large-scale commercial project in the heart of Hong Kong is a rare opportunity,” Hysan chairman Irene Lee said in a statement released Wednesday announcing the tender result.

Lee and her partners at Chinachem so valued the chance to acquire the plot just across the road from Hysan’s Lee Garden complex that they agreed to pay a land premium exceeding market expectations by at least 15 percent, at a time when Causeway Bay’s status as Hong Kong’s shopping nexus has come under stress.

Vanquished Rivals

The 159,327 square foot (14,802 square metre) site — the first in Causeway Bay to be auctioned by the government since 1997 — is less than 50 metres (52 yards) from Hysan’s Lee Garden Six commercial tower on Leighton Road. The partners plan to develop a premium commercial building with community facilities at the location.

Irene Lee, executive chairman of Hysan Development

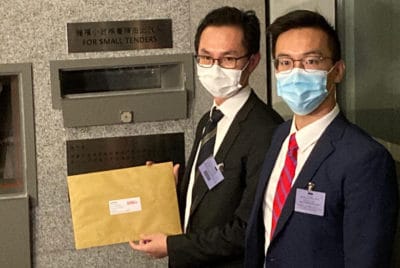

The auction of Inland Lot 8945 on Caroline Hill Road attracted a slate of bidders drawn almost entirely from Hong Kong’s largest property firms. These included affiliates of local developers Sun Hung Kai Properties, Wheelock Properties and CK Asset; Asia’s biggest real estate investment trust, Link REIT; and a consortium of Sino Land, Lifestyle International, Kerry Properties and CC Land.

After topping them all, Hysan and Chinachem get a chance to develop a project with a maximum gross floor area of 1,076,390 square feet, meaning the partners will fork over HK$18,374 ($2,366) per square foot of GFA.

The winning bid comes with conditions attached to ensure integration with the surrounding community. The new development must include a child care centre of at least 5,703 square feet, an elderly daycare centre of at least 3,856 square feet and a district health centre of at least 11,276 square feet.

In addition, a public vehicle park with 125 spaces and a footbridge connecting the property with Lee Garden Six must be built.

Defending Their Corner

Property services firm Savills said the successful tender reinforces Hysan’s status as the dominant landlord in Causeway Bay, adding nearly 646,000 square feet of GFA to the group’s portfolio for a total of 4,478,000 square feet upon completion.

The site on Caroline Hill Road drew bids from some of Hong Kong’s largest property firms

The JV’s consideration is at least a 15 percent premium to the pre-tender valuation of HK$10,500 to HK$16,000 per square foot, belying the retail district’s recent struggles during the COVID-19 pandemic. Simon Smith, senior director for research and consultancy at Savills Hong Kong, said he wasn’t surprised.

“Hysan are playing the long game and recognise the synergies which exist with their current holdings in the district,” Smith told Mingtiandi.

The Lee family’s Causeway Bay kingdom includes a set of commercial-retail towers dubbed Lee Gardens One, Two, Three, Five and Six and the Hysan Place shopping mall and office building. Hysan also owns properties elsewhere in Hong Kong and holds a 24.7 percent stake in a Shanghai mixed-use development, Grand Gateway 66.

The Caroline Hill Road project marks Hysan’s first collaboration with Chinachem, which made headlines earlier this year when it was chosen to redevelop Hong Kong’s historic Central Market.

“We are excited to have this opportunity to partner with Hysan, the most experienced developer in the district, to develop this project,” said Donald Choi, executive director and CEO of Chinachem Group. “The project will have synergy with Hysan’s other Lee Gardens developments and the long-term prospects are encouraging.”

Down, Not Out

Thomas Lam, executive director and head of valuation and advisory at Knight Frank Greater China, said the high winning price for the Causeway Bay site reflects developers’ strong confidence in the commercial property market, especially in core districts, as Hong Kong looks to rebound from its COVID-induced economic slump.

Lam estimates the total investment in the Hysan-Chinachem project at HK$26-28 billion, with a long-term rental return of 3-3.5 percent and a payback period of 20-30 years.

“The transaction price of this site is also a reference for the commercial land price in Central,” Lam said, referring to the chief business district nearby.

Leave a Reply