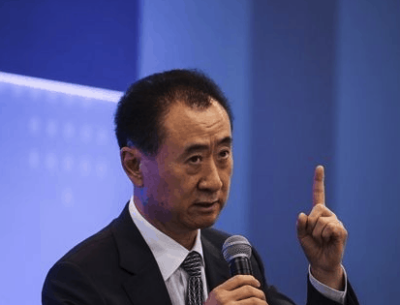

Wang Jianlin wants Wanda Commercial to focus 100% on being an asset manager

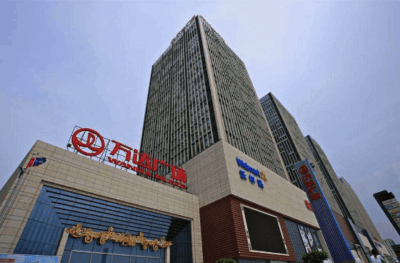

China’s largest commercial developer is set to add to its portfolio of nearly 300 shopping malls after Dalian Wanda Commercial Management Group purchased a site in southern Shanghai for RMB 575 million ($85.5 million).

Wanda Commercial, the development unit of Wang Jianlin’s Dalian Wanda Group purchased the site in Minhang district’s Maqiao town at a government auction, complete with planning approval to develop a shopping centre of up to 89,003 square metres (958,020 square feet) in size, on a 31,787 square metre site.

The site acquisition marks the second major commercial project that Wanda has taken on so far this year, as the developer which shook off debt concerns to raise $300 million in new bonds last month focuses on its core retail development business.

Grabbing a New Site in Suburban Shanghai

Wanda’s new acquisition was posted on a city government website on Tuesday after Wanda was the sole bidder for the property. At the purchase price Wanda is paying the equivalent of RMB 6458.19 per square metre for the site, which comes with 40-year land use rights.

The parcel, labeled as Block 201901902, is located near the G320 highway in Maqiao town, bordering Fu Yan Lu to the east, Fu Xue Lu to the west and Yin Xue Lu to the north. The site is nearly one hour’s drive south and west of People’s Square.

Under the planning conditions for the project, Wanda is not allowed to resell space in the Minhang project, and the finished facility must include a cinema of not less than 5,500 square metres, a supermarket of at least 7,000 square metres and a children’s playground of 4,000 square metres or more.

Going Asset Light

Contacted by Mingtiandi concerning its Shanghai acquisition sources at Wanda declined to comment, however, the company has previously laid out an “asset-light” strategy. At an internal meeting in January of this year Wang proclaimed that it would no longer act as a traditional developer, and would become an asset manager developing new projects on behalf of investors.

In 2018, Wanda Commercial ranked first among developers in mainland China by operating revenue, pulling in more than double the amount of its closest competitor, Red Star Macalline Group, according to data from real estate information provider CRIC. The group’s operating revenue from office leasing, retail operations and hotel management amounted to RMB 32.74 billion last year, according to CRIC’s figures.

Of the 59 Wanda Plazas currently being developed, only nine assets are owned by Wanda, and Wang has said that the company will apply its asset-light strategy to more than half of the Wanda Plazas to be opened this year. In addition to this week’s Shanghai project, in January Wanda won a 170,600 square metre mixed-use plot in Wuhan for RMB 976 million, and at the end of last year, there were 282 Wanda Plazas open nationwide.

Focusing on Core Competencies

More than half the newly opened Wanda Plazas this year will not be owned by Wanda

Beijing-based Wanda, which has long been China’s biggest commercial property developer, last month sold 37 department stores to Chinese retailer Suning as it continues to sell off non-core businesses. Wanda took in an amount estimated to be less than RMB 8 billion from the disposal of its retail store management division.

Wanda has attempted to shed over $9 billion worth of assets over the past year in a campaign to ease financial strains following an overseas acquisition binge, and after being singled out for its debt levels in China’s deleveraging campaign. Wanda’s hotel arm sold its pair of Australian projects in Sydney and the Gold Coast for A$315 million ($247 million) in January 2018.

Today, Dalian Wanda Group’s website touts the conglomerate’s core businesses as commercial property management, cultural industries, real estate and finance.

Leave a Reply