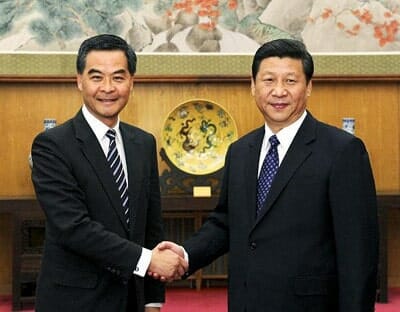

CY Leung’s next meeting with Xi Jinping may not be quite so chummy

New information has come to light about the timing of a secret agreement between now-Hong Kong chief executive CY Leung and an Australian engineering firm involving its 2011 acquisition of real estate agency DTZ, which could put the embattled leader into even more trouble.

According to a report this week in the Sydney Morning Herald, the agreement between Leung and UGL to enlist the then-director of DTZ in support of UGL’s takeover package came the same day that a rival bid offering nearly $100 million more was rejected by DTZ’s board.

UGL was selected as the preferred bidder by DTZ’s board in the rapid-fire prepack bankruptcy sale of the then-insolvent property services firm during late 2011. Leung has already been under pressure to step down in recent weeks from protestors unhappy with his handling of the Occupy Central demonstrations.

DTZ Creditors and Shareholders Lose Out on $80 Million

As revealed in a 2012 report in the UK’s Telegraph, however, there had been a rival bid from a Tianjin government real estate developer that offered to pay $80 million more for DTZ than the $124 million that UGL eventually paid.

The prepack sale of DTZ wiped out equity by existing shareholders and principal creditor Royal Bank of Scotland received repayment of $123 million on its $169 million in loans to the property services firm.

Beyond the cash for the acquisition, the Chinese bidder, Tianjin Innovative Financial Investment Company (TIFI), is also said to have lined up $16 million of working capital to help rebuild the troubled brokerage, as well as a $48 million credit line.

A report from Ernst & Young, who were appointed as administrators on the prepack deal dismissed TIFI’s proposal as “unfunded.” However the Telegraph report cited a person close to TIFI’s bid as saying “DTZ sacrificed value to get the deal with UGL done.” The unnamed source added that, “The Chinese offer was significantly better for everyone, for the employees, the shareholders and the creditors”.

Leung Secretly Paid to Support UGL’s Bid

In defending his secret agreement with UGL, Leung has contended that he violated no laws. However, Hong Kong’s Independent Commission Against Corruption has now opened a file regarding the chief executive’s conduct in his dealings with the Australian engineering firm.

Documents uncovered by the Sydney Morning Herald reveal that, in return for his payment of $6.5 million, Leung agreed to “support the acquisition of the DTZ group by UGL.” The agreement is said to have been signed the same day that TIFI’s bid was rejected by DTZ’s board. As a director of DTZ and chairman of its Asia-Pacific operations, Leung had been responsible for its rapid expansion on the Chinese mainland.

Leung received payment on his arrangement with UGL during 2012 and 2013, while he was already serving as chief executive, and continued to be bound by the terms of the secret agreement during that time.

Although DTZ’s creditors agreed with the decision by the board, the Morning Herald’s story cited two bankers involved in the deal who are said to have preferred the TIFI bid. “We felt we had a better offer,” the Herald quoted one banker as saying. “It was very frustrating at the time.”

Althought China’s leadership has continued to publicly support Leung, the details emerging about the timing and nature of the businessman-turned-politician’s relationship with UGL have been an unneeded embarrassment as Beijing seeks to calm student demonstrators and restore order in the special administrative region.

Given the Xi government’s determination to clean up the image of China’s government and enforce discipline among officials, the controversy regarding the Hong Kong chief executive increases the chance that Leung’s term in office may be cut short in some way.

Leave a Reply