JLL represented Blackstone in the sale of a Japanese rental apartment portfolio

Topping the deal charts in this edition of Mingtiandi’s Broker Battle is JLL’s sale of a portfolio of Japanese multifamily properties on behalf of funds managed by US private equity giant Blackstone. European insurer Allianz purchased the set of rental apartments for €1.1 billion, marking its entry into Japan’s residential market.

That Japan deal came after the Chicago-headquartered property services firm notched a victory in Singapore as it assisted OUE Group with the S$289 million sale of a hotel and serviced residence on Shenton Way, while Cushman and Wakefield secured a S$547.5 million office deal on behalf of Keppel REIT on the other side of downtown.

In mainland China, JLL brokered a leasing deal that saw WeWork take on 8,612 square metres (92,699 square feet) of office space in Suzhou.

Across the border in Hong Kong, activity barely registered as the Asian financial hub sweats out the on-going protests.

Keep reading for all the details on which brokerage won deals this month, and if your team has capital markets or leasing victories to report, please contact us here at Mingtiandi.

Japan

JLL represented Blackstone in the sale of a portfolio of multifamily properties held by fund managed by the US private equity giant to Allianz Real Estate. Allianz snapped up the 82 rental properties – 78 of which are in Tokyo, Osaka, Nagoya and Fukuoka – for €1.1 billion ($1.2 billion). Comprising a total of 4,600 units spread across 160,000 square metres (1.7 million square feet) of net rentable area, the portfolio has an occupancy rate of 97 percent. Read more>>

Singapore

Working on behalf of Singapore-listed Keppel REIT, Cushman and Wakefield brokered the sale of Bugis Junction Towers to a fund managed by Angelo Gordon for S$547.5 million ($397 million). The 15-storey office building, which is located in the Bugis Junction mixed-use development, has a net lettable area of 248,853 square feet. Read more>>

Cushman & Wakefield brokered the sale of Bugis Junction Towers in Singapore

JLL brokered the sale of a 268-room hotel and serviced residence, currently operated as Oakwood Premier OUE Singapore, on behalf of OUE Limited. A joint venture between Far East Consortium and Hong Kong Investment bank AMTD Group paid a combined S$289 million for the property at 6 Shenton Way in Singapore’s downtown core, while a separate joint venture backed by the two companies paid S$1.9 million for the associated hotel business. Read more>>

Cushman & Wakefield represented Keppel Corporation’s DataCentre One affiliate in the sale of the 1-Net North DC data centre to Keppel DC REIT for S$200.2 million. The Singapore-listed trust acquired the 213,815 square metre data facility in the Woodlands Regional Centre from a 51:49 joint venture between Keppel Infrastructure Trust and Tokyo-based civil engineering firm Shimizu Corporation. Read more>>

Edmund Tie has been appointed as the sole marketing agent for 333 North Bridge Road, a nine-storey office building which occupies a 999 year leasehold site opposite the Raffles Hotel. The 2,699 square metre commercial property carries an asking price of S$80 million, and can be redeveloped up to a height of 16 storeys and a gross floor area of up to 2,998 square metres. Read more>>

The owners of the Cascadale condominium in Singapore’s Changi area have appointed JLL as marketing agent for their second attempt at a collective sale of the 134-unit property in District 16. Approved for development of up to 292 homes, the owners are putting Cascadale up for tender at the same $270 million price which they had targetted in their first sale attempt in May. Read more>>

ERA Realty has been appointed as marketing agent for the collective sale of Bishan Park Condominium at an asking price of up to $688 million. Located at 14 Sin Ming Walk in District 20 — 400 metres from the upcoming Bright Hill metro station — the estate comprises 320 units across five ten-storey blocks and has 71 years remaining on the leasehold. Read more>>

Cushman & Wakefield and JLL have been appointed by private equity investment firm Lucrum Capital as joint advisers for the sale of a freehold hotel development site on Killiney Road at an asking price of S$155 million. Occupying 13,148 square feet in the Orchard Road precinct, the site has the potential to be developed into a six-storey 115-room hotel, subject to final planning approval. Read more>>

Colliers and JLL have been appointed as joint marketing agents for the sale of six adjoining two-storey shophouses in Tanjong Pagar at an asking price of S$58 million. Located at 48-56 Peck Seah Street, the tenanted shophouses have a combined gross floor area of 19,938 square feet. Read more>>

Mainland China

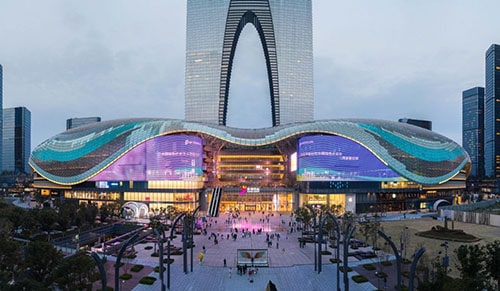

JLL assisted WeWork in securing a new location in Suzhou, a city just west of Shanghai, where the US co-working giant has taken on an 8,612 square metre lease in the Suzhou Center at an undisclosed rent. The Suzhou Center, which was developed by a unit of Suzhou Industrial Park in the western part of the Jiangsu-province city, has a combined 1.13 million square metres of commercial, residential, and hotel space, including the 300,000 square metre Suzhou Center mall. Read more>>

WeWork signed a new lease in the Suzhou Center

Savills has been appointed to provide commercial positioning and leasing agency services for Kerry Properties’ Qianhai Kerry Centre, a commercial and residential development adjacent to the Guangzhou Riverside Expressway in western Shenzhen. Upon its expected completion in 2020, the complex will comprise 266,000 square metres of offices, 48,000 square metres of retail space, 60,000 square metres of apartments, and a 30,000 square metre hotel. Read more>>

CBRE has also been appointed to provide leasing agency services for the Qianhai Kerry Centre. Read more>>

JLL has been appointed by Greenland Group to provide co-leasing agency services for the Wuhan Greenland Centre, a 476 metre skyscraper on the bank of the Yangtze river that will have 187,000 square metres of gross floor area upon completion. Read more>>

Savills has been appointed by Dalian Wanda Group to provide development consulting services for Dongba Wanda Plaza, a 234,000 square metre commercial development expected to open by the end of 2020 with 181,800 square metres of office space in Beijing’s Dongba district. Read more>>

Hong Kong

Cushman & Wakefield has been appointed to sell a set of units in the Cheung Wan Building at 8-10 Ma Hang Chung Road in Kowloon’s To Kwa Wan area, just west of Kai Tak. The vendor is making available a 1,200 square metre retail unit on the ground floor, a 440 square foot residential unit, and the 10,000 square foot first floor at a combined asking price of HK$115 million ($15 million). Read more>>

Local real estate advisory Flourish Property Agency has been appointed to sell a high-level unit of the Fu Hop Factory Building in Kwun Tong. Located at 209-211 Wai Yip Street, the 54-year-old property has an asking price of HK$16 million, or the equivalent of HK$4,243 per square foot based on the building’s 3,771 square feet of gross floor area. Read more>>

Research for this story was provided by Li Yanxia and Iris Poon. Mingtiandi’s Broker Battle series is published twice monthly on Tuesdays.

Leave a Reply