Blackstone Group LP last week let its team know that Michael Chae, the chief of Asia private equity for the alternative investment giant, would be returning to New York to resume his former job as head of media and communications investments, as well as taking responsibility for the group’s tactical opportunities fund.

What the firm has not yet announced is that its HK$2.1 billion (US$271 million) attempt to take Hong Kong real estate developer Tysan private, appears to have failed. And it’s just possible the deal failure and Chae’s transfer back home to the job he held before being promoted to head of Asia are related.

Falling Short in Hong Kong Developer Acquisition

Blackstone first made an offer for Hong Kong-listed Tysan Holdings in August last year, according to a statement to the Hong Kong Exchange at the time. The HK$2.5 billion (US$322 million) offer was intended not only to take control of the company, but also to allow the investment firm to take the company private by acquiring more than 90 percent of the available shares. The offer specified a price of HK$2.86 for each share in Tysan.

By acquiring Tysan, Blackstone intended to expand its portfolio of Chinese real estate assets, while also giving the company a platform for pursuing additional projects in China.

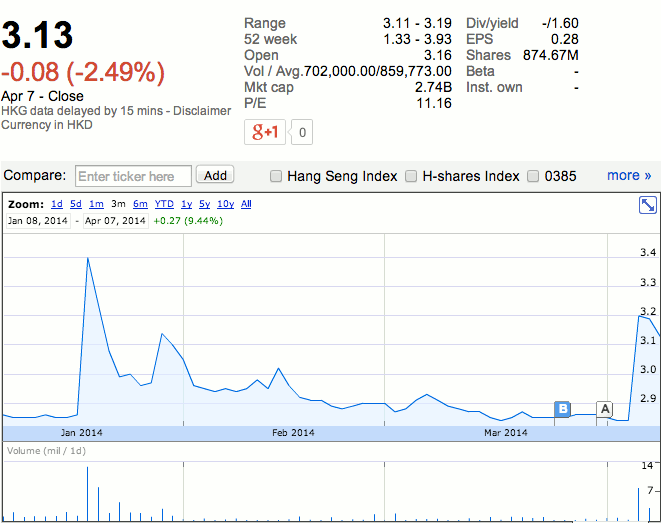

In mid-January, Blackstone had acquired 71 percent of the Hong Kong company, and taken effective control of the developer. A statement from Tysan on January 29th indicated that valid acceptances of the Blackstone offer totalled 740,751,686 shares, accounting for 84.69% of Tysan’s issued share capital, but 15.21 percent of the shares were still outstanding.

Under the terms of the buyout offer, Blackstone had four months to acquire a 90 percent shareholding to take the company private. After that, in order to resume trading without a special waiver, a 25 percent public float is required.

Unable to Close Deal After Repeated Extensions

Since Tysan’s original announcement was on August 19th, the first four months expired in December. After that, the two companies have extended the deadline repeatedly, with the most recent extension coming on April 2nd, and giving shareholders until April 22nd to accept Blackstone’s offer.

However, despite the repeated extensions, Blackstone’s shareholding has barely budged from the 740,751,686 shares ( 84.69 percent) that the firm held in January, with the company only able to buy up another 1.89 percent of Tysan since then to take its total shareholding to 757,323,947 shares (representing approximately 86.58 percent).

If this latest deadline fails to be met as the last few have, and the two sides don’t agree to keep extending indefinitely, Blackstone would need to start selling off at least 10 percent of the total shares in Tysan, that it had purchased at HK$2.86 per share.

And there have been no statements from either Blackstone or Tysan regarding the share offer since January 29th.

Tysan shares were trading at less than HK$2.86 per share for much of March until suddenly spiking to HK$3.2 per share on April 3rd and closed today at HK$3.13 per share.

Chae in Charge of Asia Since 2011

Chae took responsibility for Blackstone’s private equity efforts in Asia in 2011 and expanded the regional team to 225 people. However, a report in the Wall Street Journal pointed out that, apart from the real estate sector, the firm has done just one deal in Asia in the past three years.

According to a letter sent to investors at the time of the first close in June last year, Blackstone’s Real Estate Partners Asia fund had received US$1.5 billion in capital commitments out of a total target of $4 billion. An inability to profitability put that investor capital to work would likely lead to difficulties in raising further investment in the fund.

In November last year Blackstone China Chairman Antony Leung left the firm to head Hong Kong-based real estate developer Nan Fung, after seven years with the company.

Reshaping Blackstone’s Asia Team

According to the internal memo, Chae will continue to oversee Blackstone’s private equity business and investor relations, although responsibility for investor relations will be shared with Chris Heady, head of Blackstone’s real estate unit in Asia.

For China, Ed Huang and Yi Luo will lead investing, with Jan Nielsen and James Carnegie taking responsibility for investing in the rest of APAC. The memo also announced that Blackstone’s Singapore chairman, Gautam Banerjee, was being promoted to senior managing director and is now co-chairman of the firm’s Asia operating committee.

Note: an earlier version of this story failed to include data from the latest announcement on the buyout offer from April 2nd.

Leave a Reply