Lucas Loh has built his last Raffles City

CapitaLand announced a privatisation plan this March that promises to remake Southeast Asia’s largest developer, but one of the company’s top executives will not be helping to lead that transition, according to an announcement coinciding with the firm’s annual general meeting last week.

Lucas Loh, who had served as president of CapitaLand China since 2018, relinquished his role as the top executive for the developer’s largest strategic business unit as of 28 April, the Temasek Holdings-controlled developer said in a notice to the Singapore stock exchange.

Currently 54, Loh will be staying on as a non-executive advisor through a new role as CapitaLand Group’s China chief representative. The change will leave the $63.4 billion company without the services of an executive who led a business unit that was responsible for more than 50 percent of its revenue in 2020.

Leading Half the Revenue

In revealing Loh’s departure, CapitaLand did not offer a rationale for the personnel move, and noted only that Jason Leow, the company’s current president for Singapore and international, “will take on oversight responsibilities for the group’s development-related projects, including those in China”.

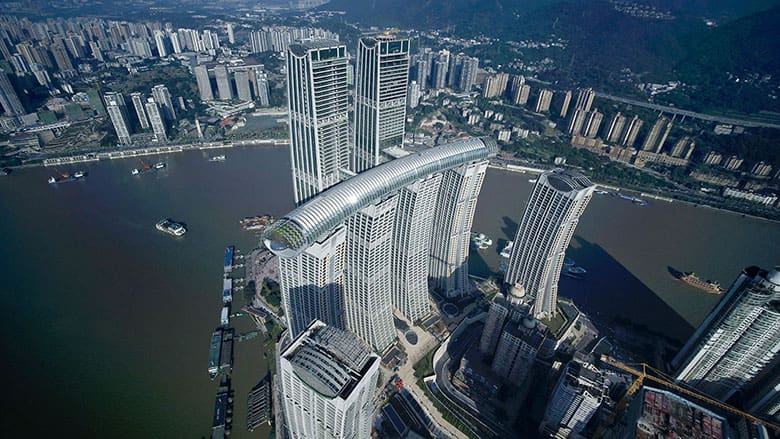

Raffles City Chongqing

Leow previously spent 13 years overseeing CapitaLand business on the mainland, including serving as chief executive for the country from 2009 to 2014.

Loh has been with CapitaLand since 2001 and has worked for the company in China since 2004. In its most recent annual report, the developer credited Loh with leading the development of four Raffles City integrated projects, including Raffles City Chongqing, which opened in September 2019.

In 2020, Capitaland China accounted for 50.4 percent of the group’s S$6.5 billion ($4.9 billion) in revenue, a figure that far outstripped its next largest strategic business unit, CapitaLand Singapore and International, which brought in 34.9 percent of the take.

By earnings before interest and tax, CapitaLand China was responsible for 53.4 percent of the S$3.58 billion total, compared with 40 percent for the Singapore and International unit, which again ranked second.

CapitaLand 3.0

In a restructuring plan unveiled in March dubbed “CapitaLand 3.0”, group chief executive Lee Chee Koon proposed to reposition the 30-country operation into a privately held company focused on real estate investment management.

Following the proposed $15.9 billion privatisation, the development operation would be repackaged as CapitaLand Investment Management (CLIM), which the group expects would be the largest real estate investment manager in Asia and the third-biggest manager of listed real estate trusts globally.

The company has also been making changes elsewhere in its leadership, with former Ascendas-Singbridge boss Miguel Ko having been named chairman last year. Outgoing chairman Ng Kee Choe served his last day on 27 April, with Ng’s cessation being announced the same day as Loh’s abdication.

On 27 April, CapitaLand also announced that Tan Sri Amirsham Bin A Aziz, now 70, had left his role as an independent, non-executive director with the company, after serving on the board since 2012.

Leave a Reply