Chines president Xi Jinping reportedly signed off on last month’s funding crackdown on Dalian Wanda

Dalian Wanda Group, China’s largest commercial property builder, is reportedly in the crosshairs of the country’s top leadership as China slams the brakes on an overseas acquisition binge by ambitious private firms.

A set of penalties levied against Wanda are said to have been approved directly by China’s paramount leader, President Xi Jinping, according to an account this week by The Wall Street Journal.

In response to the top-level scrutiny, Wanda Group chairman Wang Jianlin has vowed to confine his major acquisitions within China’s borders – reversing a five-year deal binge that had thrust Wanda onto the global stage.

After Bingeing Comes the Purge

The Journal report, which cited people with knowledge of the president’s actions, followed earlier stories detailing how Chinese regulators were to impose punitive borrowing restrictions on Wanda in response to the company’s suddenly unpopular overseas acquisition practices.

Wanda seemed to confirm the Journal’s account in an interview with mainland business outlet Caixin published over the weekend. In response to emailed questions, Wang Jianlin said his once-omni-acquisitive conglomerate would “actively respond to the state’s call and had decided to put its main investments within China.”

Wanda had helped to define China’s outbound wave with series of billion-dollar deals that transformed the biggest builder of Chinese malls into a symbol of the country’s global ambitions. In addition to having acquired properties in London, Sydney, Chicago and Los Angeles, the one-time provincial homebuilder spent billions more on film production houses and movie theatres.

The moves against Wanda came soon after Chinese regulators ordered the country’s major state-owned banks to clamp down on funding for a cohort of acquisitive mainland firms including HNA Group, Anbang Insurance Group and Fosun International.

The reported order by Xi underlines the sea-change in policy that has brought the era of aggressive overseas deal-making by indebted private firms to a virtual standstill, as China seeks to rein in outbound capital flows and curb risks in the country’s financial system.

Regulators Tighten Grip on Wanda’s Purse

The news follows a series of revelations about China’s tightening grip on its highest-profile outbound investors. Last month, China’s banking regulator instructed major banks to scrutinise lending to Wanda, HNA, and Fosun, along with Rossoneri Sport Investment (which had bought an Italian soccer club), citing the potential for “systemic risk” from these conglomerates’ massive offshore investments.

Then on June 20, banking regulators told the major state-owned lenders that six overseas deals by Beijing-based Wanda would be subject to stricter rules on outbound investment that had been rolled out by the State Council last November, effectively banning these entertainment-related projects after the fact.

Wanda’s So Bad It Was Illegal 5 years Ago

Four of the six deals in question already closed between 2012 and 2016, namely Wanda’s acquisitions of American cinema chain AMC, rival Carmike Cinemas, film producer Legendary Entertainment, and British yacht maker Sunseeker International. The two remaining deals, for European theater operators, have not yet closed and do not seem to fall under the jurisdiction of China’s regulators.

The disciplinary action, with Xi’s reported sign-off, was a major blow to Wanda’s overseas ambitions. The measure apparently bans the company from getting additional financing from Chinese banks for the four projects it has already bought, and from using its mainland funds to finance any of the deals, jeopardizing Wanda’s ability to raise funding for additional investments.

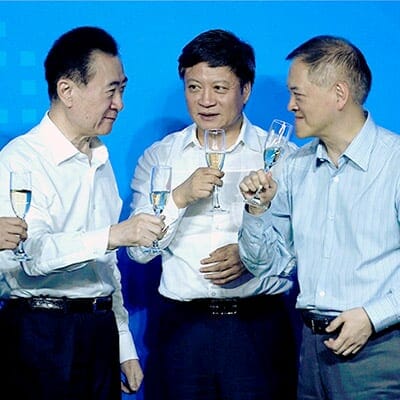

Wanda’s Wang Jianlin (left) offloaded 77 hotels and 13 tourism projects to Sunac and R&F for a total of $9.4B

Under pressure from these new controls, Wanda has been shedding assets and paring back its debt. The company headed by tycoon Wang Jianlin two weeks ago said it was offloading a portfolio of 76 hotels and 13 tourism projects to Sunac China, the Tianjin-based developer, for a total price of RMB 63.2 billion ($9.3 billion).

Then last week, with Sunac apparently facing scrutiny of its own over the prospect of becoming China’s most indebted developer through the mega-deal, the sale was hastily restructured. Guangzhou’s R&F Properties jumped in to buy an enlarged portfolio of 77 hotels from Wanda for RMB 19.9 billion ($2.9 billion), while Sunac agreed to buy a 91 percent stake in Wanda’s tourism properties for RMB 43.8 billion ($6.5 billion). In announcing the deal, Wanda noted the sale would significantly decrease its liabilities and boost its cash flow.

Preventing a Stampede of Gray Rhinos

The stricter controls on Wanda are part of China’s intensifying efforts to avert what the official People’s Daily newspaper described last week as “gray rhino” events. In contrast with the unpredictable “black swan” occurrences, gray rhinos are obvious disasters in the making that everyone ignores until it’s too late. Without naming specific firms, the government appears to be targetting the major private conglomerates that have racked up huge amounts of debt and strained the country’s foreign currency reserves to make a series of splashy foreign acquisitions over the past few years.

Since 2015, the quartet of companies that includes Wanda, HNA Group, Anbang Insurance, and investment conglomerate Fosun completed a total of $55 billion in overseas acquisitions, or 18 percent of the total for all Chinese firms, according to figures cited by the Journal.

Hainan-based HNA, which has announced over $30 billion of asset purchases since last year, including a $6.5 billion stake in Hilton Worldwide, is facing mounting scrutiny from regulators at home and abroad, with Bank of America Corp. recently telling investment bankers to stop working on deals with the conglomerate.

Anbang is in deeper trouble. The insurer’s rapid string of high-profile acquisitions since 2014, including the $5.5 billion purchase of Strategic Hotels & Resorts Inc. last year, has come to an abrupt halt with controversial CEO Wu Xiaohui being detained by “relevant departments” in mid-June. Wu has not appeared in public since.

Leave a Reply