WeWork’s latest round of funding will help it push into India and other Asian markets

In some ways, hotels and co-working spaces are a lot alike. Both feature a transient clientele base that may need space for a single day or indefinitely, but don’t want anything too permanent. Both attract people from all walks of life, from suited and booted businessmen to flip-flop wearing freelancers.

Perhaps it is those similarities that convinced Shanghai Jin Jiang International Hotels to invest in WeWork. The co-working player raised $260 million in a tranche led by the state-run hotel group to reach a final close on $690 million funding round dominated by Chinese investors, according to the Wall Street Journal. WeWork had kicked off this latest fund raising by taking in $430 million in March from investors led by Beijing-based Legend Holdings and its private equity wing, Hony Capital.

Valued at $16 billion, WeWork has raised nearly $1.7 billion in private capital to date, with some of that cash supporting the company’s expansion into Asia. The March investment came shortly after WeWork began implementing its Asian strategy, and was followed in July by the six-year old firm opening its first Asia facility in Shanghai’s Jing An district.

WeWork Remains Bullish on Asia

WeWork has been busy since that first Asia co-working space opened its doors. The company has since launched branches in Hong Kong and Seoul with expansion into Australia also expected after the New York based firm selected two sites in Sydney.

A second Shanghai space is set to open November 1st at a redeveloped warehouse site on Weihai Road, while a second Hong Kong location at Asia Orient Tower on 33 Lockhart Road is also expected to begin operations in 2016.

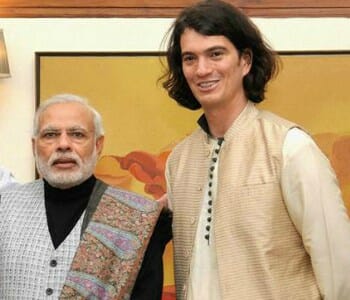

The company has also unveiled its plans for India that will see it follow a new business model. Sources told Bloomberg that Embassy Group, a Bengaluru-based real estate firm, will pay for WeWork’s first offices in the country. This deviates from WeWork’s usual strategy of leasing the space and then subletting to its members.

The company founded by entrepreneurs Miguel McKelvey and Adam Neumann received a boost for its Asian aspirations this September when banking giant HSBC agreed to rent out 300 hot desks at WeWork’s Tower 535 commercial complex in Causeway Bay. The deal saw the multinational banking and financial services firm become WeWork’s largest corporate client in Asia-Pacific.

Investors Still Keen on WeWork Despite Wobbles

WeWork co-working spaces are known for fun and games, but the startup has needed to get serious as issues mount

The latest round of funding for WeWork shows investors are still willing to buy into the co-working company’s $16 billion dream despite internal documents reviewed by Bloomberg earlier this year showing it had reduced its 2016 profit forecast by 78 percent and cut its revenue estimate by 14 percent.

Additionally, it was reported that WeWork’s near-term costs appear artificially low because of large initial concessions from landlords including free rent which was not spread out over the length of the contract on the company’s books. This could impact the firm’s profits in the next few years as leasing costs increase.

It’s interesting!