Owners of big buildings around the world should send China’s Ministry of Commerce a thank you note today, after the regulatory body announced that most overseas investments by Chinese companies would no longer need the ministry’s approval.

The decision by the ministry follows changes made last year by China’s National Development and Reform Commission (NDRC) which helped open the floodgates for outbound investment by Chinese real estate companies this year, including major acquisitions in London, San Francisco, and other global cities.

No More Ministers, No More Rules

Before this week’s rule change, companies seeking to invest more than $100 million overseas needed to apply for, and receive approval from, the Ministry of Commerce in Beijing. Companies making outbound investments of between $10 million to $100 million needed approval from provincial-level commerce departments.

Now, only overseas investment projects in sensitive countries or regions, or in sensitive industries will require approval by the ministry. The Ministry of Commerce defines “sensitive countries” as those which have not established diplomatic ties with China and those countries under the United Nations sanctions.

Under the new guidelines, projects that are not in sensitive countries or industries need only register with the ministry, without seeking approval. The new rules are set to take effect from October 6th of this year.

Following the NDRC’s Lead

The change in policy by the Ministry of Commerce is part of a general movement away from a gatekeeper role by China’s current government, particularly in the area of cross-border investment.

In December of last year, the NDRC raised the threshold for overseas investments requiring the planning body’s approval from the former $100 million to $1 billion. Since that time overseas investment in real estate by Chinese companies has grown by 17 percent, according to figures from consultancy JLL.

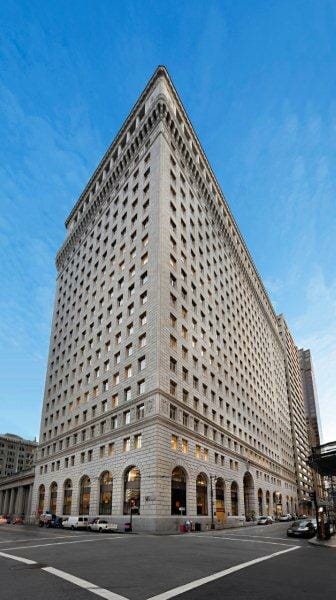

During this year Chinese companies have made a number of large investments that would have previously required NDRC approval, including the $304 million acquisition of a building in Chicago during March, a San Francisco office tower picked up for $350 million in May, and the $1.35 billion acquisition of a tower on London’s Canary Wharf in June.

With the Ministry of Commerce removing this latest barrier Chinese companies will be able to invest overseas more quickly and easily than before, although issues of access to foreign exchange will remain.

Leave a Reply