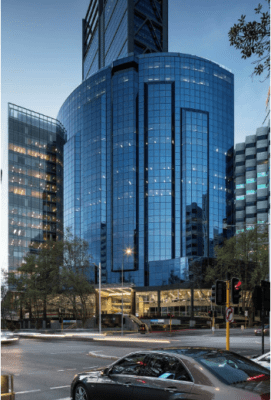

GIC reportedly acquired the 40-storey Exchange Tower in Perth

Singapore’s sovereign wealth fund GIC is said to have successfully won a tender for a prime office building in Perth, Australia, paying more than A$320 million ($228 million) to the building’s existing joint owners AMP Capital and Primewest, according to an account in The West Australian.

The deal for the Exchange Tower, hailed as the highest-profile commercial property transaction in the western Australian city, was also contested by acquisitive Chinese developer and investor Zone Q, a subsidiary of the Shenzhen-based JiaHe JianAn Group, and the listed group Elanor, The Australian reported.

The acquisition forms part of a mandate given by the $398 billion Singaporean giant in May last year to Aussie investment managers Charter Hall and Primewest, to invest up to A$800 million in the subdued office markets of secondary cities Brisbane and Perth.

GIC Heads West for Higher Cap Rates

GIC real estate boss Lee Kok Sun is looking for deals in Brisbane and Perth

The reported deal for the premium-grade tower at 2 The Esplanade in the capital of West Australia, comes at a core capitalization rate of about 6.5 percent, as market analysts make the case for a recovery in Perth’s office leasing after a sustained downturn.

GIC’s mandate last year tasked ASX-listed property fund manager Charter Hall Group and Perth-based Primewest to act as its domestic fund manager for a strategy targeting core and core-plus office properties in Brisbane and Perth in a bet on the long-term growth potential of the two cities.

The 40-level Exchange Tower would be GIC’s second significant Perth office acquisition after it snapped up the A-grade Quadrant, at 1 William Street in July last year, for a bargain basement A$175 million in a deal brokered by Primewest.

When that deal closed last November, Quadrant was 38 percent vacant; Primewest, which is managing the building, now reports that the asset is fully occupied, although some of the recent leasing agreements have yet to be converted to formal leases. According to the West Australian, Primewest is likely to continue to manage the Exchange Tower following the purchase by GIC.

Perth Sale Follows Upgrade

The sale of the Exchange Tower, which was jointly marketed by Cushman & Wakefield and JLL, came after Primewest picked up a half-stake in the building two years ago from a private property syndicate run by Vicinity Centres in a play that valued the asset at A$227 million. The Perth-based firm then worked with AMP, which owns the other half of the property, to reposition the asset.

GIC had previously purchased the Quadrant in Perth as part of its $800 million investment mandate in the area

The two groups undertook a A$50 million upgrade, including improvements to the lifts, a reworked forecourt and lobby, and increased retail presence. The work effectively transformed the premium-grade office building into the poster child for Perth’s office leasing recovery story, winning several new tenants including Morgan Stanley, Bain International Mitsubishi Australia, Knight Frank, and Azure Capital, while taking its occupancy to more than 90 percent.

With its two significant Perth office tower acquisitions, GIC has capitalized on the worst office market conditions in Perth in a decade, striking deals as the market starts a fairly convincing recovery, noted the West Australian.

Real Estate Institute of Western Australia deputy president Damian Collins said, as cited in a recent article by Australian Financial Review, increased interest from buyers over east (and Asia) in all commercial sectors was due to the belief the Perth market was in the bottom of its economic cycle.

He added bigger investment funds were targeting office space due to the office vacancy rate in the city dropping to around 20 percent.

GIC Buying Streak Continues

As part of its A$800 million investment mandate to target quality countercyclical assets in Perth and Brisbane, GIC last December teamed with Charter Hall to purchase the 41-storey Santos Place tower in Brisbane for A$370 million in the Queensland Capital’s biggest office deal of the year.

In September this year, with Sydney office values on the rise, the world’s eighth-largest sovereign wealth fund put a 50 percent stake in its wholly owned Chifley Tower asset in Sydney on the market, and GIC also owns the Queen Victoria Building in the capital of New South Wales.

The fund was also active in Europe this past week, where it announced the €465 million ($536 million) acquisition of the Tour Ariane, a 40-storey office building in Paris.

Leave a Reply