Atlantis The Palm in Dubai

US hotels and resorts continue to be a target for Chinese investors after one of the mainland’s biggest property developers recently signed a deal with Kerzner International to develop a super-luxury Atlantis resort on the Hawaiian island of Oahu.

China’s Oceanwide Holdings, which has made a series of major US real estate acquisitions in the past three years, continued to expand its presence in North America by joining up with the high end resort operator to bring the award-winning resort concept to a 26 acre (10.5 hectare) site which the Beijing-based developer acquired in two separate transactions starting in November last year.

Colony Brings Together Chinese Capital With International Brand

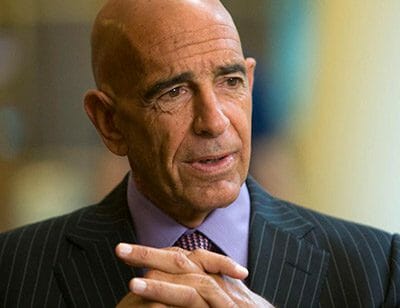

Colony Capital’s Tom Barrack helped bring together Kerzner and Oceanwide

The agreement between the developer controlled by Chinese billionaire Lu Zhiqiang and the Goldman Sachs-invested hospitality management firm was facilitated by Colony Capital chairman Tom Barrack, Jr whose investment management firm also holds a major stake in Kerzner, according to sources familiar with the deal who spoke with Mingtiandi.

With Oceanwide already having invested in projects in California and New York, Colony, which established a permanent presence on the mainland last year, kick-started discussions between the Shenzhen-listed developer and the resort operator.

“Following the success of the Atlantis concept in Dubai and the Bahamas, and with Oceanwide’s interest in the resort sector, we thought it was a conversation that needed to happen,” Scott Barrack, Colony’s China Representative told Mingtiandi. The two groups began discussing the potential cooperation last year in Beijing, with Oceanwide agreeing to spend a total of $290 million on two separate land purchases in November 2015 and February of this year. Oceanwide closed on its acquisition of the sites on September 15th, according to a statement by the company to the Hong Kong stock exchange.

Atlantis Feeling the Love From the Mainland

The Atlantis brand had already begun to gain traction in the mainland after Kerzner signed a cooperation deal with China’s Fosun International to build an Atlantis resort in Hainan province’s Sanya in 2013. The seven-star, $1.7 billion project topped out in July of this year and is expected to open its doors in the second half of 2017.

In Hawaii, the Atlantis project will be a neighbor of Disney’s Aulani resort and spa in the master-planned 642-acre Ko Olina Resort in West Oahu. The first Atlantis resort in the US is expected to incorporate elements similar to its successful Atlantis Palm Dubai destination, which includes a water park and aquarium along with more than 20 restaurants, a nightclub, spas, salons and a fitness center.

Barrack, who controls a $25 billion portfolio of assets through Colony, helped to take Kerzner private in 2006 via a $3.6 billion deal that was also backed by Goldman Sachs’ Whitehall Funds and a unit of Dubai’s sovereign wealth fund. In addition to its stake in Atlantis, Colony is also a major investor in several other hospitality companies, including Asia’s Fairmont Raffles Hotels International hotel chain.

Oceanwide Continues US Deals

Is that a wreath of Hawaiian leis that Lu Zhiqiang is admiring in this picture?

In Oceanwide, Colony found a partner which has shown a growing appetite for US projects since its first North American investment in late 2013. After starting out in Los Angeles with the $200 million Fig Central project in December of that year, Oceanwide went on to acquire a site at 50 First St in the Mission district of San Francisco for $296 million in 2015.

In August of last year, Oceanwide jumped into the New York market by purchasing a pair of sites in Manhattan’s South Seaport area from the Howard Hughes corporation for $390 million, before turning its attention to Hawaii.

Leave a Reply