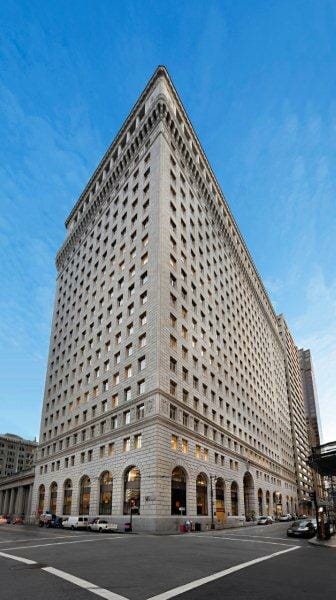

225 Bush Street in San Francisco brought its owners nearly $140 million in two years.

The former Standard Oil Building at 225 Bush Street in San Francisco changed hands this week for the second time in two years, passing from a German investment fund to Chinese real estate group in a transaction valued at $350 million. The deal values the property at nearly 40 percent more than the last time the building changed hands two years ago.

The deal is said to be the largest office sale in San Francisco since 2012 and marks the impact that cashed-up Chinese investors are having on California’s real estate market.

Kylli Inc, a little known subsidiary of China’s Genzon Group purchased a stake in the 22-storey, 583,000 square foot structure from German investment firm SEB ImmoInvest and minority owners GEM Realty Capital and Flynn Properties. Kylli is owned by Chinese golf course developer Genzon Group together with the company’s principal.

Flynn Properties will retain a stake in the building under the terms of the deal. The transaction shows the rapid rise of San Francisco’s already healthy real estate industry, valuing the property at nearly 40 percent more than the $212 million valuation it received when the current owners acquired it from Goldman Sachs in 2012.

Current tenants of the historic office tower, which is located in an area which has rapidly become popular with US tech firms, include Groupon Inc., Zillow Inc. and RocketSpace, according to real estate consultancy JLL, which brokered the investment deal.

Chinese Buyers Rushing into Gateway Cities

As China’s real estate market has slowed in the past year, the country’s developers have become leading acquirers of property assets internationally, particularly in cities that act as centers for international trade and investment.

“We’ve seen increasing interest from Chinese buyers in trophy office buildings in global gateway cities for several years, with a focus on London and New York to date. This large, off-market transaction shows that Chinese investors are also aggressively pursuing Class A office buildings on the West Coast of the United States” said Rob Hielscher, a managing director with JLL’s Capital Markets team.

Earlier this year an investment firm owned by China’s “bad asset” bank Cinda bought the 65-storey 311 South Wacker Drive office tower in Chicago for $304 million, and last year Chinese conglomerate Fosun picked up the One Chase Manhattan Plaza in New York for $725 million.

Leave a Reply