Start spreading the news, another of China’s real estate giants is determined to make it on the world’s biggest stage, as Greenland Group announced last week that it intends to buy a 70% stake in the Atlantic Yards project in New York City.

According to a statement from the two companies, Greenland agreed to acquire the shares in the venture from Forest City Ratner Cos. on the basis that the two firms would co-develop the $4 billion project.

The purchase price for Greenland’s stake has not yet been disclosed, however, according to a report in the Wall Street Journal, Forest City has already invested $500 million in the 22-acre project.

Building Apartments, Offices and Retail in Brooklyn

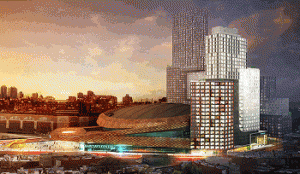

The Atlantic Yards development includes infrastructure, apartments, an office building and retail space, as well as the Barclays Center – a sports arena which is home to the NBA’s Brooklyn Nets.

The first housing tower is already under construction, and the already operational Barclays Center, which is which is jointly owned by Forest City and Russian billionaire Mikhail Prokhorov, will not be included in the Greenland acquisition.

Under the terms of the agreement, Greenland is to provide 70% of the cash needed to finish the project, excluding any debt that is taken on for the construction.

Greenland to Be China’s Biggest International Real Estate Player

The Brooklyn deal is the biggest to date for a Chinese developer that has exploded onto the international stage this year.

Starting in March when it agreed to buy a residential site in Sydney for US$107.5 million, Greenland has made a series of deals that seem destined to make it China’s biggest international investor in real estate.

Following the Sydney deal, the Hong Kong-listed company signed an agreement in July to purchase the 25,600 square metre Metropolis office project in Los Angeles, and stated that it expects to invest as much as $1 billion into the project.

Also, on Wednesday last week, Greenland announced that it had signed a memorandum of understanding to acquire a pair of sites in Melbourne, Australia to develop up to 2000 apartments for sale.

China Developers Going Global

The purchases by Greenland are part of a larger trend of Chinese companies investing overseas.

In addition to Greeland Group’s moves during this year, the Dalian Wanda Group announced plans for US$1 billion dollar hotels in both London and New York. Also real estate mogul Zhang Xin of SOHO China helped lead a consortium of investors who bought a controlling interest in the landmark GM Building in New York.

[…] development projects in the way that Chinese real estate firm Greenland Group has moved into the New York and Los Angeles markets, Cinda is buying a mature asset with existing rental […]