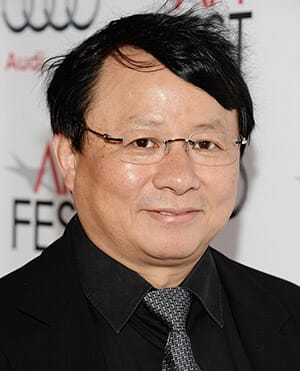

IDG China chief Hugo Shong is said to play a key part in the deal

Mainland real estate developer China Oceanwide Holdings is continuing its overseas investment spree with a move to acquire one of America’s best known names in technology media.

The Beijing-based developer, which has already made more than $3.8 billion in real estate and insurance acquisitions in the US, is now leading a Chinese consortium which is closing in on the purchase of tech media and investment firm International Data Group, according to an account today in the Wall Street Journal.

The deal, which could approach $1 billion in value, is set to be announced in the coming days, according to the Journal story, which cited sources familiar with the discussions.

IDG Greater China Head Playing Leading Role

Oceanwide is reportedly being joined in its bid by IDG Greater China chairman Hugo Shong, who founded IDG Capital in China as general partner in 1993. Shong is expected to take over IDG’s venture capital operations globally as part of the transaction, the Journal reported.

IDG has been in transition since its founder and then-owner Patrick Joseph McGovern died in 2014. Last year the McGovern family foundation hired Goldman Sachs to explore a possible sale of the group.

Oceanwide Becoming One of China’s Cross-Border Heavyweights

Oceanwide bought a pair of sites in NYC’s South Street Seaport for $390M in 2015

For Oceanwide, the potential media acquisition is the latest in a series of US focused deals for the Hong Kong-listed developer, and the second transaction in three months to see the company branch out into new industries.

In October, Oceanwide followed a path already blazed by Anbang Insurance, Fosun and other Chinese players in buying a US financing company. The $2.7 billion purchase of mortgage and life insurance firm Genworth Financial more than doubled the company’s previous total of US investments.

Prior to the Genworth deal, Oceanwide had acquired a pair of sites in Hawaii for $290 million in 2015 and early 2016. That pair of adjacent properties are now set to become a high-end Atlantis resort, thanks to an introduction from Colony Capital’s Tom Barrack to Atlantis operator Kerzner International.

The Hawaii development followed Oceanwide’s $390 million purchase in August 2015 of a pair of sites in Manhattan’s South Street Seaport development from the Howard Hughes Corporation, for construction of a supertall mixed-use tower. Earlier that same year the developer had purchased the First and Mission residential project in San Francisco for $296 million.

Oceanwide’s first US project, the $1 billion Figueroa Central mixed-use development in Los Angeles which it purchased in late 2013, is currently under construction and scheduled to be completed in 2019.

Leave a Reply