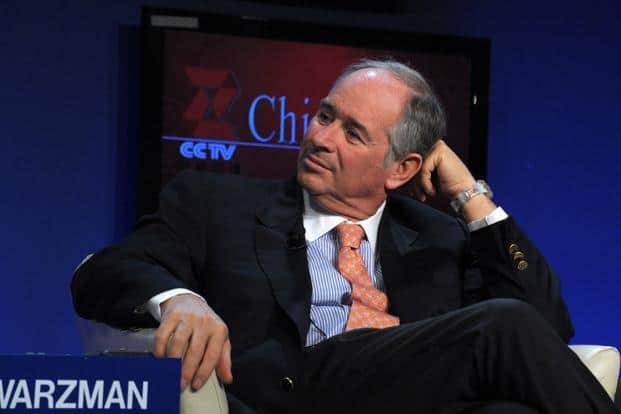

Blackstone’s Schwarzman says there is much more Chinese outbound investment to come

Stephen Schwarzman, chairman and CEO of private equity giant Blackstone believes that Chinese investors will continue to favor international real estate as an asset class, and that the current wave of trophy property investments is the path of least resistance for Chinese corporates going international.

“Buildings are easy to buy and less political sensitive than companies,” the Blackstone chief pointed out in an interview at a recent event in New York, Xinhua reported.

Blackstone and Schwarzman have developed increasingly close ties with China as the PE firm has teamed up with Vanke and other developers for deals on the mainland, while selling properties to Chinese investors in London and other locations.

More Opportunities for Chinese to Invest in the US

The head of the largest alternative investment firm in the world acknowledged that Chinese companies have attractive opportunities across a broad spectrum of industries in the US, but said that real estate was a particularly good fit.

Schwarzman predicted that US housing prices would continue to climb as they are still well below their pre-crisis levels, which should provide opportunities for companies and individuals to profit. And many Chinese have already established a preference for real estate as an asset class and have experience built through the country’s 15 year property boom.

However, Schwarzman did recommend that Chinese investors should find a local partner before venturing overseas.

Blackstone has profited handsomely from sales of real estate to Chinese investors, after selling a London business park to China Investment Corporation (CIC) for more than US$1.28 billion (GBP 800 million) in 2013. The private equity firm also sold Gold Fields House in Sydney to Chinese developer Dalian Wanda last year for $329 million.

Private Equity Chief Likes China’s Malls

Blackstone has also been active within China’s real estate sector, investing in everything from a Hong Kong residential developer, to shopping malls and warehouses.

In his talk in New York, Schwarzman singled out shopping centres as presenting lucrative investment opportunities in China, thanks to the growth of the country’s middle class.

“Shopping centres, correctly located, have tended to hold up very well and probably will in the future,” the private equity boss said in a report by Bloomberg.

In 2013, Blackstone took a stake in mall developer SZITIC Commercial Property Co (now known as SCP) for a reported $400 million.

Schwarzman also saw logistics real estate as a promising area for expansion in China.

“There’s a lot of demand in China for anything touching the internet,” Schwarzman told Bloomberg, noting the success of high tech logistics and warehouse firms.

Blackstone has teamed up with China Vanke to invest in logistics real estate development on the mainland.

Leave a Reply