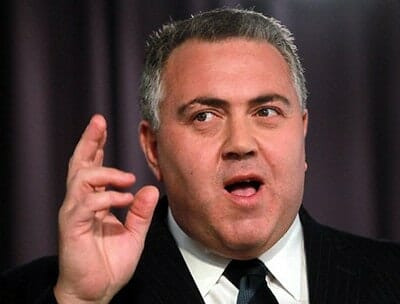

Is Treasurer Joe Hockey really trying to make a point about suppressing foreign demand for Aussie property?

Australia announced last week that it is putting in place new barriers to foreign purchases of homes in the country, and will start enforcing existing regulations, following a wave of Chinese investment that saw real estate prices in Sydney rise more than 14 percent last year.

The new rules, which call for a fee of A$5,000 (US$3,900) on purchases of existing homes valued at less than A$1 million ($781,000), and a further fees of A$10,000 for every additional A$1 million in home investment by non-Australians, are not likely to have much effect and home purchases by Chinese buyers can be expected to rise still further in 2015.

And the reason for this increasing appetite for Australian real estate among Chinese buyers is that the country’s falling currency is giving Chinese (and other foreign buyers) an effective discount on their home purchases that far outstrips these new fees.

Are Australians Getting Priced Out of Their Own Homes?

Australian Treasurer Joe Hockey announced the planned measures on Tuesday, which also include setting up a register of foreign nationals buying real estate and penalties for those who evade the current regulations. These penalties would include a fine of up to a quarter of the value of the property and forced divestment of the asset.

While Hockey did not point fingers at any particular group, China was the leading source of foreign investment in Australia in 2013, with nearly A$6 billion ($5.58 billion) in approved deals. Chinese real estate companies such as Dalian Wanda, Shimao and Greenland Group have made a series of increasingly high profile investments in the country in recent years.

The tighter control over foreign home purchases comes as Australia’s real estate market booms, despite a slowing economy.

According to data from real estate intelligence provider CoreLogic RPData, housing prices across Australia’s major cities rose 1.3 percent in January compared to December, and were up an average of eight percent over the same period a year earlier. Melbourne prices rose fastest at 2.7 percent month on month, with Sydney just behind with a 1.4 percent gain over December.

The price increase come amidst an influx of home purchases by Chinese buyers that is expected to continue. A study last year by Credit Suisse predicted that Chinese would purchase $39.54 billion worth of Australian residential property over the next seven years.

New Fees Not Likely to Have Much Effect

The new rules may be an attempt to keep housing affordable to average Australians, but are more likely being put in place to give the appearance that the government is doing something about what is becoming something of a social issue in down under.

However, for a home that costs less than A$1 million, the new fees could amount to just less than 0.5 percent of the purchase cost, and even for a home that cost A$10 million, the cost of the new fees would amount to less than one percent of the purchase cost.

Just last year, Singapore increased the surcharge it slaps on foreign buyers from 10 percent to 15 percent, after mainland purchasers drove up its market, and Hong Kong also charges a 15 percent stamp duty on homes bought by foreigners (including mainlanders).

Given that Australia’s currency devalued by more than 12 percent against the Chinese yuan during the second half of 2014, and is expected to keep sliding in 2015, that one percent surcharge still leaves Aussie homes looking like bargains.

Currency Devaluation to Continue and So Will Chinese Investment

Although some analysts expect the Chinese yuan to depreciate against the US dollar this year – it has already slid by 2.3 percent against the greenback since November – that devaluation is not expected to keep pace with what’s happening with the Aussie dollar.

Just last week Citigroup predicted that the Australian dollar would be at US$0.70 by the end of 2015, down from US$0.82 at the end of 2014 and a further slide of more than 10 percent against the current rate of US$0.78.

With an effective additional discount of ten percent on the way for foreign buyers of homes down under, that one percent surcharge doesn’t look like much of a deterrent, and the Australian market should get ready for even more demand from mainland real estate investors.

The devil is in the details.

The fines and sanction are the real kicker here. If a buyer is found to have breached FIRB regulations, then he or she or it can be fined either the capital gain on the purchase price or b/w 10% and 25% of the purchase price, whichever is greater.

And it looks like one of China’s richest men may be about to experience this first-hand. Stay tuned!